December update: Valuation intelligence, improved filters, and more

Smarter valuations, sharper filters, and deeper insights, all live now.

Last week’s private market activity reflected a return to strategic capital deployment over raw volume.

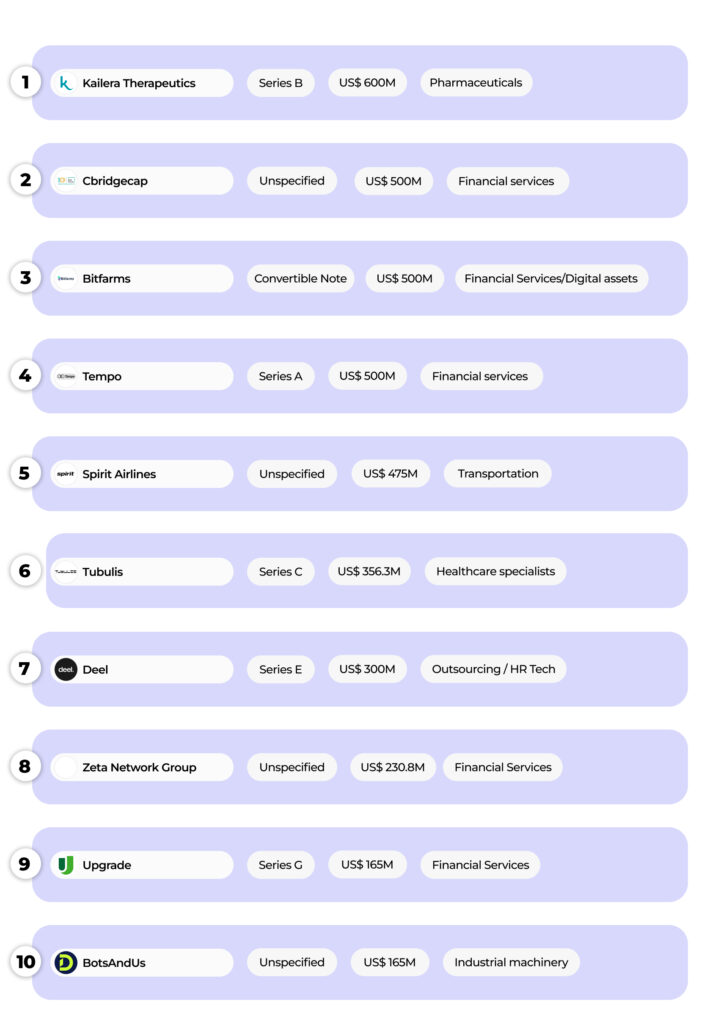

With 66 deals announced globally, private investors concentrated their capital in companies with strong defensibility, infrastructure depth, and near-term scalability. The top ten rounds accounted for the majority of disclosed funding, with a combined USD 4.8B raised across fintech, pharmaceuticals, and industrial automation.

1. Kailera Therapeutics Series B | USD 600M, Pharmaceuticals

Developing advanced oncology therapeutics targeting previously untreatable cancers. Funds will support late-stage clinical trials and manufacturing expansion, signaling investor confidence in biotech firms nearing commercialization.

2. Cbridgecap | Unspecified Round, USD 500M, Financial services

Expanding its cross-border investment infrastructure and private credit operations. The raise reflects institutional demand for alternative yield and scalable financial architecture.

3. Bitfarms | Convertible Note, USD 500M, Financial services / Digital assets

Securing capital to upgrade energy-efficient mining technology and expand U.S. operations. Highlights cautious optimism returning to digital asset infrastructure with a focus on operational efficiency.

4. Tempo | Series A, USD 500M, Financial services

An unprecedented debut round for a fintech focused on embedded finance for SMEs. The scale underscores investor conviction in fintech infrastructure that powers the real economy.

5. Spirit Airlines | Unspecified Round, USD 475M, Transportation

Bolstering liquidity amid consolidation pressures. This round enhances Spirit’s flexibility for restructuring or strategic partnership moves.

6. Tubulis | Series C, USD 356.3M, Healthcare specialists

Advancing next-generation antibody-drug conjugates. The raise solidifies Tubulis as one of Europe’s top biotech innovators, drawing continued global investor attention to healthcare defensibility.

7. Deel | Series E, USD 300M, Outsourcing / HR Tech

Expanding its global workforce management platform and automation ecosystem. Deel’s continued funding momentum highlights investor appetite for scalable SaaS solutions driving operational efficiency.

8. Zeta Network Group | Unspecified Round, USD 230.8M, Financial services

Building an integrated fintech infrastructure network across Asia and the Middle East. The company is positioning itself as a key player in next-gen cross-border financial systems.

9. Upgrade | Series G, USD 165M, Financial services

Further scaling its digital lending and credit product ecosystem. The round demonstrates continued investor support for profitable fintechs with diversified product portfolios.

10. BotsAndUs | Unspecified Round, USD 165M, Industrial machinery

Developing AI-powered robotics for airports, warehouses, and retail. This raise underscores automation’s growing role in reshaping industrial efficiency.

These top 10 deals captured the majority of disclosed global funding last week, reinforcing a capital concentration trend around fintech, healthcare, and automation.

While the top 10 represent the largest checks, other sectors also saw meaningful activity:

While fintech dominated value, healthcare and industrial innovation continue to provide defensible, acquisition-ready assets for strategic buyers.

Last week’s funding shows where the deals will be next year.

The week’s funded companies define the next wave of acquisitions. M&A pipelines need to focus on fintech rails, late-stage healthcare, and automation first.

Data source: Saida, DealPotential

Stay tuned for next week’s Deal Analysis to see where global capital moves next and which sectors set the tone for Q4’s closing stretch.

Share the news

Receive our regular newsletter about recent investments, market trends, promising opportunities and much more

You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails. We do not sell or share your information with anyone else.

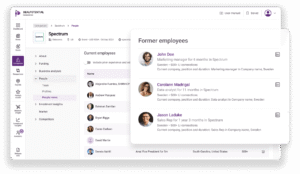

Data aggregator designed to help investment professionals find, analyze, and evaluate opportunities in private markets.

Smarter valuations, sharper filters, and deeper insights, all live now.

Simplify deal sourcing with new company organization and revenue tracking features.

This update introduces AI-powered due diligence that eliminates manual research and provides faster, smarter insights.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.