Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

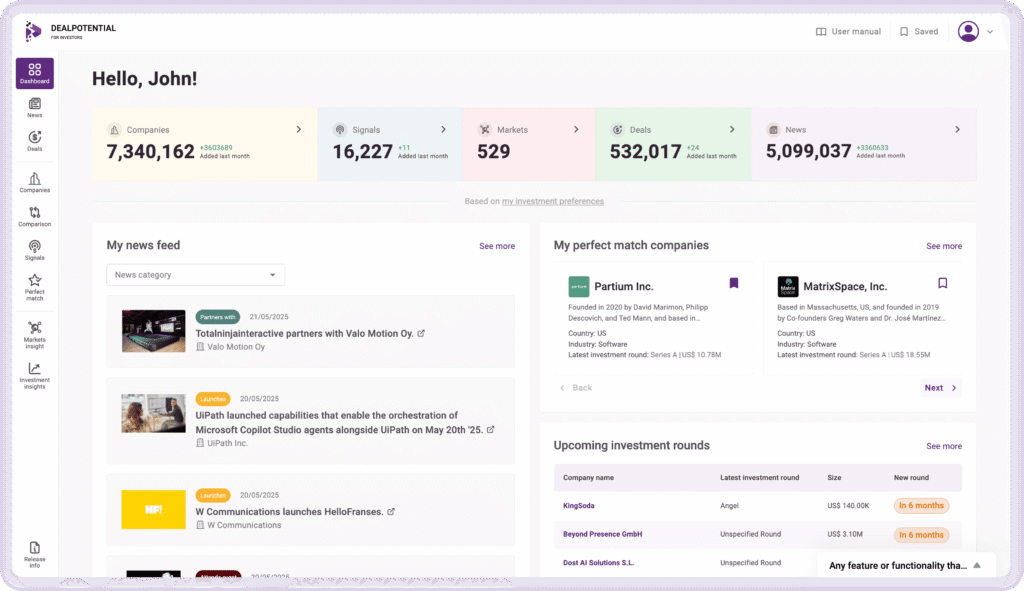

Our AI collects, cleans, and analyzes private company data. It delivers red flags, opportunities, and investment-ready insights so you can skip the research and focus on closing deals.

Data aggregator built for investment professionals who need due diligence done in minutes.

Get a complete, data-backed analysis of any company in minutes, covering financials, competitors, and more.

Get personalized private market news and access powerful search across all private companies and transactions.

Avoid overpaying with predictive next-round benchmarks and industry-specific valuation trends.

View all funding rounds and investor changes in the company’s timeline.

Perfect investment opportunities tailored to your strategy.

Side-by-side analysis of competitors or your preferred companies in seconds.

DealPotential brings together company data, funding signals, and market insights in one easy-to-use software, helping investors quickly find opportunities, compare options, and make confident decisions.

Get a complete, data-backed view of any company in minutes. We connect financials, operations, and more into one clear analysis with insights you can act on right away.

