How DealPotential Predicts Future Deals Before They Happen.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

Investment bankers fight for speed. Yet most deals surface too late, when competition is high and founder expectations peak. DealPotential changes this dynamic. Our platform helps bankers predict future M&A deals before they hit the market.

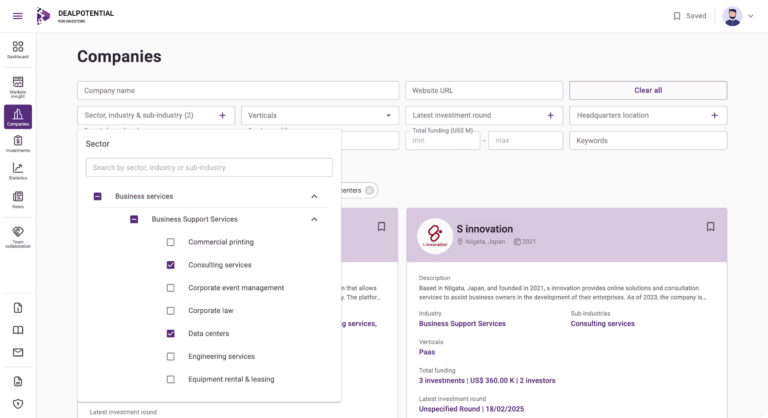

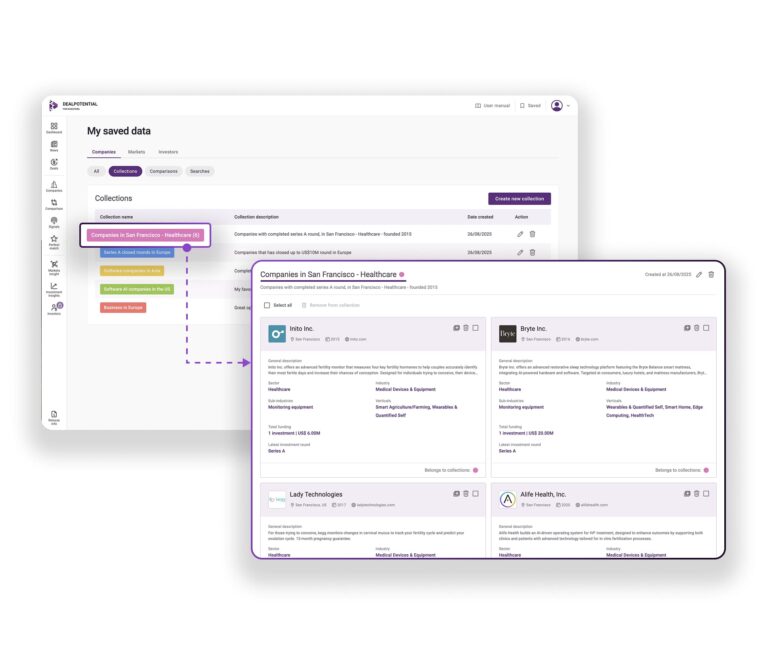

With verified private-company data, predictive AI signals and sector-deep classification, DealPotential reveals which companies will move, when they will move, and why the window matters.

Traditional sourcing is reactive. Data arrives after companies start engaging advisors. Consequently, deal teams lose weeks. However, proactive sourcing drives better outcomes.

Modern bankers want a view into tomorrow’s pipeline. They want signals that expose founder intent, capital pressure and expansion momentum. DealPotential delivers that visibility with accuracy and speed.

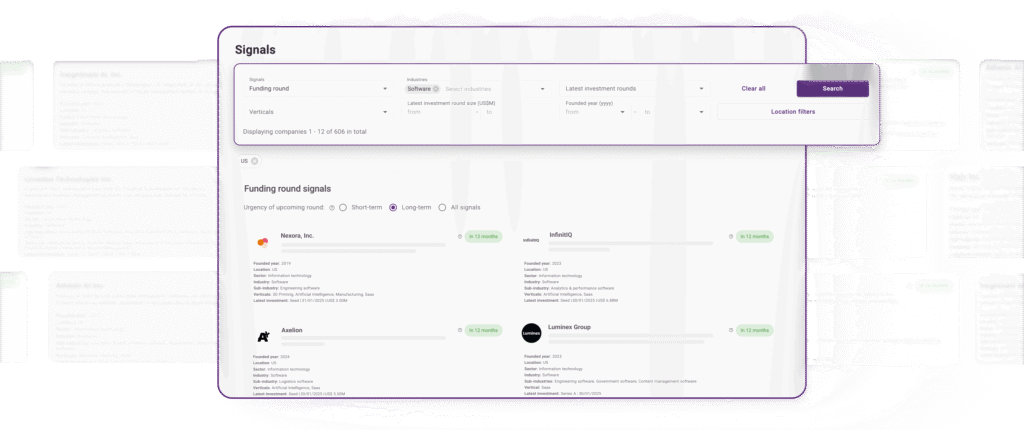

DealPotential tracks millions of private companies and applies predictive models to surface early signals. The platform highlights companies likely to raise capital or explore strategic options within 2–8 months.

The Key Indicators Behind Predictive M&A Signals

Financial Momentum Shifts

Companies showing accelerated or decelerating growth often reassess strategic options. Sharp momentum changes act as early indicators of upcoming decisions.

Team Expansion and Role Changes

Leadership hiring patterns reveal future intent. Executive transitions or new strategic roles often precede capital raises, acquisitions or exits.

Funding Pressure and Runway Patterns

DealPotential detects when companies approach capital thresholds. Limited runway and upcoming financing cycles strongly correlate with future M&A activity.

Product and Market Expansion Signals

Shifts in market footprint, new product launches and sudden demand spikes create liquidity windows. These movements serve as predictive markers of potential deals.

Digital Growth Patterns

Increases in digital presence, traffic or brand visibility often signal new strategic phases. Our models interpret these patterns as leading indicators of upcoming decisions.

Most platforms rely on outdated or incomplete private-company data. Consequently, insights lag behind reality. DealPotential solves this with:

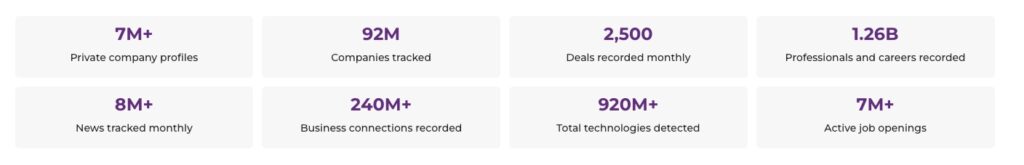

Verified data on 7M+ private companies

Proprietary classification across industries, sub-industries, verticals and keywords

AI-driven scoring models tuned for timing accuracy

Continuous monitoring of digital and structural company signals

Bankers get early clarity, cleaner intelligence and a more reliable view of upcoming activity.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

EU-based AI tools for private equity research help investors analyze markets and spot early opportunities. DealPotential leads this shift.

identify companies before fundraising with predictive AI and granular classifications. DealPotential helps you source early deals faster.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.