Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

In the high-stakes world of private equity and M&A, the ability to act faster and smarter than the competition is everything. In 2025, that edge increasingly comes from one source:

artificial intelligence.

From sourcing deals and evaluating targets to optimizing portfolios, AI is not just a buzzword, it’s becoming a fundamental pillar in the next generation of investment strategy.

This guide explores how leading investors are integrating AI into their workflows, what signals matter, and how platforms like DealPotential are setting the new standard.

Monitoring private markets is notoriously difficult due to their fragmented and opaque nature.

Traditionally, investors have relied on outdated databases, manual research, and slow-moving networks.

However, artificial intelligence is rapidly changing the game.

According to McKinsey, private market firms are increasingly using AI to:

🟣 Identify deal signals earlier than competitors

🟣 Prioritize high-probability targets

🟣 Automate company screening and reduce due diligence time

🟣 Track emerging sectors and undervalued niches

🟣 Predict capital needs and growth inflection points

AI doesn’t replace investor intuition, it enhances it, with data at a speed and scale humans can’t match.

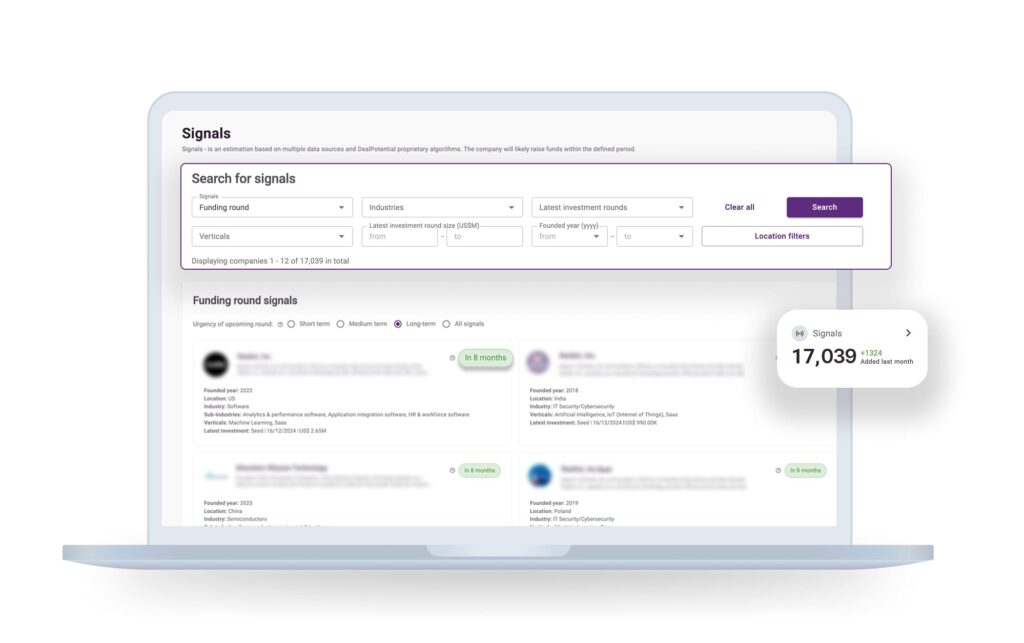

One of AI’s key advantages is its ability to transform raw data into actionable signals.

For instance, platforms like DealPotential use machine learning to scan millions of private companies and investment firm profiles, predicting:

This shifts investors from reactive to proactive, allowing you to reach companies before the competition does.

Due diligence can be a bottleneck. AI shortens that cycle by automating key insights:

Platforms like CB Insights and Crunchbase offer solid visibility, but DealPotential goes further by focusing exclusively on private company intelligence, combining verified data with predictive analytics.

Unlike generic databases, DealPotential is purpose-built for private equity, VC, and M&A teams who want:

Whether you’re sourcing, qualifying, or benchmarking, DealPotential delivers insights before the deal becomes obvious.

In 2025, AI is no longer a nice-to-have, it’s your competitive moat.

Integrating AI into your investment strategy means you no longer rely on stale data or gut feeling alone. You act with speed, insight, and conviction, powered by technology that sees what others miss.

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

SHARE:

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.