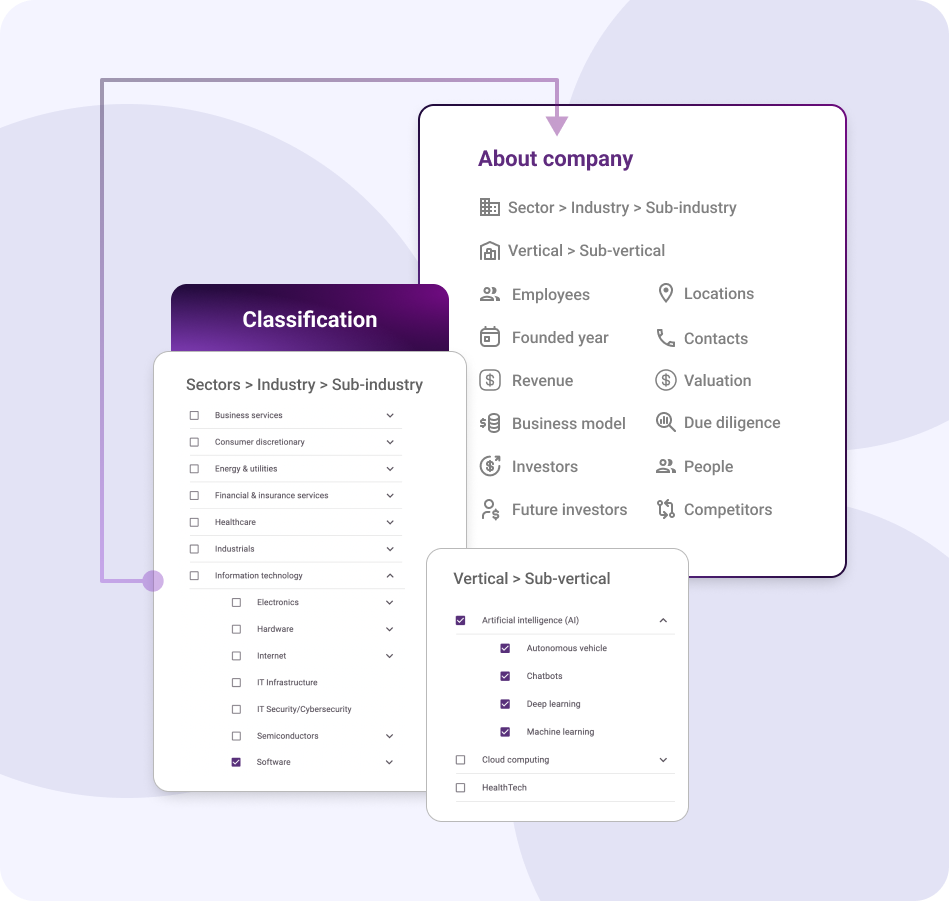

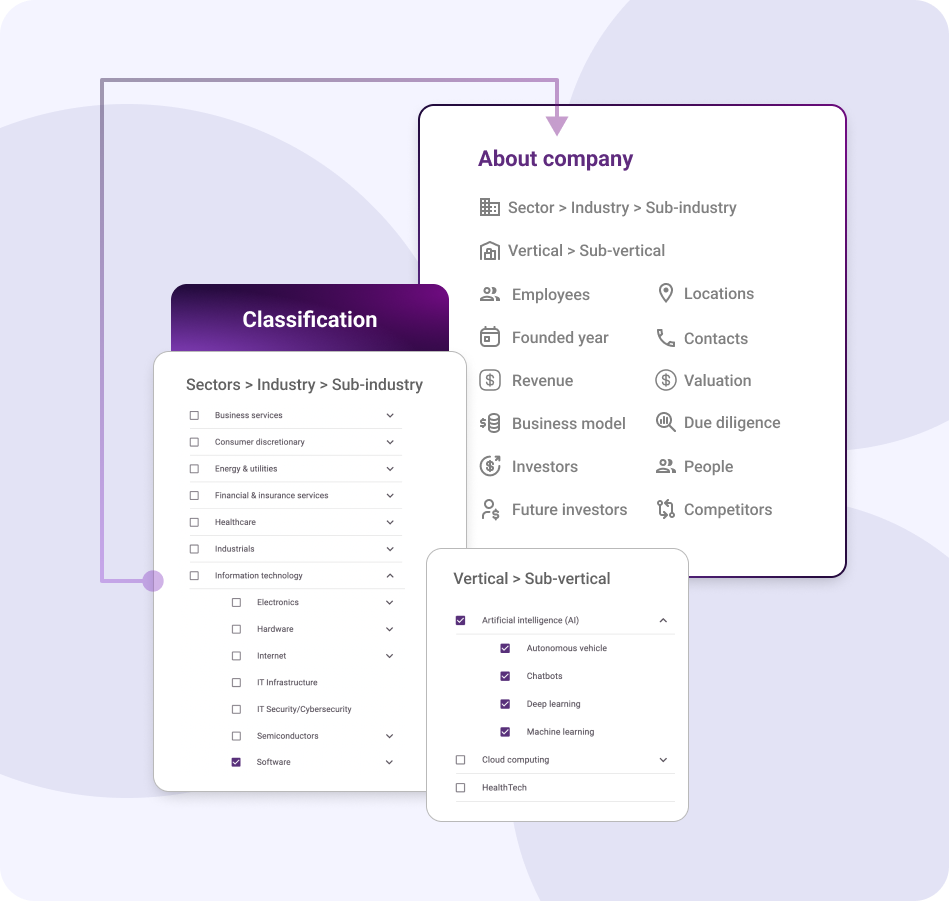

Access 7M+ private companies worldwide. Each is organized by sector, industry, sub-industry, vertical, and sub-vertical, making it easy to find the right targets, compare peers, and uncover new opportunities

