December update: Valuation intelligence, improved filters, and more

Smarter valuations, sharper filters, and deeper insights, all live now.

In today’s hyper-competitive deal environment, speed and precision aren’t luxuries, they’re the only way to win.

But private market investors are still dealing with fragmented data, PDF-heavy diligence processes, and reactive decision-making.

Our July upgrade is your competitive advantage: a new suite of due diligence tools designed to accelerate qualification, surface risks earlier, and empower better investment decisions with real-time people data.

Let’s break down what’s new, and why it matters.

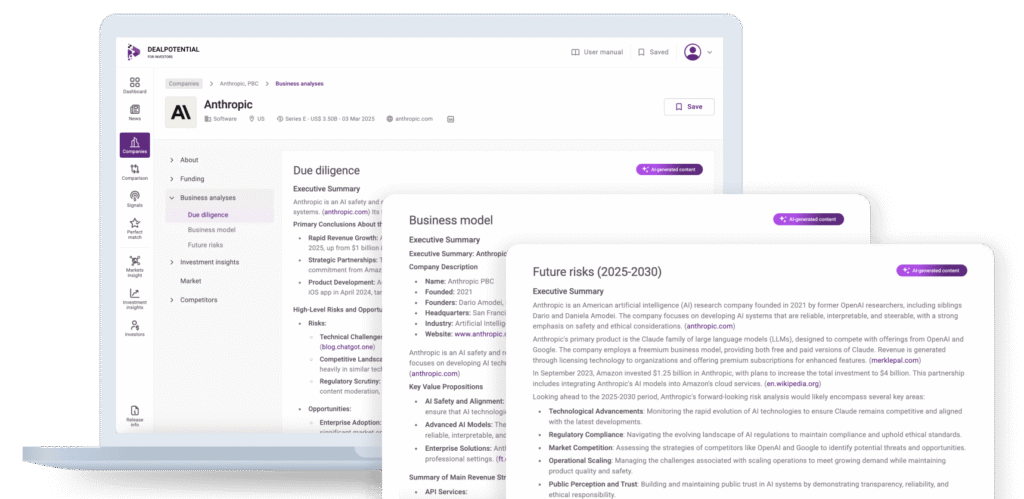

With the new Business Analysis improvement, you get a unified view of each company’s:

– Financial health

– Market position

– Operational performance

This redesigned Due Diligence report gives you an upfront view of a company’s strategic direction, operational efficiency, and growth signals, without the noise.

Benefits for deal teams:

– No more buried insights in bloated decks

– Quickly separate high-potential deals from distractions

– Focus your time on strategic deep dives, not initial filtering

Evaluating scalability and unit economics shouldn’t require guesswork. The Business Model report breaks down:

– Revenue streams

– Cost structure

– Growth model

-Competitor positioning

This helps you:

– Validate product-market fit early

– Spot fragile or inflated models

– Compare monetization logic across your pipeline

Financial models rarely expose leadership churn, operational fragility, or market saturation. The Future Risk report offers a strategic five-year outlook, covering:

– Financial exposure

– Operational bottlenecks

– Market risks

– Suggested mitigation strategies

Why it’s critical:

