December update: Valuation intelligence, improved filters, and more

Smarter valuations, sharper filters, and deeper insights, all live now.

Your most valuable asset is time. Yet for most investors, that time is consumed by the tedious, manual work of deal sourcing: endless scrolling, repetitive filtering, and cross-referencing data across tabs.

What if you could automate that grind and redirect those hours toward what truly matters: deep analysis, building conviction, and engaging with founders?

Our September release is engineered to do exactly that. By pairing these updates with our AI-driven Due Diligence Intelligence, we’ve fixed the tedious work of deal sourcing—giving you more time to analyze, not administrate.

Here’s how you can instantly free up 5 hours of your week.

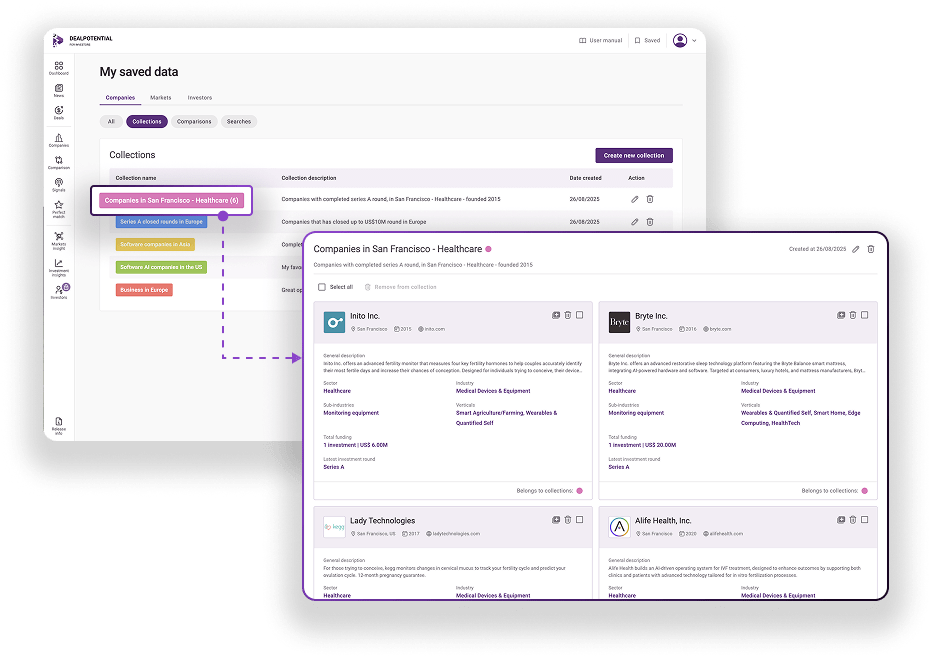

Collections allow you to group target companies by thesis, sector, or stage; think “Potential Roll-Up Targets” or “Series B Growth Equity Fits.”

Why it works: Prioritize targets in seconds and present curated lists to your investment committee instantly, without wasted effort.