Intuitive interface, straightforward metrics, and AI-driven insights designed to help you make decisions fast, without a steep learning curve or data overload.

Why We’re The Go-To Data Aggregator

We are the data aggregator that perfected private company intelligence.

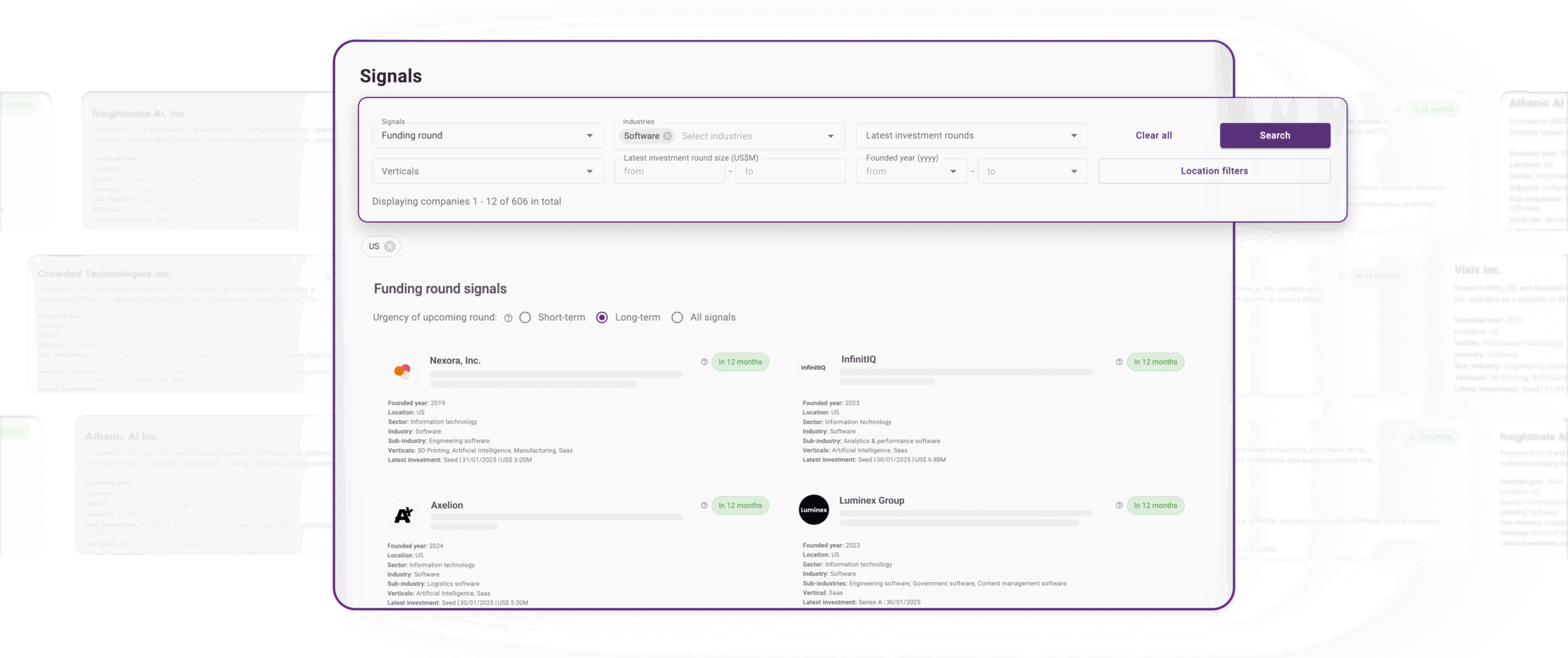

Act first on pre-public funding rounds to secure standout opportunities.

