Automated due diligence platforms that give bankers speed

Automated due diligence platforms help investment bankers move faster with precision. Discover how DealPotential transforms diligence.

Private markets move fast, and information asymmetry defines the winners. Traditional sourcing catches companies after the round begins. The real opportunity lies in predictive discovery: to identify companies before fundraising and move first.

DealPotential’s predictive AI and hyper-granular industry classification reveal early indicators months before capital raises go public. Investors who act on these signals capture better valuations, exclusivity, and strategic advantage.

To truly identify companies before fundraising, you need to move beyond reactive research and embrace predictive intelligence. At its core, this means using data that reflects real-time business activity from hiring trends and product launches to market expansion and industry shifts. These are often strong indicators a company is preparing for a new capital raise.

Traditional methods like waiting for press releases or regulatory filings create lag and leave value on the table. Predictive signals, meanwhile, allow firms to proactively build pipelines and engage founders before the noise hits the market.

AI signals analyze patterns across millions of companies to flag behaviors correlated with upcoming fundraising events. Investors may look for:

Rapid headcount increases or department growth

Competitive product launches or geographic expansions

Strategic partnerships, new clients, or revenue momentum

Executive changes and board movements

Early capital influx in supplier or partner networks

These signals act as real-time indicators that a company is gearing up for external investment, often before any public announcement.

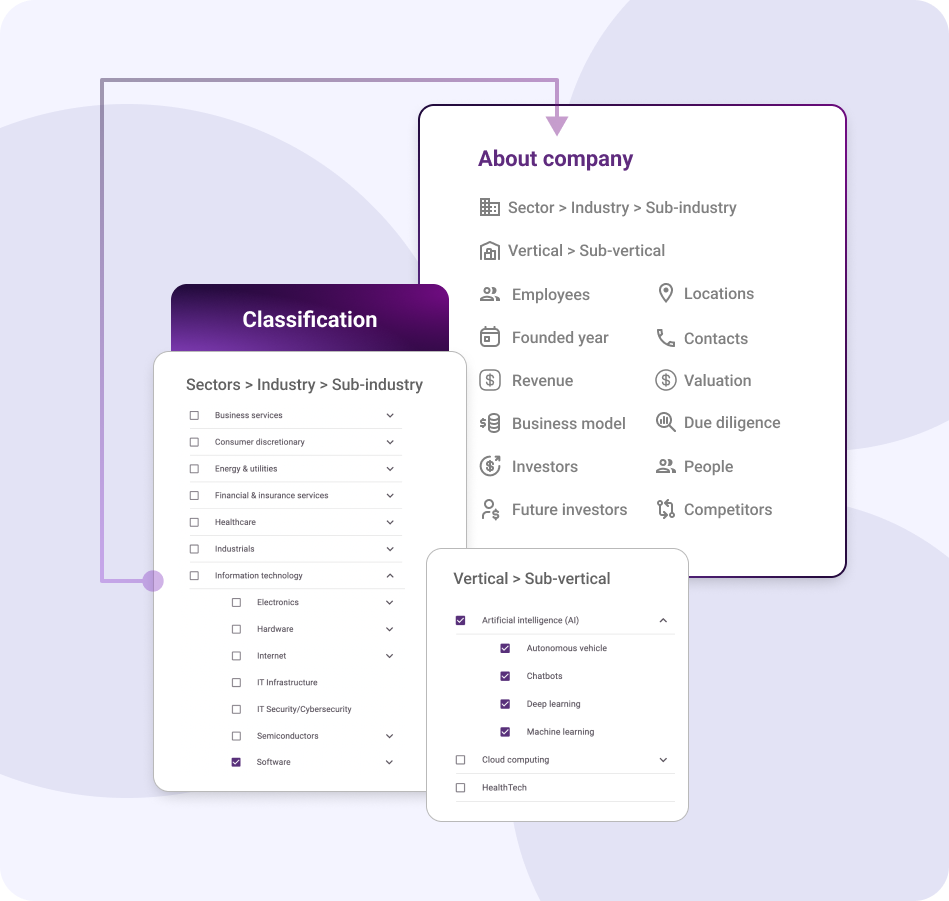

DealPotential’s industry classification goes deeper than broad categories. It sorts companies into refined sub-sectors, giving investors precise context on:

niche growth markets

adjacent expansion opportunities

nuanced competitive landscapes

This classification ensures filters and searches aren’t just accurate they’re relevant. Targeted discovery means you can pinpoint companies that match your investment thesis, lowering noise and increasing high-quality leads

Proactive sourcing improves deal flow quality and timing. Firms that identify companies before fundraising can:

Engage founders with context-rich outreach

Benchmark opportunities against sector-specific metrics

Allocate due diligence resources more efficiently

Build proprietary lists ahead of competition

DealPotential’s ecosystem, with millions of company profiles and real-time activity signals, is designed to accelerate this process and reduce reliance on surface-level research

Here’s how investment teams can implement early detection:

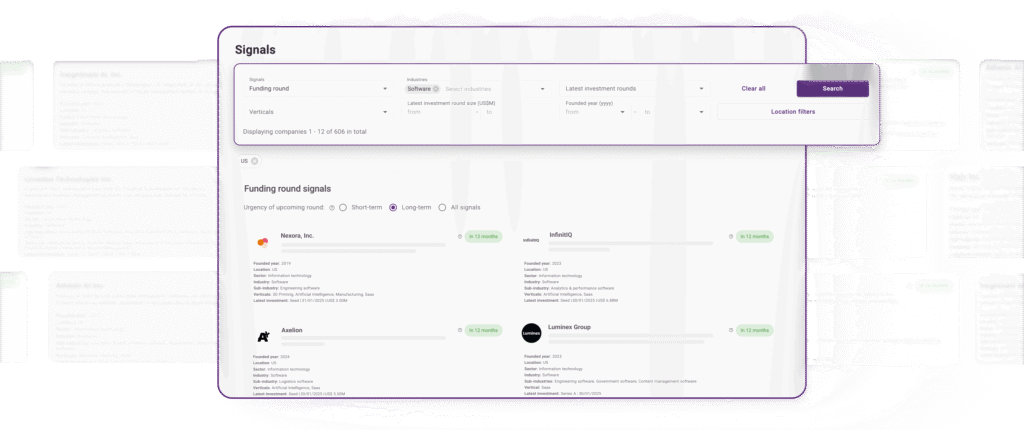

Leverage real-time signal alerts

Filter by activity triggers that historically precede rounds.

Use hyper-granular classification filters

Target industry niches showing momentum.

Benchmark growth against peers

Compare hiring, revenue signals, and market expansions.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

Automated due diligence platforms help investment bankers move faster with precision. Discover how DealPotential transforms diligence.

Private market valuations based on real transactions and regional data. Get realistic valuation ranges that update with the market — not outdated theoretical models.

Private market analytics turn 7M company data into actionable due diligence insights. See how DealPotential accelerates decisions.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.