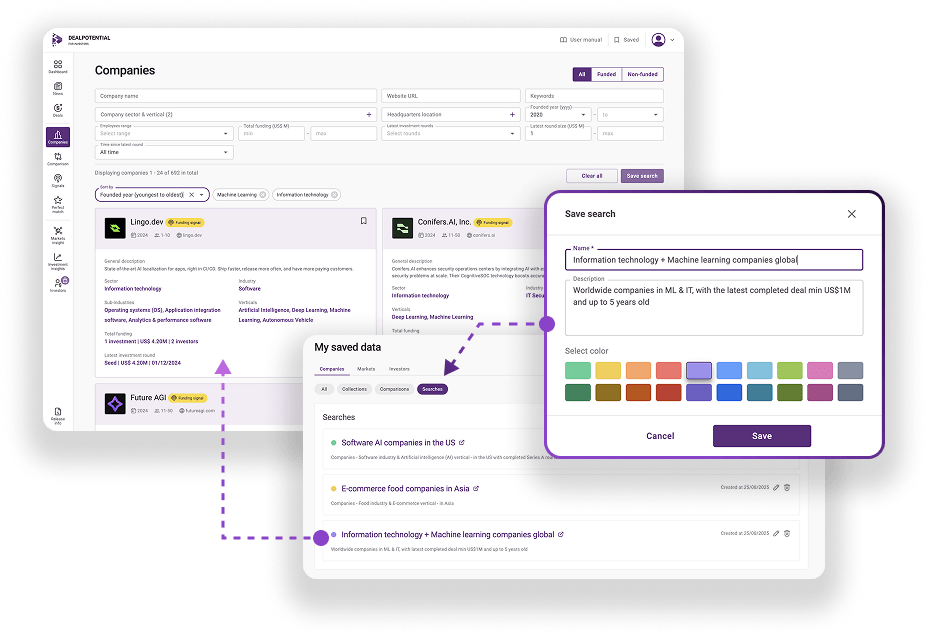

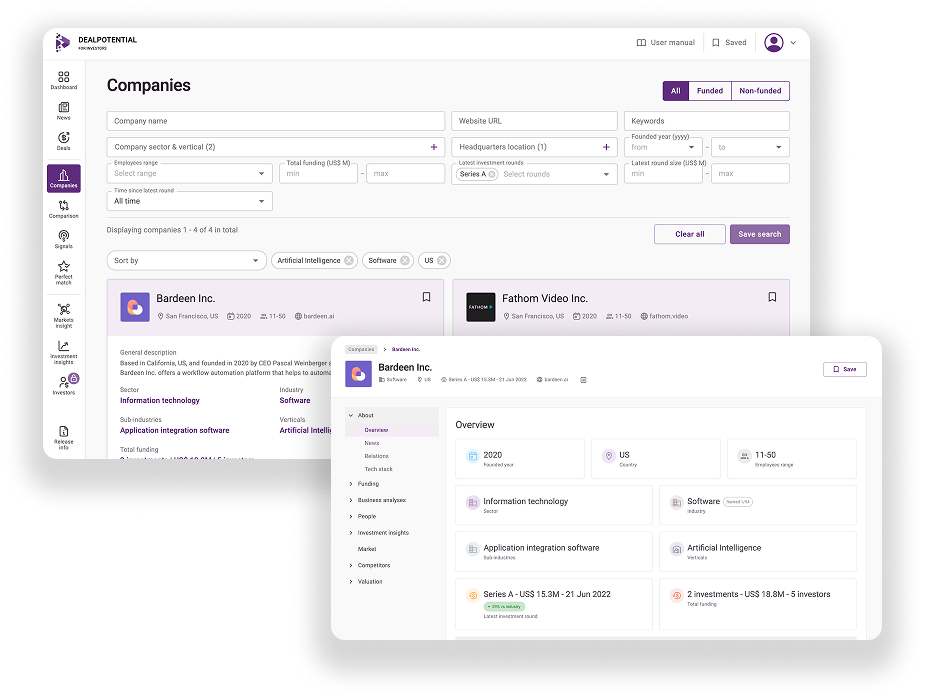

With Saved Searches, you get one-click access to your most complex filters for funding, employees, geography, and more.

Why it works: Re-run critical searches weekly to catch new market entrants before your competitors do, eliminating hours of repetitive manual research.

