How a M&A advisory firm started winning competitive mandates faster

A mid-market UK M&A advisory firm turned time pressure into competitive advantage with AI-powered deal origination.

Small private equity firms and boutique investment banks face a structural disadvantage.

They compete with larger firms, yet operate with fewer people, less time, and tighter budgets.

That’s why deal sourcing for small firms cannot rely on traditional workflows.

Manual research, spreadsheets, and slow due diligence are no longer sustainable.

Within the first 20 minutes of analysis, you should already know if a company is worth pursuing.

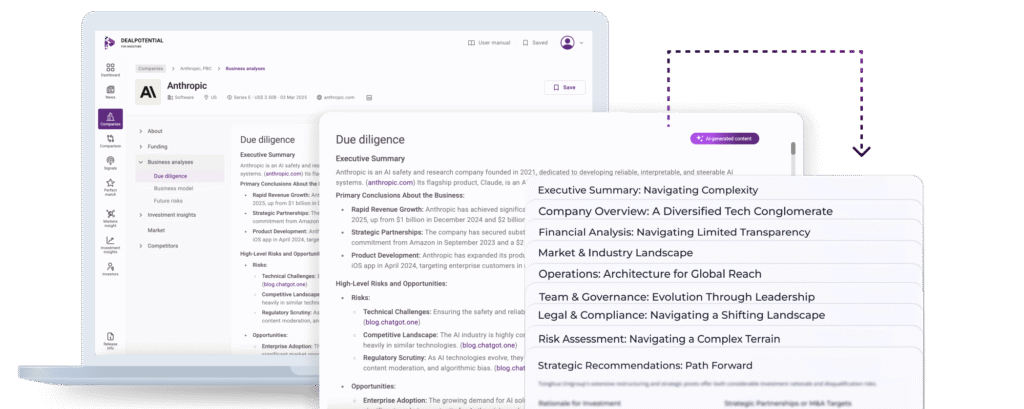

This is exactly where DealPotential changes the game.

Most deal sourcing processes were designed for large organizations.

They assume multiple associates, long research cycles, and high software budgets.

Small teams work differently.

They need clarity early, not complexity later.

As a result, many smaller firms struggle with the same issues.

○ Too much time spent on companies that never convert

○ Late entry into deals that are already competitive

○ Repeated research across disconnected tools

○ High costs for platforms built for enterprise funds

Over time, this slows momentum and weakens the pipeline.

Early-stage due diligence is where most time is lost.

Before a single meeting is booked, hours disappear into manual validation.

With DealPotential, initial due diligence takes around 20 minutes.

You instantly access structured insights such as:

○ Company intelligence and ownership data

○ Industry and vertical classification

○ Investor activity and funding context

○ Predictive signals indicating capital needs

This allows teams to qualify opportunities quickly.

As a result, time is spent on deals, not preparation.

Hiring a junior associate is expensive and slow.

It also adds operational overhead that small firms often want to avoid.

DealPotential acts as a digital associate layer.

It removes repetitive tasks without replacing human judgment.

Teams use it to:

○ Screen companies faster

○ Build focused shortlists

○ Avoid duplicate analysis

○ Improve internal decision speed

In practice, this feels like expanding the team.

However, costs remain predictable and controlled.

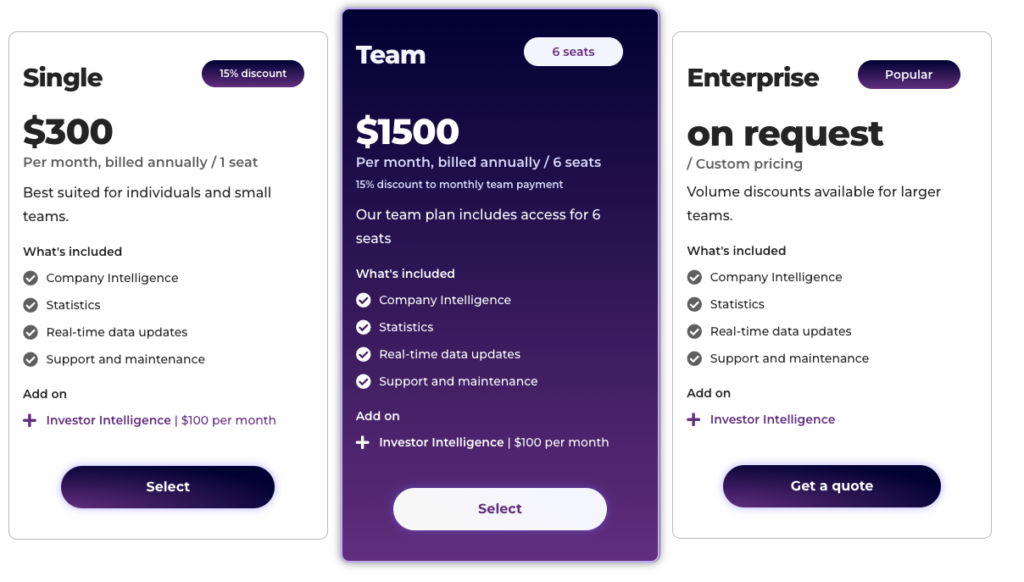

Most private market platforms are priced for large funds.

They bundle features that small teams rarely use.

DealPotential is intentionally different.

Pricing is designed for individuals and small teams who need results, not bloat.

Compared to traditional platforms or additional hires, the cost is significantly lower.

This makes deal sourcing for small firms sustainable over time.

Growth no longer requires exponential cost increases.

DealPotential is not a data warehouse.

It is a decision-support layer built around speed and precision.

The platform helps teams move from search to action faster.

It also ensures timing is based on signals, not assumptions.

For small firms, this creates a real advantage.

Insight arrives early, and focus stays sharp.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

A mid-market UK M&A advisory firm turned time pressure into competitive advantage with AI-powered deal origination.

A leading US investment bank, focused on early- and growth-stage transactions, finally found a single tool to unify its fragmented deal intelligence.

A UK private equity firm transformed its investment process by replacing weeks of manual research with AI-powered due diligence, now delivering results in under 10 minutes.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.