– Identify long-term vulnerabilities before term sheets go out

– Strengthen IC memos with proactive risk flags

– Avoid late-stage surprises or valuation mismatches

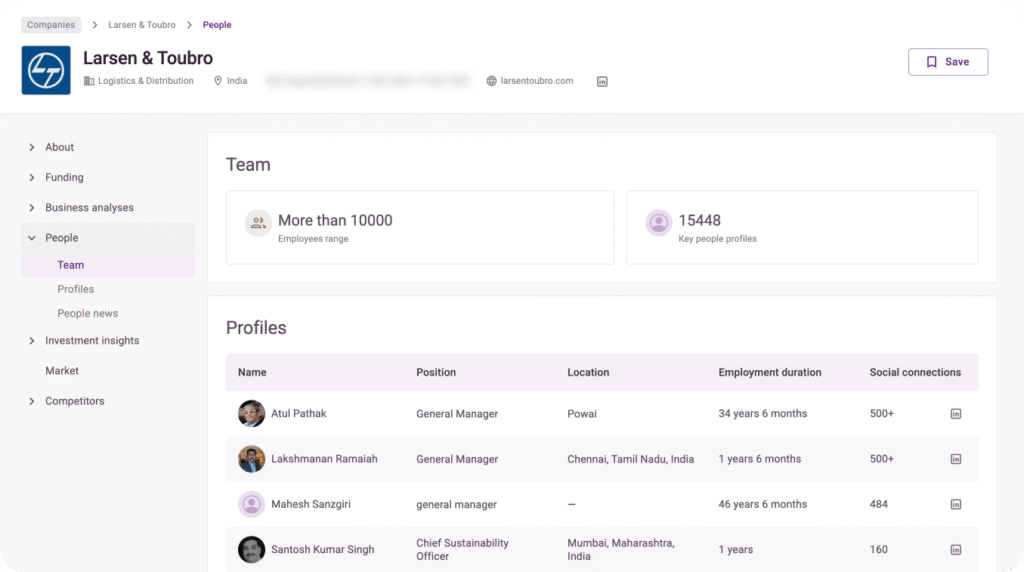

In private markets, you’re not just investing in a product, you’re investing in a team. The new People Tab brings people data to the forefront:

– Key executives and roles

– Org structure and team composition

– Real-time updates on leadership changes

For VCs, PEs, and investment banks:

– Spot founder-led vs. operator-heavy teams

– Monitor executive turnover

– Detect talent risk before it hits performance

Pro tip: Use people data as an early signal for culture misalignment, scaling risk, or founder burnout.

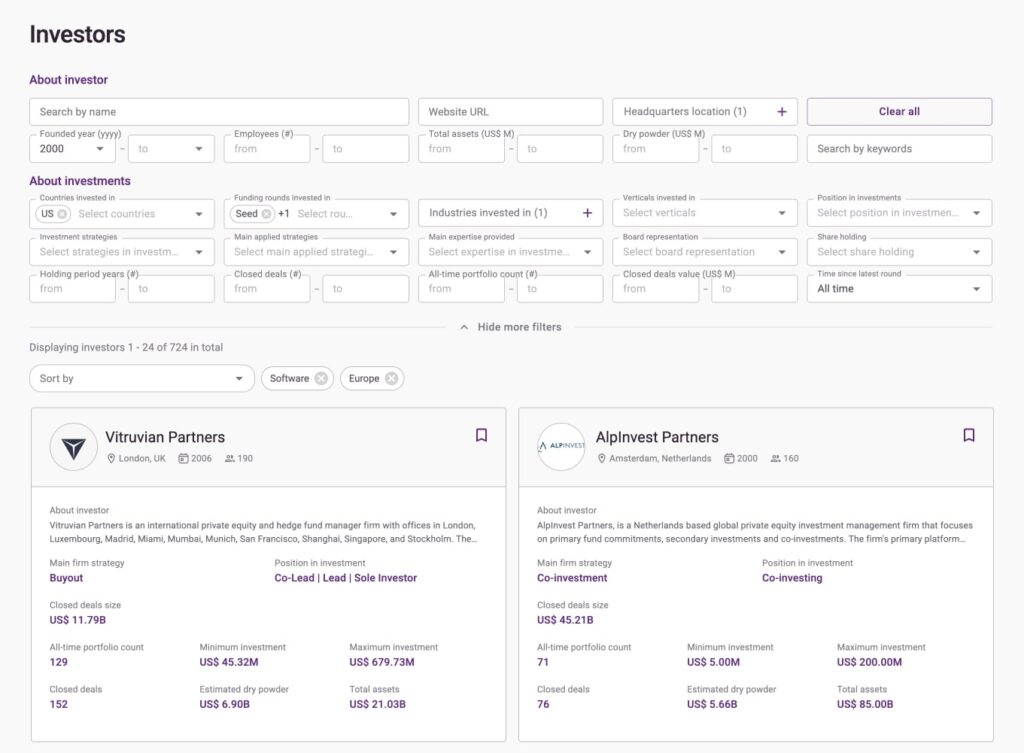

Looking for strategic co-investors? Benchmarking your deals against others in the market?

With the new Investor add-on, you can search and filter 33,000+ institutional investors by:

– Investment strategy

– Location

– Portfolio composition

This enables you to:

– Identify new fundraising opportunities

– Benchmark investors in similar deals

– Build smarter syndicates and reduce blind outreach

This isn’t just a UI upgrade, it’s a fundamental shift from static research to dynamic, real-time intelligence. With all your diligence tools in one place, you move faster, qualify better, and close with confidence.

The key differentiator? People data.

Because the next deal isn’t just about metrics, it’s about the people who will (or won’t) make it succeed.

Book your demo today and experience the difference!

Share the news

Data aggregator designed to help investment professionals find, analyze, and evaluate opportunities in private markets.

Smarter valuations, sharper filters, and deeper insights, all live now.

Simplify deal sourcing with new company organization and revenue tracking features.

This update introduces AI-powered due diligence that eliminates manual research and provides faster, smarter insights.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.