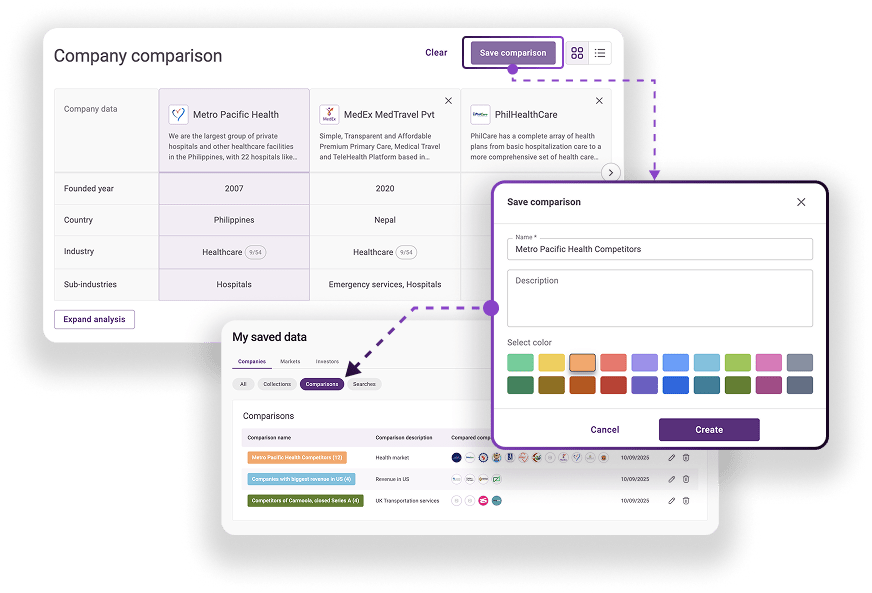

Comparisons, whether based on preselected competitors in company profiles or custom selections in the Comparisons page, can be saved and accessed at any time in Saved Data.

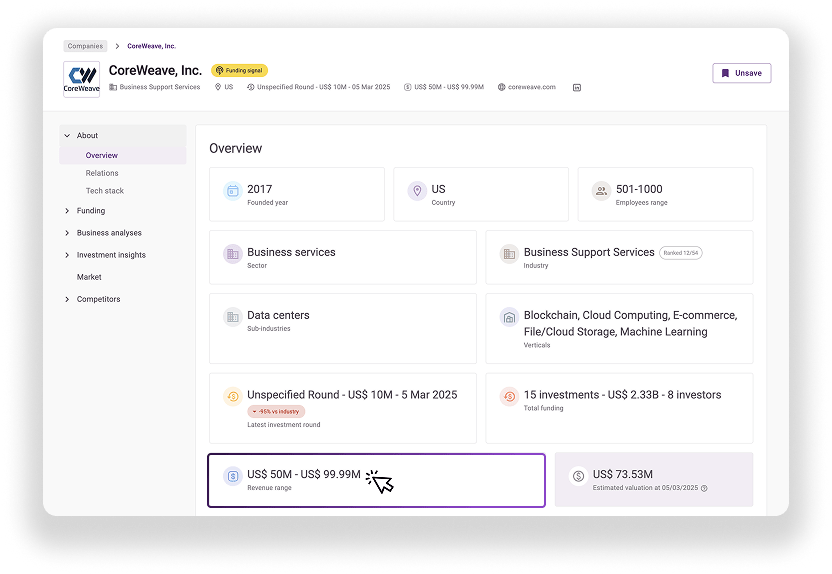

Revenue ranges are now visible for companies, providing instant clarity on company scale.

Why it works: Quickly gauge market opportunity and deal size at a glance. By knowing the revenue brackets, you can prioritize targets that fit your investment thesis, identify growth-stage patterns, and streamline valuation assumptions, saving hours of manual research.

