Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

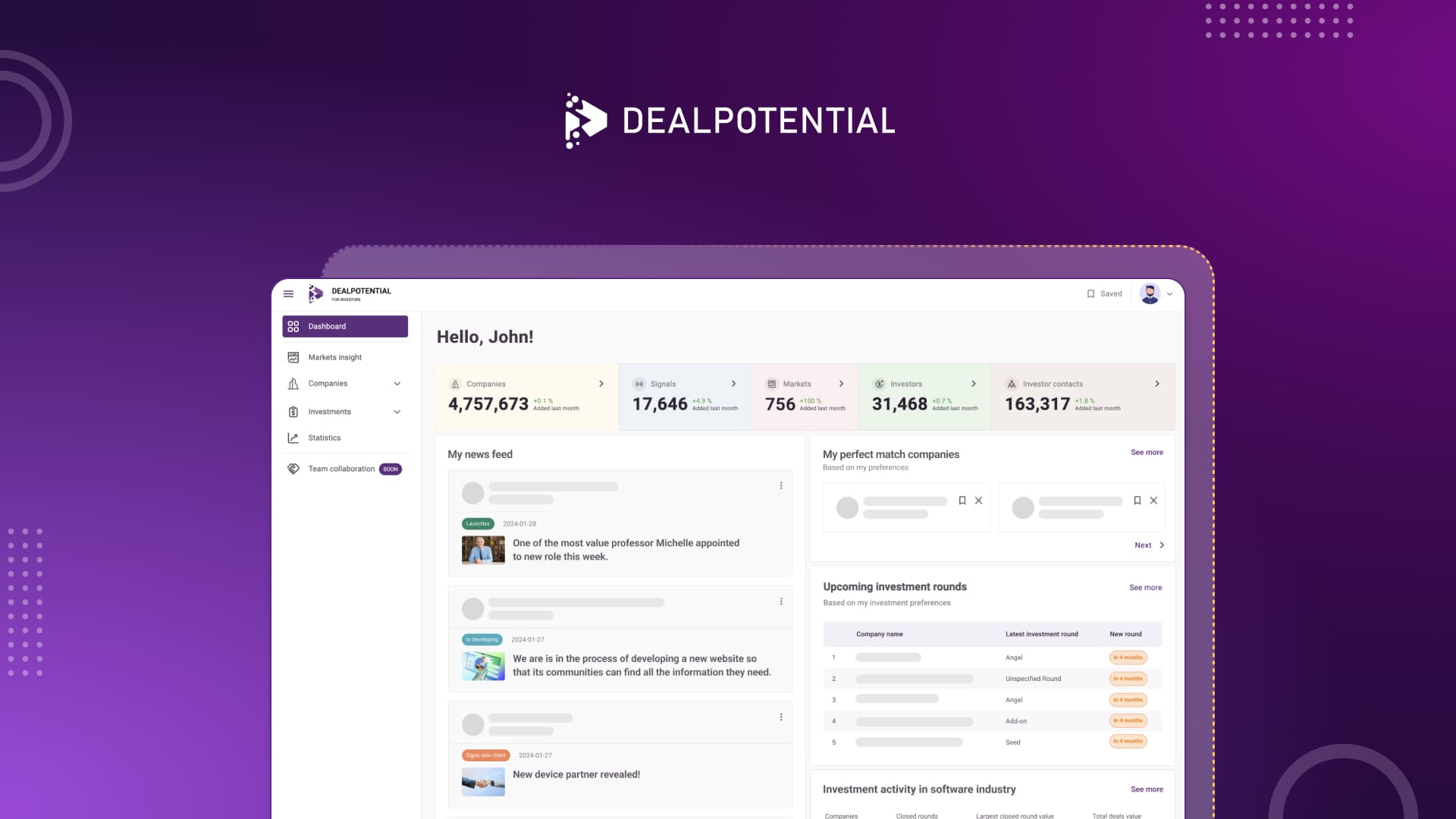

In today’s crowded tech landscape, private market investors are increasingly asking themselves, “Do we really need another platform?” This question is justified—especially when the market is saturated with tools that promise everything and deliver little. However, DealPotential changed this narrative. Our data aggregator fundamentally transforms how private investors leverage company data.

DealPotential is an AI-powered data aggregator that gives private investors comprehensive and actionable insights into millions of private companies worldwide.

Although an overwhelming amount of data is available to private investors, actionable insights remain scarce. The primary challenges include:

❌ Fragmented sources: Teams waste time reconciling discrepancies across spreadsheets, databases, and third-party tools.

❌ Stale or unverified data: Web-scraped and self-reported data from most platforms risk compromising due diligence.

❌ Analysis paralysis: Unstructured insights drown teams in noise instead of clear signals.

DealPotential solves these challenges. Our platform pulls verified data from 21,000+ global sources including financial institutions and regulatory filings into one AI-powered solution. As a result, less time is wasted on data sourcing, and more time is dedicated to execution.

Unlike traditional data providers, DealPotential combines breadth, accuracy, and predictive power to deliver actionable intelligence:

✔️ Sourced and verified company data: We collect private company data from 21,000+ trusted sources like financial institutions and research firms.

✔️ Comprehensive private company coverage: Our hyper-granular classification system organizes millions of private companies by niche industries and verticals.

✔️ Predictive analytics: AI algorithms identify high-probability funding rounds and competitive shifts before they happen.

✔️ User-friendly interface: Interactive dashboards and customizable reports streamline workflows for all users.

For private equity firms, venture capitalists, and corporate development teams, DealPotential is not just another tool—it is a productivity multiplier. Notably, clients report major reductions in research time and faster, more confident deployment of capital.

In an industry where speed and precision dictate success, the critical question becomes: Can you afford not to upgrade your data infrastructure?

DealPotential redefines private market intelligence by replacing inefficient, reactive processes with AI-driven foresight. Rather than simply centralizing data, DealPotential transforms how private investors identify, evaluate, and act on opportunities.

Ready to move beyond legacy tools? Explore DealPotential today!

Book a demo today and experience firsthand how we can make a significant impact on your business.

SHARE:

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.