December update: Valuation intelligence, improved filters, and more

Smarter valuations, sharper filters, and deeper insights, all live now.

We at DealPotential understand that data can feel overwhelming. Spreadsheets, confusing charts, endless numbers… it’s easy to lose hours trying to make sense of it all.

But what if data didn’t feel like a burden? What if it sparked excitement, clarity, and smarter decisions?

That’s exactly what we’ve built over the last two months.

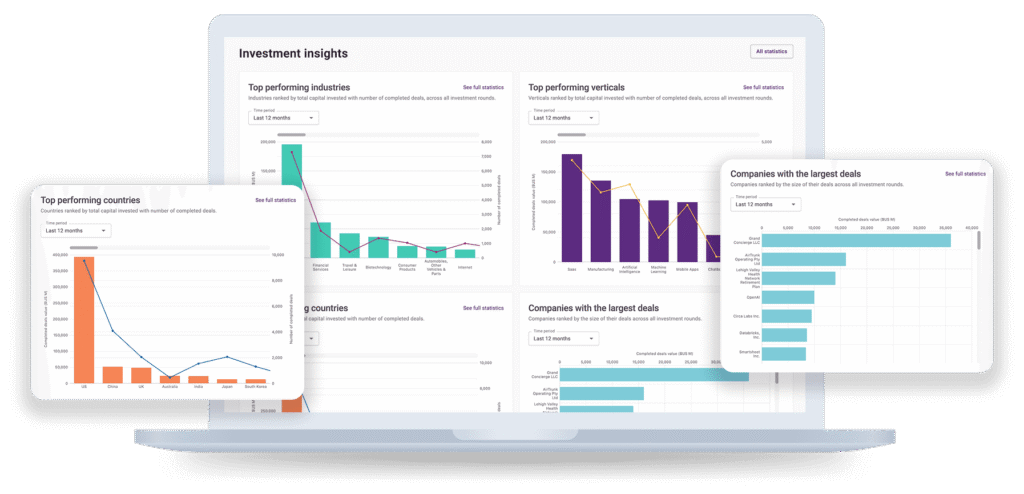

Our latest update is designed to turn raw investment data into intuitive, interactive insights you can actually use—whether you’re an investor, analyst, or founder looking for an investment opportunity.

How to access: Investment Insights

Why you’ll love it:

✅ Use our filters to narrow down your search and save hours with just a few clicks

✅ Make faster decisions with visualizations that show exactly what the numbers mean

✅ Compare trends over time with a dual-chart view

Understanding where the market is headed starts with knowing which industries are gaining momentum. With our new interactive industry charts, you can easily monitor growth patterns, filter by timeframe, and get early signals on emerging sectors.

How to access: Investment Insights > Top-performing industries

Why you’ll love it:

✅ Spot sectors on the rise—before they peak

✅ Compare timeframes to identify trends and declines

Go deeper within industries to explore how capital is flowing into specific verticals. Whether you’re looking for rising niches or want to validate market focus, this view gives you clarity and direction.

How to access: Investment Insights > Top-performing verticals

Why you’ll love it:

✅ See exactly where capital is flowing

✅ Discover which verticals are attracting the most deals and funding

✅ Compare trends across different timeframes

Markets behave differently by region. Our country-level insights help you spot high-growth markets, assess geographic risks, and make smarter cross-border investment decisions.

How to access: Investment Insights > Top-performing countries

Why you’ll love it:

✅ Discover high-growth regions

✅ Avoid risky areas with precise, data-backed insights

✅ Compare performance by location and timeframe

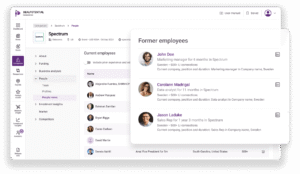

Want to know who’s making the most moves? Our investor activity tracker lets you monitor the most active players in the space—perfect for identifying potential partners, competitors, or co-investors.

How to access: Investment Insights > Top-performing investors

Why you’ll love it:

✅ Learn which investors are closing the most deals

✅ Spot potential collaborators and network connections

Not all investors are equally equipped to act. This interactive chart shows which investors have capital ready to deploy and what their assets under management look like—critical intel for outreach and partnership.

How to access: Investment Insights > Investors with the most dry powder and AUM

Why you’ll love it:

✅ See which investors are ready to invest now

✅ Gain strategic insights into AUM for smarter targeting

Some companies are magnets for capital. This view reveals the organizations closing the biggest rounds, so you can spot breakout stars, understand where investor interest is heating up, and stay on top of industry leaders.

How to access: Investment Insights > Companies with the largest deals

Why you’ll love it:

✅ Identify high-potential, high-growth companies

✅ Gain insight into which industries and verticals are driving the largest deals

Some of the most promising opportunities lie in companies that haven’t yet raised funding. Our data helps you discover these companies before the market catches on—giving you a first-mover advantage.

How to access: Companies > Companies search > Non-Funded

Why you’ll love it:

✅ Spot rising stars before valuations surge

✅ Build early relationships with founders

Where does a company stand in the market? Compare its latest funding round against direct competitors to understand how it stacks up—and where the gaps are.

How to access: Companies > Company profile > Competitors

Why you’ll love it:

✅ See funding size differences at a glance

✅ Quickly understand market positioning

Get the bigger picture. Dive into comprehensive company comparisons to evaluate your portfolio, benchmark competitors, and identify strategic opportunities.

How to access: Companies > Company profile > Competitors

Why you’ll love it:

✅ Understand the competitive landscape in detail

✅ Benchmark your companies or prospects

✅ Spot strengths, weaknesses, and white space opportunities

These aren’t just new features—they’re new capabilities designed to help you:

✅ Spot opportunities first

✅ Analyze with clarity

✅ Act faster than your competition

Share the news

Data aggregator designed to help investment professionals find, analyze, and evaluate opportunities in private markets.

Smarter valuations, sharper filters, and deeper insights, all live now.

Simplify deal sourcing with new company organization and revenue tracking features.

This update introduces AI-powered due diligence that eliminates manual research and provides faster, smarter insights.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.