December update: Valuation intelligence, improved filters, and more

Smarter valuations, sharper filters, and deeper insights, all live now.

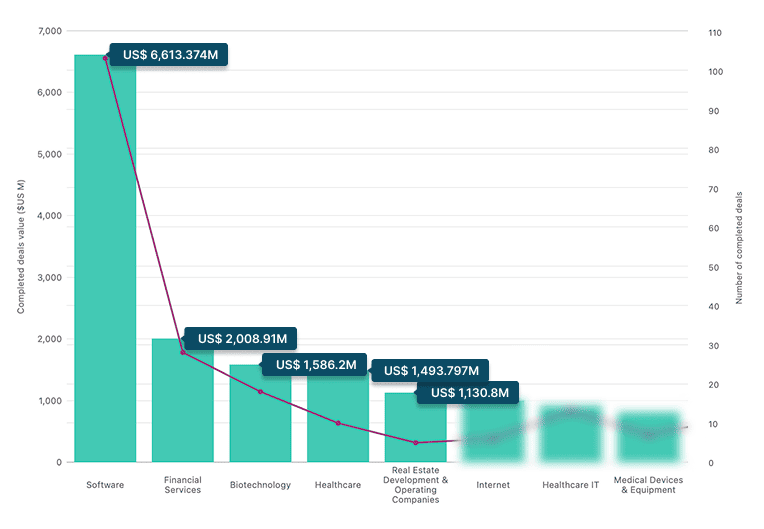

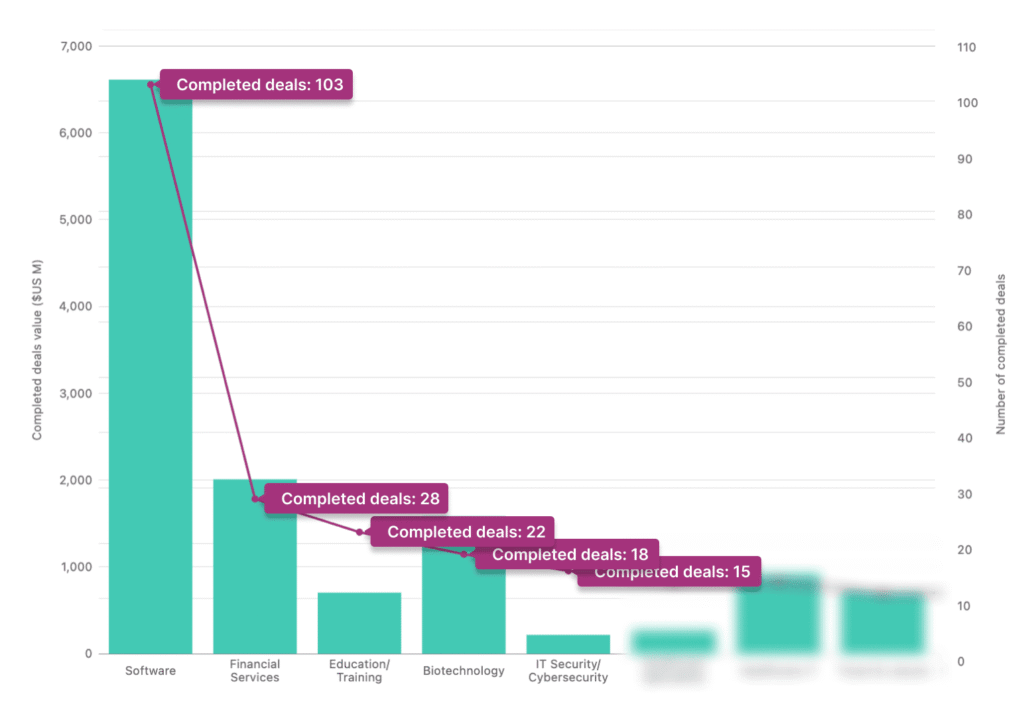

September’s investment data reveals a clear hierarchy in where capital is being deployed. The trends point to sustained confidence in technology and life sciences, with a significant portion of funds concentrated in a small number of large-scale deals.

The software sector remains the primary destination for investment, securing US$6.61B across 103 deals. Financial Services followed with US$2.01B across 28 deals. This highlights the massive ongoing disruption in the fintech space, including digital banking, payment processing, and blockchain technologies.

Biotechnology and Healthcare also demonstrated their resilience and high-cost R&D nature, pulling in US$1.59B and US$1.5B respectively. These sectors continue to attract major investment as they tackle global health challenges and develop next-generation therapies.

