December update: Valuation intelligence, improved filters, and more

Smarter valuations, sharper filters, and deeper insights, all live now.

While the markets may have their ups and downs, one thing remains constant: the relentless pace of innovation and investment.

Last week was a blockbuster for major deals, with billions of dollars flowing into sectors poised to define our future, from AI infrastructure and semiconductors to sustainable energy.

Let’s break down the biggest moves and the trends they reveal.

The software sector remains the primary destination for investment, securing US$6.61B across 103 deals. Financial Services followed with US$2.01B across 28 deals. This highlights the massive ongoing disruption in the fintech space, including digital banking, payment processing, and blockchain technologies.

Biotechnology and Healthcare also demonstrated their resilience and high-cost R&D nature, pulling in US$1.59B and US$1.5B respectively. These sectors continue to attract major investment as they tackle global health challenges and develop next-generation therapies.

From a massive sustainability-linked facility in India to a fresh batch of AI unicorns, the diversity and scale of last week’s deals were impressive.

Beyond the individual headlines, the data reveals clear winning sectors.

The United States reaffirmed its position as the global capital of venture funding, with a staggering US$1.26B invested. However, the story doesn’t end there:

Last week painted a clear picture of investor priorities: foundational technology. The massive bets on AI infrastructure (Vercel), specialized AI chips (Rebellions), and AI applications (Eve, Gojob) show a market doubling down on the AI revolution. At the same time, significant capital is flowing into sustainable infrastructure (L&T, Entergy) and groundbreaking biotech (Star Therapeutics), proving that long-term, world-changing solutions remain firmly in vogue.

Stay tuned for our next update to see which sectors and companies capture the market’s attention this week!

Share the news

Data aggregator designed to help investment professionals find, analyze, and evaluate opportunities in private markets.

Smarter valuations, sharper filters, and deeper insights, all live now.

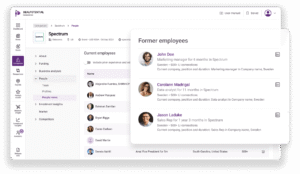

Simplify deal sourcing with new company organization and revenue tracking features.

This update introduces AI-powered due diligence that eliminates manual research and provides faster, smarter insights.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.