Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

In 2025, private market investors no longer rely on gut instinct or historical benchmarks alone. The hunt for alpha has shifted toward real-time, forward-looking indicators predictive investment signals that forecast opportunity before it becomes obvious. Whether you’re a partner at a mid-market PE fund or a data-driven VC in Singapore, mastering these signals is the new edge.

Let’s explore the five most powerful predictive investment signals reshaping capital deployment in the private markets this year.

When top-tier talent starts flowing into a startup or rapidly exits investors take notice.

Platforms like H1 and SignalHire allow funds to monitor senior-level hires, especially in product, finance, or sales. According to a recent McKinsey report, talent density is often a stronger predictor of future success than capital raised or revenue growth.

Private equity firms are increasingly using AI to track “stealth hires” before formal announcements hit LinkedIn. When a 20-person B2B SaaS firm hires a CFO from Stripe, that’s not a coincidence, it’s a signal.

Behavioral signals across digital channels have become early indicators of deal activity.

Tools like 6sense and Bombora scan keyword searches, content downloads, and B2B website traffic to predict which companies are preparing to raise or restructure. These intent signals often show activity weeks before any formal outreach to investors.

In 2025, digital intent isn’t just a marketing metric—it’s a buy signal.

Smart investors are watching policy shifts as closely as revenue metrics.

New tax credits, subsidies, or compliance requirements often drive sudden demand for specific verticals climate tech, digital infrastructure, defense, or medtech. Tools like FiscalNote and Quorum help identify which companies will benefit (or suffer) from these shifts.

As McKinsey notes in its 2025 investment outlook, successful funds integrate geopolitical and regulatory dynamics into sourcing strategies.

What other smart investors are not saying publicly is often most telling.

Top funds monitor Form D filings, pro-rata allocations, and cap table movements using tools like Carta or Affinity. If two leading VCs both quietly increase their exposure in a pre-Series B deal, something is brewing.

By layering co-investment trends with platform-specific analytics, investors can detect emerging momentum rounds before they hit TechCrunch.

While all of the above signals are powerful, they still require manual effort, scraping tools, connecting dots, and acting quickly before the competition does.

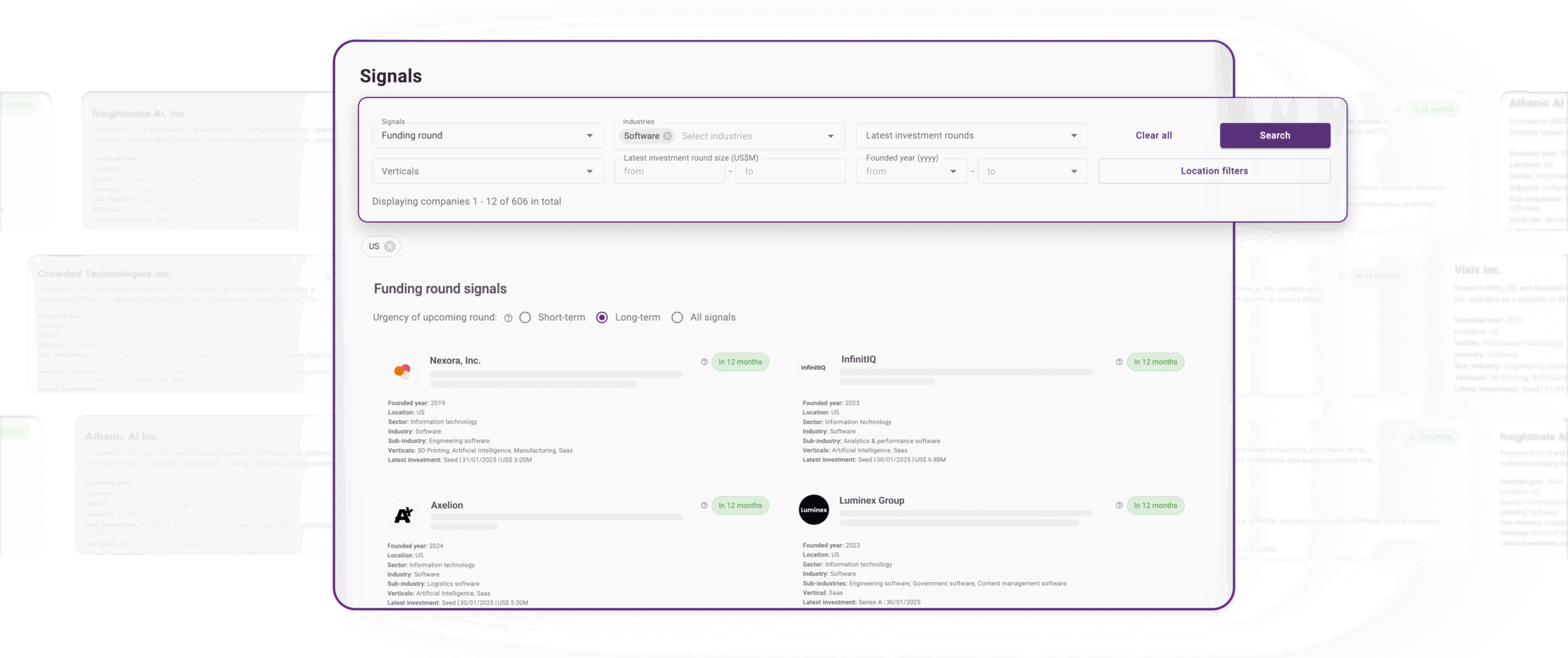

DealPotential eliminates that friction.

Its proprietary Signals feature uses AI to analyze thousands of data points, founder behavior, market movement, hiring trends, digital signals, and even investor behavior to predict which companies will likely raise capital within 2, 4, or 8 months.

Instead of searching, you receive a ranked list of companies likely to raise based on your industry, region, and strategy preferences. No more cold outreach. No more spreadsheets. Just deal intelligence on autopilot.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.