Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

In today’s deal environment, access to private company intelligence tools is no longer a nice-to-have, it’s foundational. Investors, M&A advisors, and corporate development teams need more than just company names or basic metrics. They need context, signals, and structure. This is where solutions like Grata and DealPotential come in, but while both aim to support better decisions, their focus and capabilities differ in key ways.

Grata has earned a place in many teams’ toolkits by focusing on early discovery. Using website data and AI to surface private companies that may not appear in traditional databases, it helps expand the universe of what’s visible, especially in the lower middle market. For teams looking to cast a wider net, that approach has clear value.

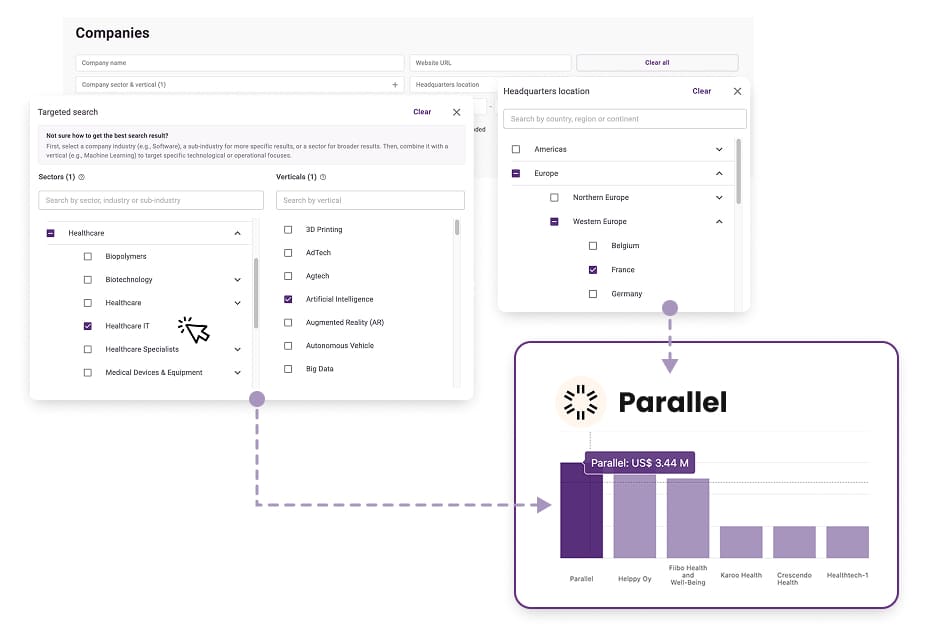

DealPotential, especially with the launch of DealPotential 2.0, was built with another goal in mind: helping you understand when, why, and how to act. Instead of just showing who’s out there, we go deeper, surfacing ownership structures, funding history, valuation signals, investor activity, and predictive indicators around capital needs, restructuring, or upcoming exits.

Grata surfaces what a company says it does. DealPotential surfaces what the data suggests is about to happen. Our newly expanded signals engine identifies early-stage activity patterns, offering insight not just into who to talk to, but when.

In the new 2.0 experience, users can segment by industry, subindustry, vertical, and strategic tags, then narrow the field further with intent-based filters. Whether you’re advising on a sell-side mandate or sourcing strategic add-ons, the goal is the same: getting to the right opportunity, faster, with confidence.

Both Grata and DealPotential bring something important to the table. But as the market continues to demand more structure, clarity, and predictiveness from data platforms, the distinction becomes clear.

Grata helps you see more companies.

DealPotential helps you act on the right ones.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.