Prioritize top-tier investments by benchmarking companies across 15+ metrics like estimated value.

Our AI delivers the intelligence you need to focus on what truly matters.

Our AI matches companies to their correct markets, so you stop wasting time on misfits.

Spot trends and make decisions faster with AI-generated visuals that replace hours of analysis.

No technical skills needed. Spend your time on deals, not software training.

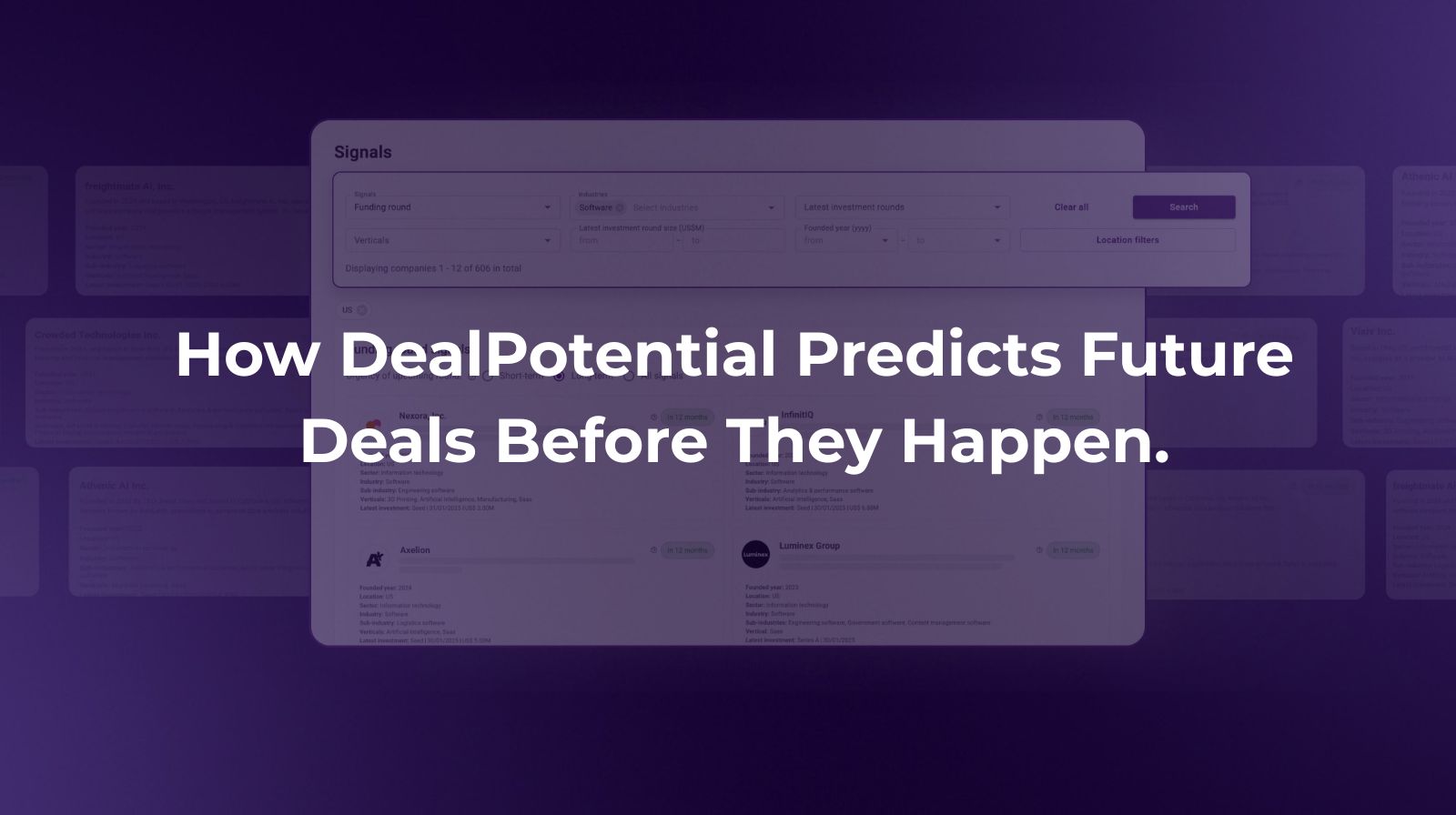

Find companies showing early signals of an upcoming raise and move before competitors.