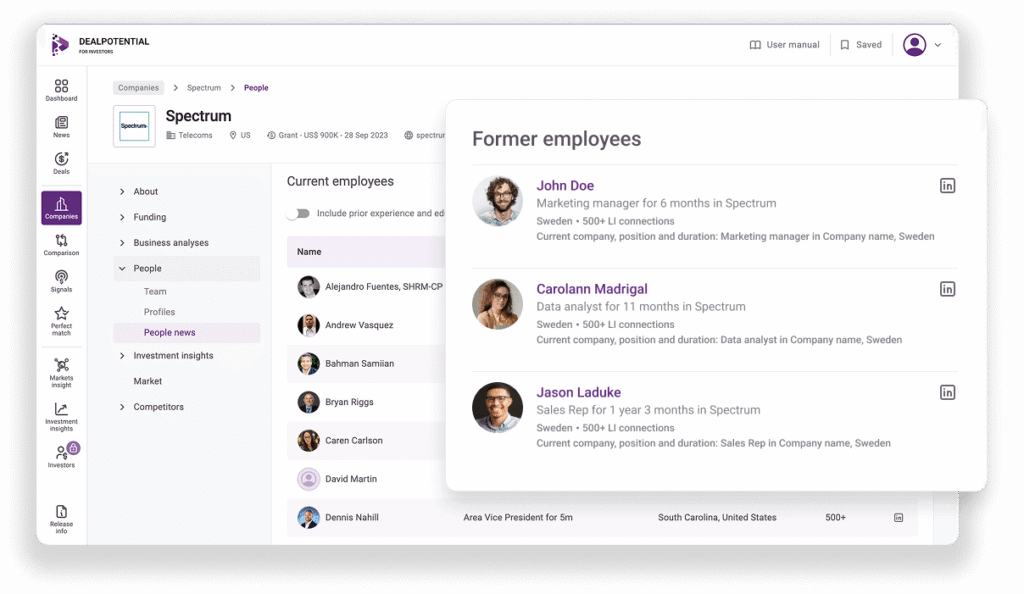

Track where ex-executives and key employees move to map relationship pathways for sourcing, validation, and market insight.

Why it works: Discover opportunities and potential co-investors that your competitors might miss, directly strengthening your market diligence.

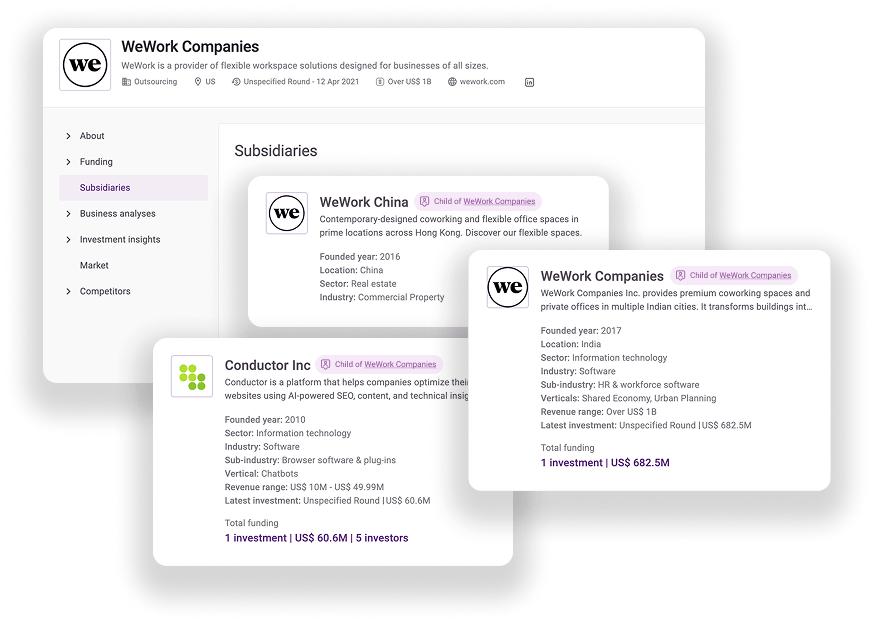

Company profiles are now enriched with detailed information on parent and subsidiary companies, giving you a complete view of corporate structures.

Why it works: Understanding ownership and corporate relationships helps you assess strategic alignment, uncover potential conflicts of interest, and spot growth or risk opportunities across a group of companies. This clarity ensures smarter investment decisions and more accurate market analysis.

Our Deals with sources feed provides a daily-updated list of deals with direct links to the original article or announcement.

Why it works: Spot trends and find comps instantly, allowing you to build persuasive IC memos without ever switching tabs.

Across our entire solution, you’ll experience more precise company information and clearer market signals.

Why it works: Reduce the risk of errors in diligence, improve underwriting accuracy, and ultimately make faster, smarter investment decisions.

This update is not just new features; it’s a new way to work that gives you the most precious commodity back: time.

Stop letting manual tasks dictate your week. With these updates, you can finally focus on what matters: discovering the best deals, analyzing opportunities deeply, and building conviction that wins.

➡️ Schedule your demo today.

Share the news

Data aggregator designed to help investment professionals find, analyze, and evaluate opportunities in private markets.

Smarter valuations, sharper filters, and deeper insights, all live now.

This update introduces AI-powered due diligence that eliminates manual research and provides faster, smarter insights.

This update delivers real-time people data, business model clarity, and 5-year risk insights to help you qualify smarter and close stronger.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.