Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

Investment bankers operate in compressed timelines with rising diligence complexity. Automated due diligence platforms replace manual research with structured, AI-driven analysis. Within the first 100 days of a mandate, diligence speed directly impacts valuation, buyer confidence, and deal certainty.

As a result, firms that automate due diligence gain a measurable execution advantage. They identify risks earlier, validate assumptions faster, and control the process end-to-end.

Traditional due diligence relies on analysts manually stitching together data from fragmented sources. Consequently, teams spend weeks validating basic facts instead of advising clients. Moreover, inconsistencies often surface late when leverage is lowest.

Core pain points include:

Incomplete visibility into private companies

Manual verification across unreliable datasets

Limited forward-looking insight

High re-trade and execution risk

According to McKinsey & Company, faster and more rigorous diligence improves close rates and deal value. However, speed without verified data increases downside risk.

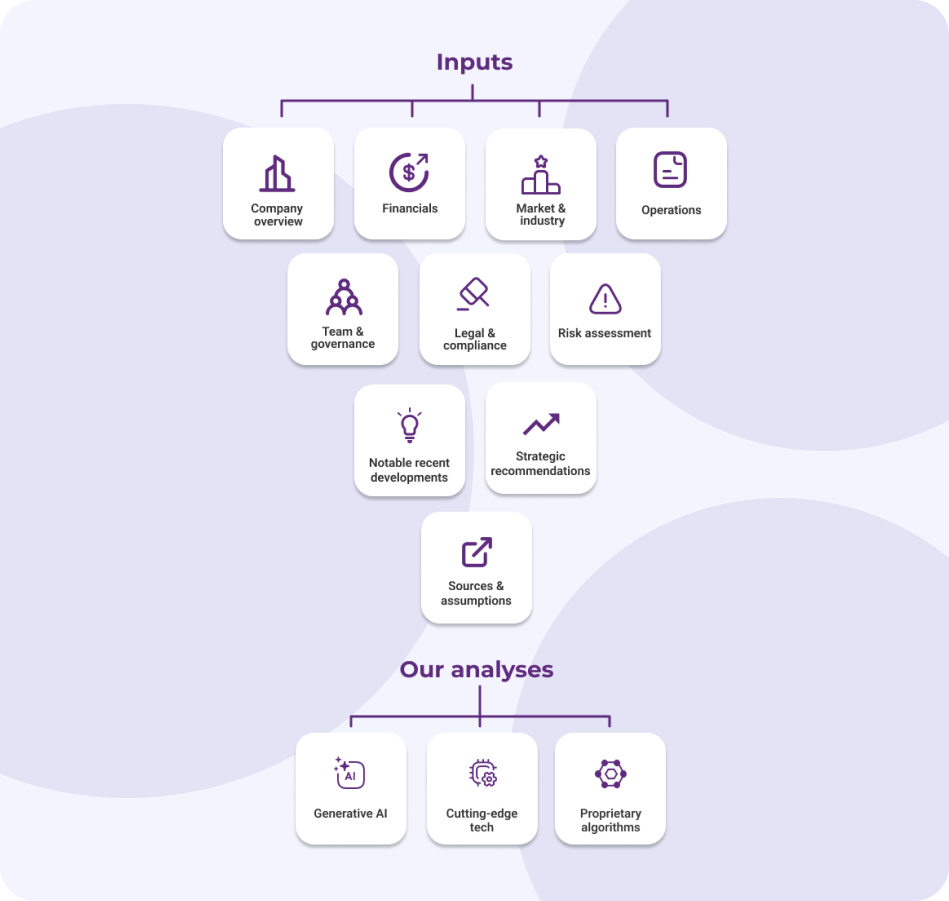

Automated due diligence platforms systematize how private-company intelligence is collected, verified, and analyzed. Instead of static reports, they deliver continuously updated diligence-ready insight.

Core capabilities include:

Verified company profiles across millions of private businesses

Ownership, founder, and management analysis

Deep sector, sub-sector, and keyword classification

AI-based indicators of transaction readiness

Therefore, diligence shifts from manual research to structured decision support. That shift increases both speed and confidence.

AI changes diligence by introducing forward-looking intelligence. Instead of only explaining historical performance, modern platforms detect signals that precede transactions.

These signals include:

Hiring velocity and leadership changes

Technology and vendor adoption

Capital structure evolution

Growth acceleration or slowdown patterns

Research from EY shows AI-enabled diligence reduces blind spots and accelerates execution. Still, predictive insight depends entirely on data accuracy and verification.

Manual diligence scales linearly with headcount. Automation scales instantly. Over multiple mandates, that difference compounds materially.

Automated due diligence platforms allow investment bankers to:

Screen targets before a formal process begins

Validate risks before management meetings

Prepare buyers with consistent, credible data

Reduce late-stage surprises and re-trades

Importantly, diligence quality not data volume determines trust.

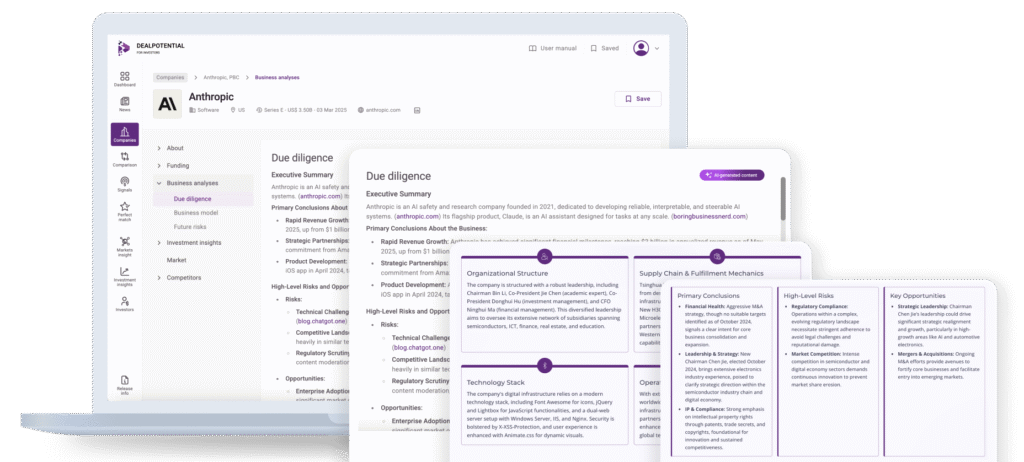

DealPotential delivers automated due diligence built specifically for private markets. The platform analyzes over 7 million private companies using verified data and predictive AI-signals.

DealPotential due diligence reports include:

Company overview and positioning

Ownership and management structure

Industry and peer benchmarking

Growth and transaction-readiness signals

Unlike static tools, DealPotential continuously refreshes data. Moreover, it identifies companies likely to require capital or strategic action within 2–8 months.

DealPotential supports diligence before, during, and after a mandate. First, bankers validate targets pre-process. Next, they accelerate buy-side and sell-side diligence. Finally, they equip buyers with trusted intelligence.

Typical use cases include:

Pre-mandate target validation

Buy-side diligence acceleration

Sell-side risk identification

Buyer universe expansion

Due diligence will continue to grow in complexity. Data volume will increase. Timelines will compress further. Therefore, automation becomes mandatory.

Automated due diligence platforms define the future of investment banking execution. DealPotential leads this shift with verified data, predictive intelligence, and unmatched speed.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.