Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

Discover how AI-powered company intelligence enables private investors to unlock smarter deal sourcing, real-time investment signals, and predictive analytics that outperform static data methods. In addition, in today’s competitive private business environment, relying solely on firmographics, funding rounds, and outdated classifications is no longer enough. Instead, investors must leverage artificial intelligence (AI), real-time signals, and predictive analytics to uncover hidden opportunities, anticipate market shifts, and stay ahead of competitors.

While access to vast amounts of private company data presents unprecedented opportunities, it also creates a critical challenge: determining how to extract actionable insights from the noise. Rather than simply collecting data, the key differentiator is intelligent analysis that transforms raw information into strategic foresight.

Revolutionizing the field, AI is transforming private company intelligence by moving beyond passive data aggregation to real-time pattern recognition, trend forecasting, and predictive modeling. For example, by employing machine learning algorithms, vast datasets are analyzed to:

🟣 Spot high-growth companies before they enter mainstream awareness

🟣 Gain insight into market sentiment through social media, news, and product reviews

🟣 Catch early signals of disruption or competitive threats

Consequently, an AI-driven platform can continuously scan global data sources, evaluate company trajectories, and surface the most promising investment or partnership opportunities—well before competitors take notice. In essence, this turns raw data into actionable foresight.

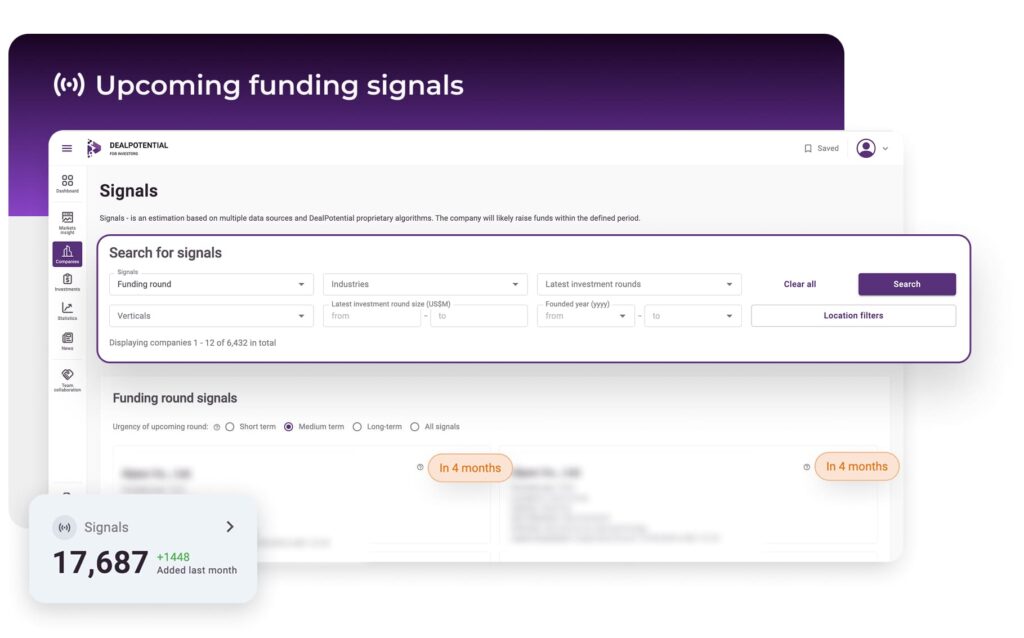

Investment signals—real-time indicators of private company health and market momentum—are critical tools in modern deal sourcing. These include but are not limited to:

🟣 Emerging industry trends

🟣 Shifting consumer demand

🟣 Regulatory or competitive disruptions

By incorporating these upcoming funding signals, investors can adapt strategies proactively, ensuring they capitalize on investment opportunities and mitigate risks faster than the competition.

Beyond raw data, the true power of AI-driven company intelligence and real-time signals lies in predictive analytics, which enables investors to forecast future trends with precision. This provides invaluable for:

🟣 Evaluating investment risks and opportunities

🟣 Timing market entry or exit strategies

🟣 Benchmarking startups against industry trajectories

Rather than relying exclusively on historical data, private investors can now use predictive models to assess a company’s future funding.

Through the integration of AI, signals, and predictive analytics, a new intelligence framework is emerging that transforms deal sourcing. With this approach, investors can now:

🟣 Prioritize high-potential targets with data-driven confidence

🟣 Mitigate risks by anticipating challenges before they materialize

Thus, this shift moves investment strategy from static data to dynamic intelligence, helping forward-thinking private investors stay ahead in an increasingly volatile market.

Looking ahead, the next era of company intelligence will be defined by AI-powered insights, real-time signals, and predictive foresight. In fact, firms that embrace these technologies will not only keep pace with change—they will drive it.

At Deal Potential, we’re at the forefront of this transformation, empowering businesses to navigate complexity, uncover hidden opportunities, and maximize strategic potential.

Then take the first step today: Book a demo!

SHARE:

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.