Sourced directly from financial institutions, regulatory filings, and vetted databases giving you accurate, hard-to-find intelligence on private companies worldwide.

DealPotential transforms private market data into actionable due diligence, using AI-driven aggregation and predictive insights to help private equity firms, investment banks, and M&A advisors make faster, more confident decisions.

“The level of data depth is unique in my experience. I can form a comprehensive view of a company almost immediately.”

Portugal

“DealPotential stands apart not just because of the depth of data, but because of how usable it is. Our analysts and senior decision-makers are aligned from day one, working from the same source of truth. It has significantly improved both the quality and speed of our decisions.”

Tier-1 Bank

“What surprised us was how widely it was adopted internally. Analysts like it for the data, but senior management uses it because it’s easy to grasp without a long explanation.”

International bank

“We initially tested it for one project. It’s still being used across the team, which probably says more than anything else.”

Private Markets Team

“The breadth of coverage immediately stood out. It helped us fill gaps in areas where public or traditional providers are weak, especially in private companies.”

Large bank

“The biggest benefit for us has been consistency. Everyone comes into the discussion with the same baseline understanding of the market and the company. That alone has saved a lot of time and unnecessary debate.”

European PE firm

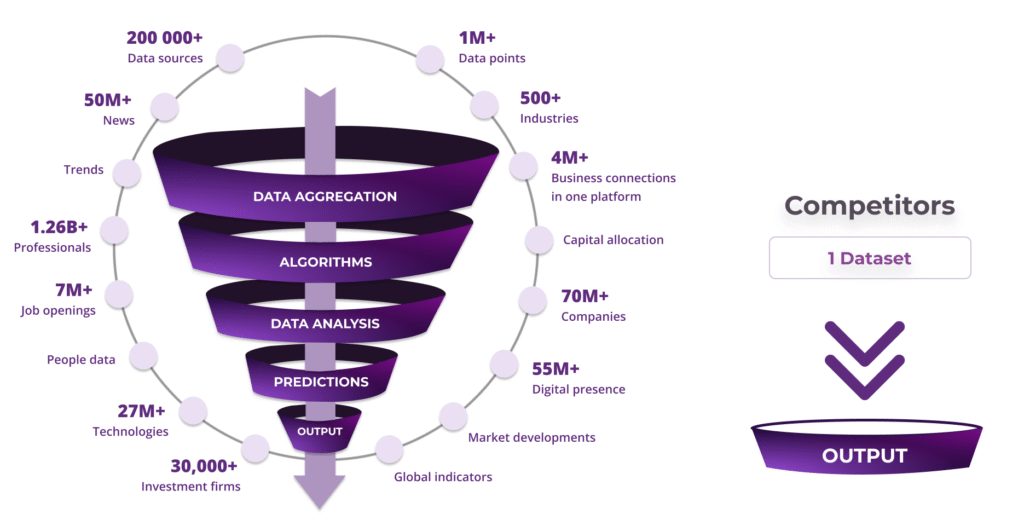

We collect information from over 21,000 sources, including financial institutions, research companies, and conduct our own research, which gives us over 200,000 data points. However, too much information can be confusing. Our goal is to make complex data simpler and easier to understand, so you can use it to make important business decisions right away.

We use special methods like unique calculations, computer programs, and AI technology, including machine learning and natural language generation, to provide you with data that is easy to understand. To learn more, please visit our Data webpage.

Yes. Every company in our database has a complete due diligence report. In total, that’s over 7 million reports ready to access. To learn more visit our FAQ page.

We cover more than 7 million international private companies. We work on a global scale with investors and entrepreneurs all over the world as we want to make a global impact.

We tailor the pricing based on the number of licenses you need. For more information, please see the Pricing page.

Read more about market trends, daily global news, product updates,

top industries, trending companies and more

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails. We do not sell or share your information with anyone else.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.