December update: Valuation intelligence, improved filters, and more

Smarter valuations, sharper filters, and deeper insights, all live now.

The private investment landscape moves at lightning speed. To stay ahead, you need hyper-granular industry classification—a system that adapts with the market, not behind it. For the past three months, we have been working on an update that isn’t just about features—it’s about empowering you to make decisions with clarity, precision, and foresight.

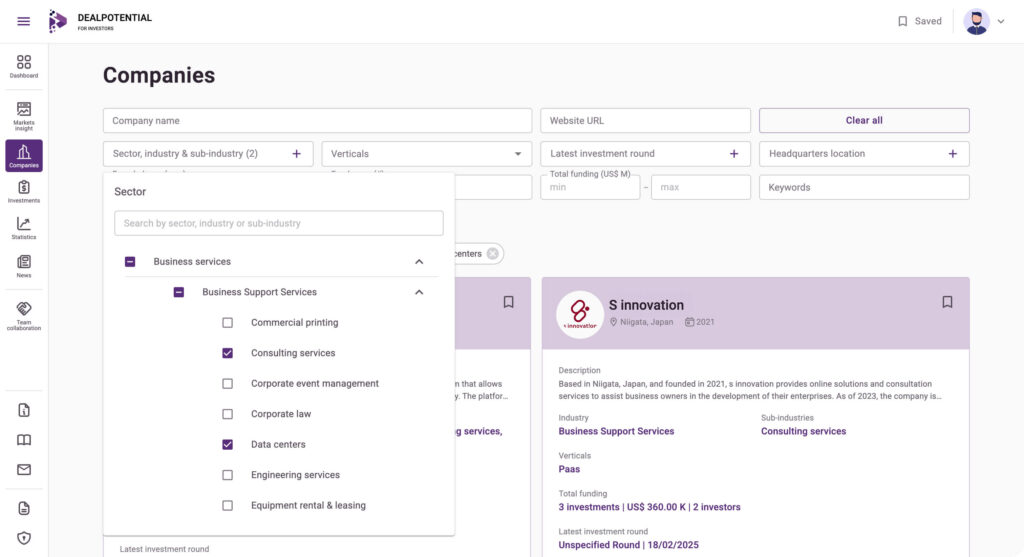

A new classification system has been developed using the latest proprietary model and advanced machine learning techniques. Millions of companies in the database have been reclassified into sectors, industries, and sub-industries, thereby enabling granular search, deeper insights, and improved categorization accuracy.

How to access: Companies > Sector, industry & sub-industry

Why you will love it:

✅ Unparalleled precision – Companies are categorized with greater accuracy than ever before.

✅ Granular search & discovery – pinpoint niche markets and emerging trends.

✅ Deeper insights for smarter decisions – clearer view of industry dynamics

✅ Enhanced portfolio diversification – identify truly distinct sub-industries and diversify your portfolio

✅ Machine learning-powered adaptability to market shifts – keeping pace with market shifts and industry transformations

Anticipate deals before they trend.

Signals, which are predictive algorithms for upcoming rounds or relevant company developments that align with investment preferences, now feature advanced filters for location, verticals, latest deal size, and founding year.

How to access: Companies > Signals > Filter based on your preferences

Why you’ll love it:

✅ Cut 20+ hours/month chasing dead ends

✅ Spot high-potential deals first

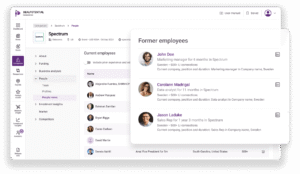

With expanded comparison dimensions and data points have been added to the Competitors page, enabling more granular and effective comparisons of competitors.

How to access: Companies > Company comparison > Choose up to 4 companies

Why you’ll love it:

✅ Unmatched competitive analysis – Go beyond surface-level comparisons

✅ Smarter investment decisions – Identify the true market leader by analyzing key metrics

✅ Spot future winners early – Gain a data-driven edge by evaluating long-term competitive advantages

✅ Risk mitigation – Avoid blind spots with a multi-dimensional approach

To maximize your strategy, benchmark against top investors while uncovering strategic co-investment opportunities.

How to access: Statistics > Choose the statistics > Investors with the most valued portfolio

Why you’ll love it:

✅ Benchmark against the best

✅ Identify under-the-radar co-investors

Identify potential partners with new Co-Investors insights, showcasing investors who have previously co-invested with your selected investor.

How to access: Investments > Investors > Select the investor > Co-Investors insights

Why you’ll love it:

✅ Build alliances

✅ Improved due diligence

By analyzing deals that others walked away from, you gain a complete market picture while turning missed opportunities into strategic wins.

How to access: Investments > Deals > Deal status filter

Why you’ll love it:

✅ Learn why others walked away—and turn their “no” into your strategic yes

Industry snapshot map now includes a legend, providing clear funding data by country for investment deals over the past year.

How to access: Companies > Select a company > About insights

Why you’ll love it:

✅ Pinpoint investment hotspots at a glance

The dashboard now highlights companies in your preferred industry with funding rounds completed in the last two years, sorted by deal size for easy analysis.

How to access: Dashboard > Scroll to Trending companies

Why you’ll love it:

✅ Skip the noise and see only what matters

We have added the Global news page that allows you one-click access to global funding alerts, PE exits, and VC gossip. Never miss a lapsed deal or a stealth-mode unicorn again.

How to access: News > Choose category, industry, vertical or search by keywords

Why you’ll love it:

✅ Turn rivals’ “no” into your strategic “yes”

✅ Always be updated

Future-proof your investment strategy!

➡️ Book a demo

Share the news

Data aggregator designed to help investment professionals find, analyze, and evaluate opportunities in private markets.

Smarter valuations, sharper filters, and deeper insights, all live now.

Simplify deal sourcing with new company organization and revenue tracking features.

This update introduces AI-powered due diligence that eliminates manual research and provides faster, smarter insights.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.