Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI deal sourcing for private markets is revolutionizing how firms find and evaluate targets. By tapping advanced analytics and AI signals, DealPotential’s platform can deliver an estimated “70% faster market evaluation” essentially slashing due diligence time dealpotential.com.

In today’s competitive environment, investors who rely on automation and data-driven tools can outperform those still sifting through spreadsheets.

As Bain notes, generative AI can cut deal-screening time per company “from a day to an hour,” making teams far more productive bain.com.

The result: faster discovery of high-value deals, fewer missed opportunities, and a sharper focus on the strongest leads. DealPotential embeds these innovations into its database of 4+ million private companies, using AI-driven signals and vertical classification to help private equity and VC investors work smarter.

In practice, AI deal-sourcing tools enable firms to prioritize the best prospects.For example, an EY survey found 70% of PE firm leaders agree that accelerating AI integration is critical to stay competitive defianceanalytics.com.

Bain reports a concrete scenario: a fund that once examined ~10 deals to find one investment realized that generative AI could “produce the initial list faster” and cut per-company screening from a whole day down to about an hour bain.com.

This dramatic efficiency gain means teams “become more productive” and can focus on analyzing the “potential gems” that survive the AI filter bain.com.

DealPotential harnesses these principles. Its AI-driven platform automatically ingests and analyzes millions of data points, surfacing leads that fit an investor’s criteria.By expanding searches beyond obvious candidates and leveraging predictive modeling, DealPotential uncovers high-potential targets before they hit traditional screens. As one industry note explains, firms can “accelerate and expand searches to surface not just peers in adjacencies but less-visible candidates” with AI mckinsey.com.

In short, AI deal sourcing for private markets shifts the process from guesswork to guided discovery, delivering faster, smarter deal pipelines.

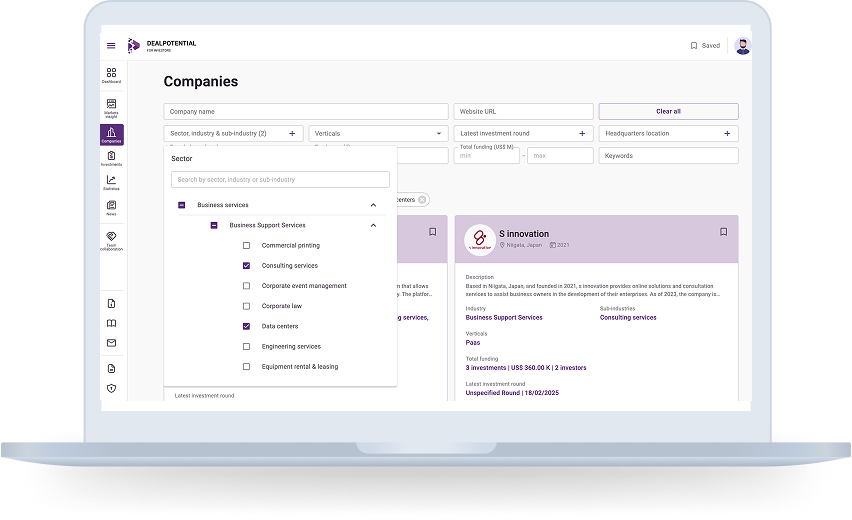

A key reason AI outperforms legacy methods is precision. DealPotential’s new hyper-granular classification system tags each company across sectors, industries, sub-industries, and even niche verticals dealpotential.com

Millions of firms have been re-classified with this proprietary model to ensure every search filter pinpoints the right market segment.

For example, a fintech startup might fall under “Financial Software” (industry) but also “Blockchain” or “Digital Payments” as a vertical. This level of detail means benchmarks (TAM, growth rates, peer comparisons) are always accurate.

As DealPotential explains, its system “enables pinpoint searching of niche markets” and uses machine learning to surface industry “hidden gems” and early signals of change.

The payoff is clear. By pre-labeling companies into hundreds of micro-segments, investors no longer waste time crafting search queries or correcting miscategorized targets.

Instead they can run hyper-targeted scans (e.g. “Series A AI-enabled healthcare startups in Scandinavia”) and immediately see precisely matching firms. This vertical-level tagging alone saves effort: DealPotential’s analysis suggests clients achieve “70% faster market evaluation”, cutting research time dramatically. It also “doubles your qualified pipeline” by weeding out irrelevant firms upfront.

In effect, AI classification turns months of manual sorting into minutes of actionable insight.

We can see these efficiency gains in action. Compared to static databases, DealPotential turns weeks of research into hours. An investor needn’t compile lists from disparate sources or validate every data point by hand: the platform aggregates verified data and updates it daily.

AI-driven workflows mean fewer false leads, one user survey observed traditional tools often miss small bootstrapped companies and thus less time lost on dead ends. In practice, a single associate might spend only a couple of hours per week on early screening, versus the 15–20 hours of manual scouring seen previously.

In sum, AI deal sourcing for private markets means working smarter, not harder.

By blending predictive funding signals with hyper-granular classification, DealPotential turns a formerly laborious research cycle into a streamlined process. Investors gain the foresight of a full research team with just a few clicks, allowing them to seize opportunities first and with greater confidence. In a space where timing and precision are everything, this level of automation and insight can make the difference between winning and missing the next big deal.

Book a demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

SHARE:

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.