When evaluating an investment, reliable information is everything. DealPotential delivers comprehensive and data-driven due diligence that gives you complete visibility into a company’s financial health, risks, market position, and future potential.

DealPotential delivers due diligence that goes beyond numbers. Verified company data, industry intelligence, and advanced analytics come together in a single, structured report, giving you a clear view of fundamentals, risks, and growth potential.

We handle the research, verification, and analysis so you don’t have to. Receive decision-ready insights that save time, reduce manual work, and accelerate confident deal-making.

Automated intelligence is combined with expert review to produce fast, accurate, and forward-looking analysis. Stay ahead of market shifts and make investments with certainty.

We start with the big picture.

Understand the company’s history, mission, core products, and its place in the business ecosystem. Get the foundational context you need first.

We analyze cash flow, valuation & funding history, regional breakdown & growth drivers, and key financial ratios to assess the company’s past performance and future potential.

Is the market growing or shrinking? Who are the key competitors? We provide the strategic context to evaluate the company’s market position and growth opportunities.

How does the business actually work? We assess the supply chain, technology, production capabilities, and operational efficiencies that

drive the business.

We provide information on the leadership team, board and major shareholders, and governance practices and policies.

Identify potential legal landmines. We screen for pending litigation, regulatory compliance, intellectual property issues, and key contractual obligations.

What could go wrong? We identify and prioritize key operational, financial, market risks, reputational and legal risks, so you can plan for challenges before they arise.

We provide actionable insights and recommendations on strategic partnership or acquisition opportunities, exit strategies, and mitigation strategies for risks.

We cite all data sources and outline our key assumptions, so you know exactly how our conclusions were reached.

We highlight recent events, news, or strategic shifts that could have a material impact on the deal.

Needing fast, reliable intelligence

Conducting pre-investment or exit due diligence

Providing clients with deeper insights

Requiring robust validation

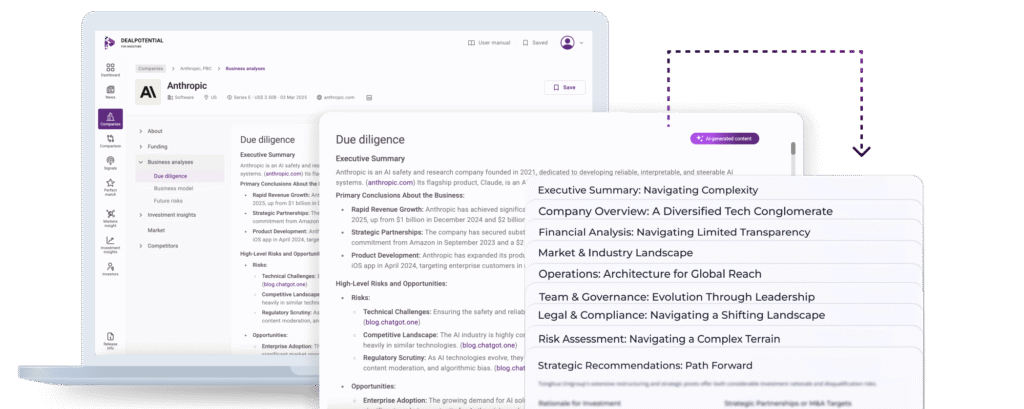

Due diligence reports open directly in the platform with structured insights, essential metrics, and clear summaries.

Delivery time: 3–15 minutes. You will receive an email and a notification inside the tool once the report is ready. You can download multiple reports at the same time.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.