sourced, not web scraped

We collect global data on markets, investments, and private companies from over 21,000 sources. Recognizing that too much data can be overwhelming, we use AI technology to present it for impactful business decisions.

We research and gather unique, mission-critical, non-public and alternative data about companies and markets all over the world.

Real time updates about important KPIs. Companies with most hirings, most new customers, lowest churn, revenue increase, and more.

Identify similar companies, analyze their performance, and understand market dynamics.

Uncover opportunities through our advanced tools and features that allow you to analyze market trends and get in-depth insights into various industries.

Compare private companies and make predictions about their future success through highly detailed data.

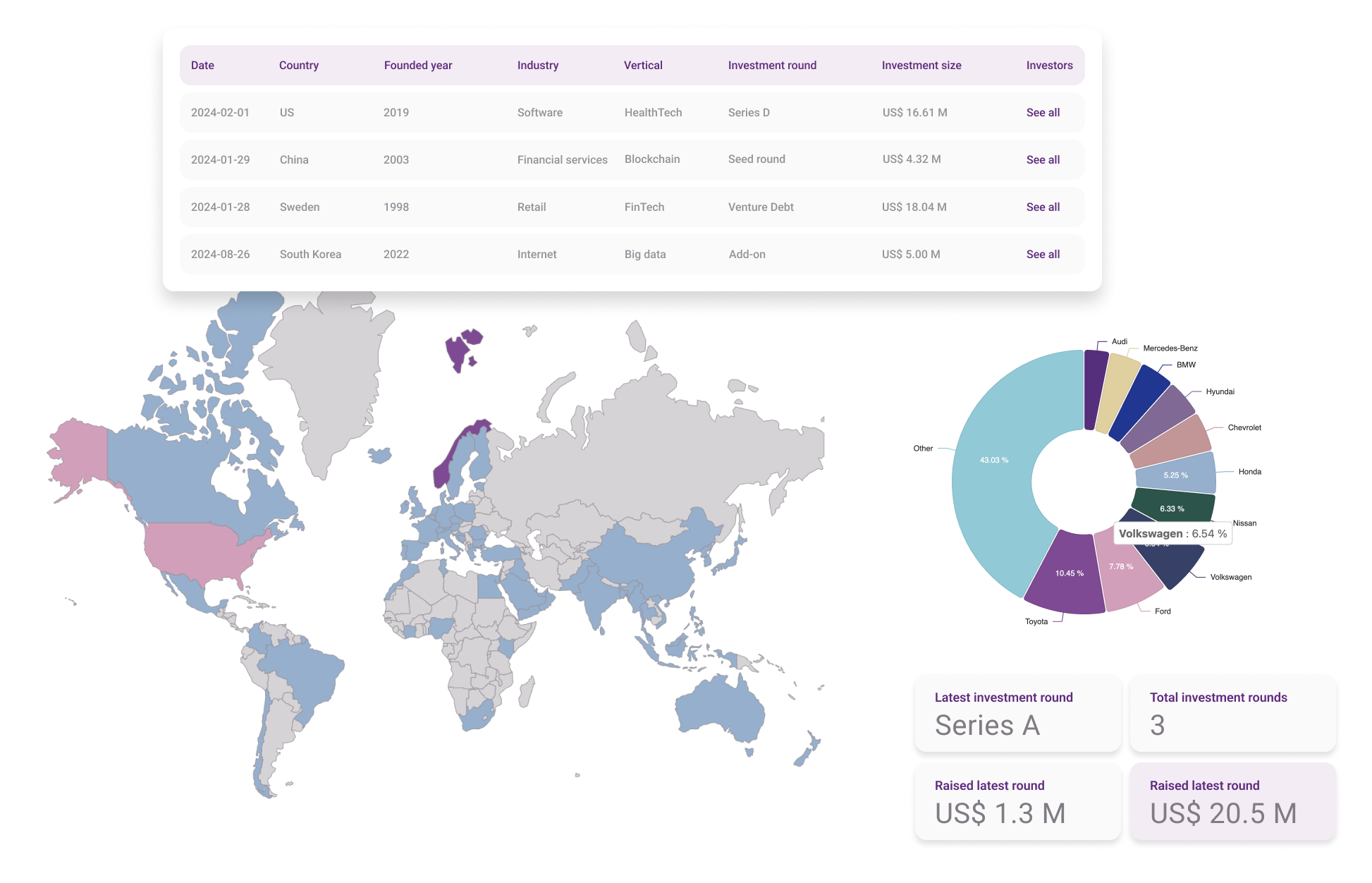

Never miss a seed round again. Get noticed on ongoing and upcoming investment rounds.

Filter results by criteria such as: industry, location, round, and more to find companies that match your investment needs.

Take a look at our extensive database that includes valuation and revenue multiples.

Our platform's forecast market data and advanced algorithms allow you to predict market trends and stay ahead of the competition.

Access information to cover all of your due diligence needs in one place.

With our extensive database of private companies, you can easily find potential buyout opportunities and acquire the right company for your investment portfolio.

Utilize our market sizing estimate database to pinpoint the most promising markets for investment and expansion.

Get an up-to-date access to a wide range of different company, team analysis and its latest financing rounds and valuation.

We use special methods like unique calculations, computer programs, and AI technology, to provide you actionable insights.

We gather data from 21,000+ sources (financial institutions, research companies, news, own research).

We deliver a full stacked augmented analytics with deep insights that can only be found at DealPotential.

We apply our own KPIs and metrics to get our unique DealPotential scores, track historical performances, and benchmark the results.

We track historical performances and benchmark the results.

We use Natural Language Generation combined with AI and Machine learning to get undiscovered insights and make the findings understandable for everyone.

Our sources include financial institutions, research companies, expert interviews, as well as our own research department.

Our platform is updated and enriched daily with global data, such as news and closed rounds, whether announced or completed.

Our data undergoes thorough verification by experienced research professionals to ensure added security.

Inside our market and company reports, we provide you with a full audit trail of our trusted sources.

The only solution in the market offering company, investment, and market data, mapped in a single dashboard, instead of using multiple data sources.

We apply sophisticated predictive analytics, AI, ML, and NLG technology to forecast future market trends, business and investment opportunities.

our resources

Gain insights into various industries, key investment trends, and future projections in the private market—driven by DealPotential data.

Access granular data on 4+ million private companies, such as growth and market potential, competitive landscape, business model, funding history, risk factors, and much more.

Market trends and insights into various industries, dynamics, peers, cost- and revenue trends. Our reports contain not only historical data, but also predictive analytics and risk assessment.

Explore recent deals, global fund data, and statistics, gaining unparalleled insights into the portfolios and strategies of over 31,000 institutional investors.

We collect information from over 21,000 sources, including financial institutions, research companies, and conduct our own research, which gives us over 200,000 data points. However, too much information can be confusing. Our goal is to make complex data simpler and easier to understand, so you can use it to make important business decisions right away.

We use special methods like unique calculations, computer programs, and AI technology, including machine learning and natural language generation, to provide you with data that is easy to understand. To learn more, please visit our Data webpage.

We utilize it by leveraging AI, but also natural language generation (NLG), and machine learning (ML), to provide comprehensive and easily understandable findings to drive informed decision-making.

You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails. We do not sell or share your information with anyone else.

Unique private investment, company, and market data for confident decision-making.