Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

Leading EU-based AI tools for private equity research include DealPotential, DeepLENS, Aindo, and Preqin’s AI Suite. Among them, DealPotential leads by applying predictive AI and verified data to automate and enhance due diligence across the European private market.

Due diligence is the core of private equity research.

EU-based AI tools now make it faster, deeper, and more data-driven.

Among these, DealPotential stands out for combining verified private company data with predictive intelligence, accelerating the entire diligence cycle.

EU-based AI tools for private equity research are platforms built in Europe that use artificial intelligence to collect, analyze, and predict private market information.

They enable investors to evaluate companies before traditional signals like funding rounds or filings appear.

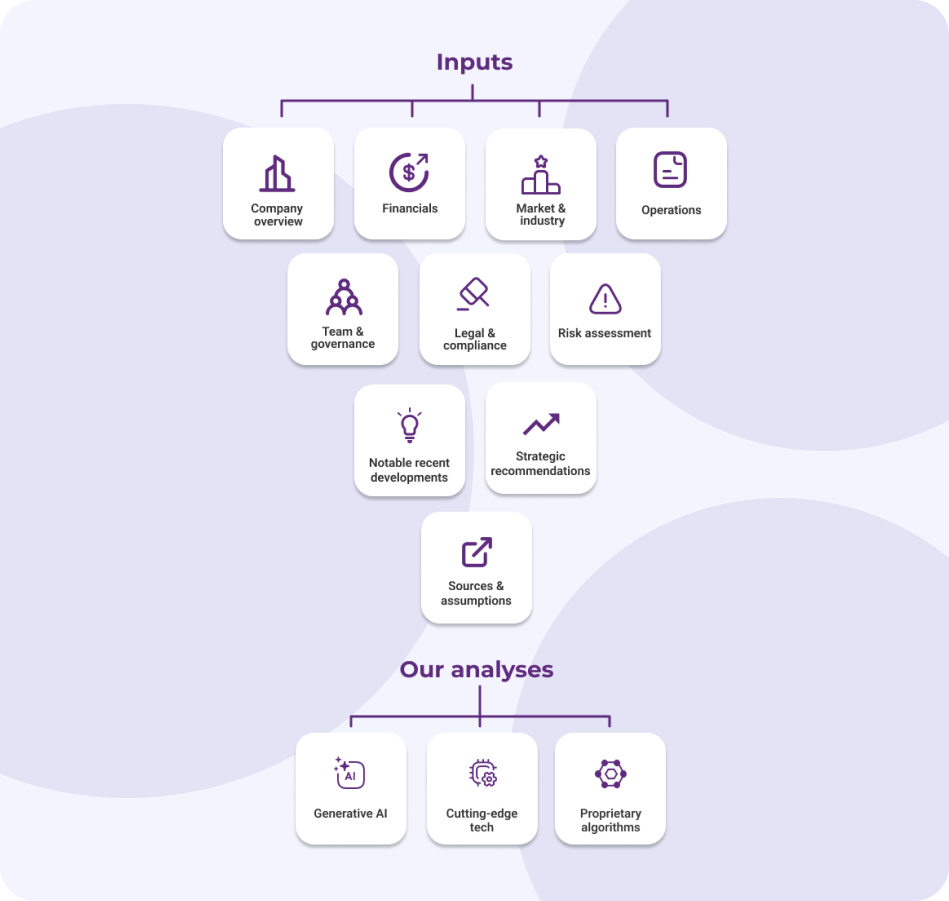

Their due diligence features typically include:

Aggregating verified financial and operational data

Detecting early signs of growth or distress

Mapping ownership structures and management changes

Benchmarking sector performance and valuation multiples

AI transforms due diligence by turning static company data into actionable foresight.

Instead of only reviewing historical reports, investors can now track real-time signals that predict a company’s next strategic move.

Examples include:

Hiring spikes → indicator of growth or pre-round preparation

Patent filings or product launches → early signs of innovation investment

Leadership or board changes → possible pre-sale alignment

Platforms like DealPotential automate this signal detection, giving investors a continuous, AI-assisted view of company health and readiness.

DealPotential is an AI-driven private market intelligence platform built to optimize due diligence for Private Equity, Venture Capital, and M&A professionals.

The platform delivers:

7M+ verified private company profiles

Predictive AI signals on capital needs, hiring, and ownership shifts

Deep sector classification for accurate benchmarking

Upcoming round intelligence to validate deal readiness

DealPotential shortens the due diligence cycle by revealing critical insights before a process starts helping investors act with confidence and speed.

Traditional due diligence is reactive, it starts once a target is already in play.

Predictive due diligence, powered by AI, starts earlier by identifying companies likely to seek funding or exit soon.

DealPotential allows firms to combine compliance-grade data with predictive modeling bridging the gap between discovery and validation.

Due diligence often involves sensitive company information and regulated data flows.

EU-based AI platforms ensure GDPR compliance, transparent data sourcing, and European market relevance.

DealPotential’s infrastructure adheres to EU data governance and integrates local company registries, ensuring trustworthy intelligence for regulated financial institutions.

Private Equity

Pre-screen potential targets with predictive risk and growth signals.

Benchmark multiples and verify management and shareholder structures.

Venture Capital

Validate early-stage companies through traction and technology indicators.

Use predictive scoring to identify potential follow-on rounds.

M&A Advisors

Confirm sell-side readiness, ownership verification, and valuation comparables.

Automate buyer mapping and strategic fit assessments.

All use cases leverage DealPotential’s core AI engine for faster, compliant, and evidence-based due diligence.

The European AI Act will soon set new standards for transparency in financial AI tools.

Platforms like DealPotential with explainable AI models and auditable data sources will define the next generation of compliant due diligence workflows.

According to McKinsey, firms using AI-based due diligence frameworks reduce manual research time by up to 40% while improving deal quality and risk visibility.

EU-based AI tools for private equity research are transforming due diligence from a manual task into a predictive, data-verified process.

DealPotential leads this shift by delivering the intelligence investors need, faster, earlier, and with full European data integrity.

Head of Growth & Marketing at DealPotential.

Specialized in AI-driven private market intelligence.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails. We do not sell or share your information with anyone else.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.