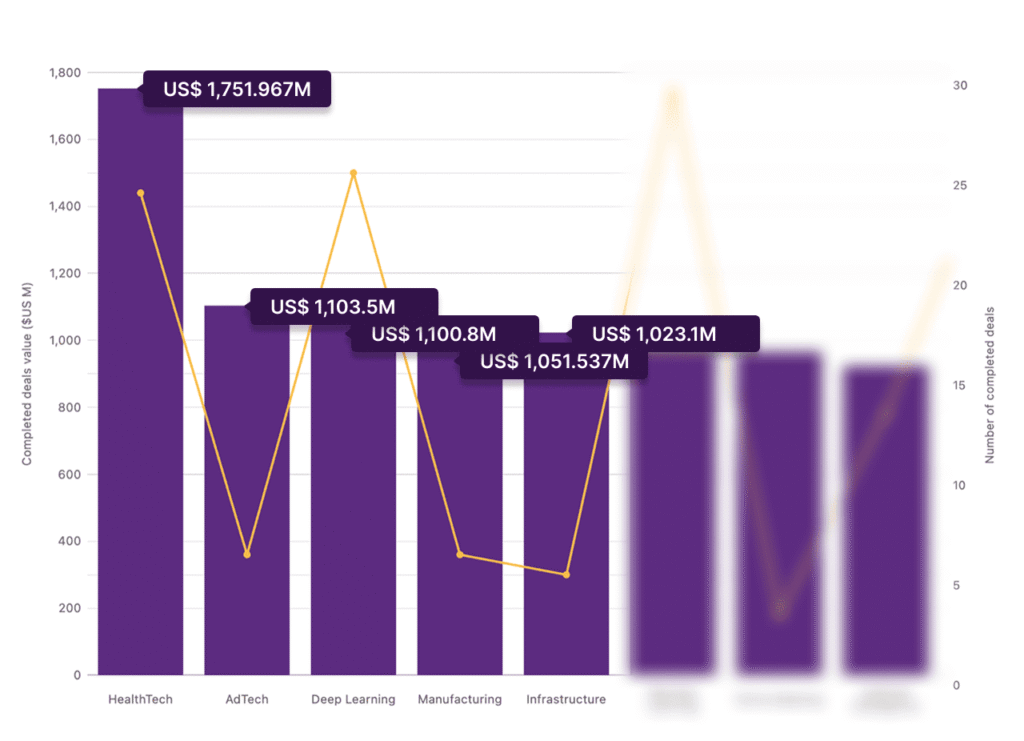

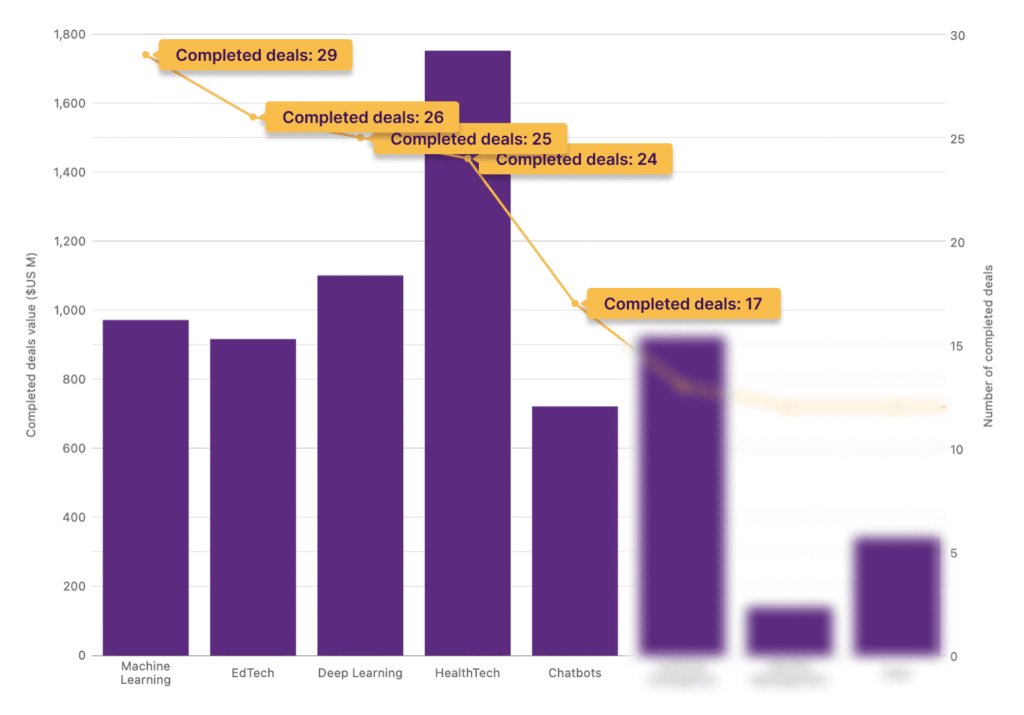

Looking beyond broad industries, the top-performing verticals tell an even more specific story about our technological priorities:

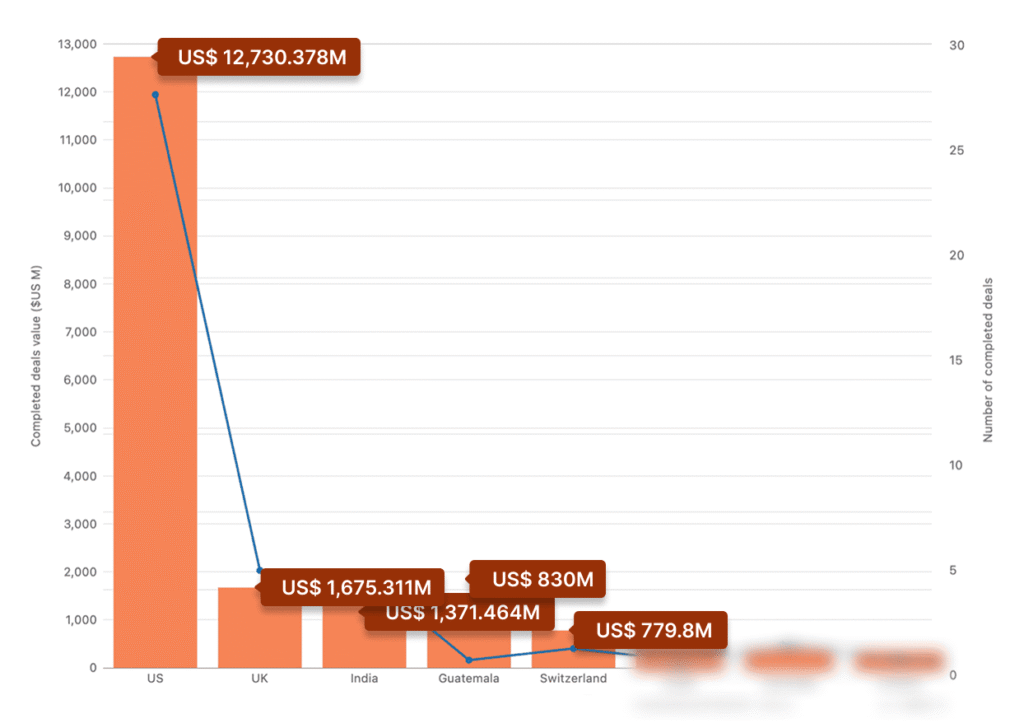

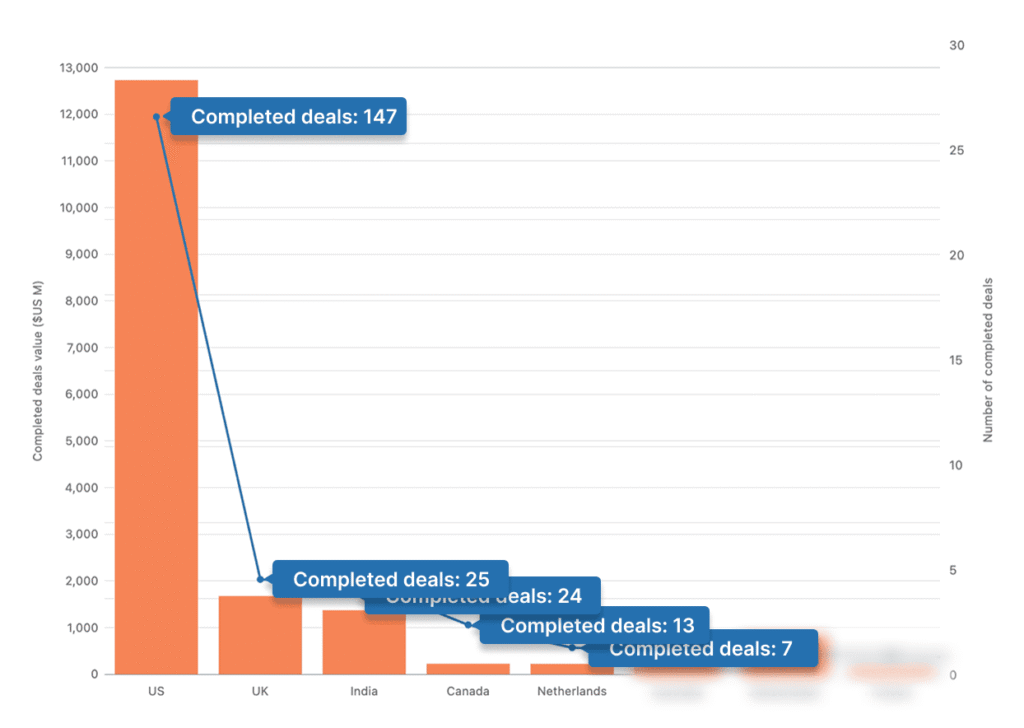

Geographically, the distribution of capital is stark. The United States firmly leads the pack, with US$12.73B invested across 147 deals. This represents a vast majority of the total capital, reinforcing its position as the world’s primary innovation hub.

The United Kingdom holds a strong second place with US$1.7B, maintaining its role as Europe’s financial and tech center. India follows closely with US$1.37B, signaling its explosive growth as a major market and source of innovation.

The appearance of Guatemala with a massive US$830M from just two deals is a notable outlier, potentially pointing to a rising star or a single, transformative project in the region.

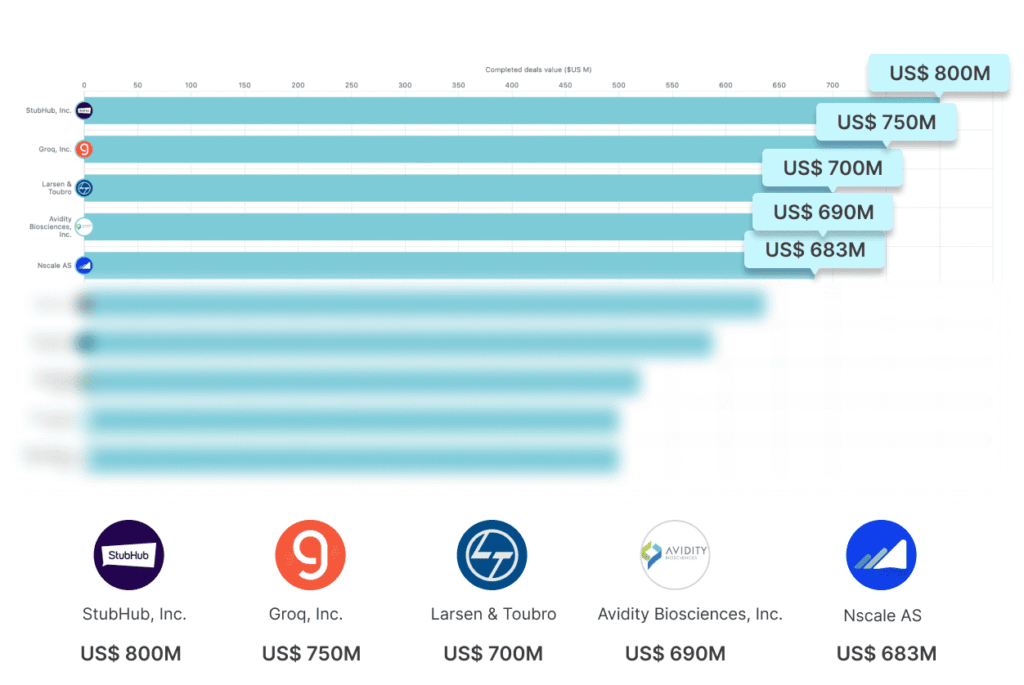

The largest individual deals highlight the scale of current investments:

The current investment landscape is characterized by a strong focus on software and health technology. Funding is not only concentrated in these sectors but also geographically, with the US capturing most of the capital. The prevalence of deals nearing the billion-dollar mark indicates a strategic shift towards making fewer, but substantially larger, bets on established front-runners.

The data in this blog is based on completed deals across all investment rounds in September 2025.

Share the news

Data aggregator designed to help investment professionals find, analyze, and evaluate opportunities in private markets.

Smarter valuations, sharper filters, and deeper insights, all live now.

Simplify deal sourcing with new company organization and revenue tracking features.

This update introduces AI-powered due diligence that eliminates manual research and provides faster, smarter insights.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.