Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

The bad data problem grows as private markets move faster than legacy databases. Moreover, company structures shift quickly, creating more room for errors. Outdated firmographics, wrong classifications, and missing ownership details distort the full picture. Consequently, M&A advisors, PE firms, and VCs lose momentum before deals begin.

Teams that build lists on inaccurate data waste time on the wrong targets. Investors also miss high-quality companies they should have identified months earlier.

Corrupted signals introduce even more risk. A company may appear active while operations are declining. A revenue figure may be updated, yet still three years old.

These distortions push analysts toward false assumptions.

The result is slow screening, uncertain due diligence, and elevated transaction risk. Therefore, investors need a source that delivers both depth and accuracy not just volume.

Bad data is more than a nuisance. It’s a direct cost driver. M&A teams build inaccurate longlists. PE firms misread market dynamics. VC funds miss early-stage momentum in fast-moving verticals.

In addition, they lose sight of founder-led companies before a process starts. This weakens pipeline quality and slows deal flow.

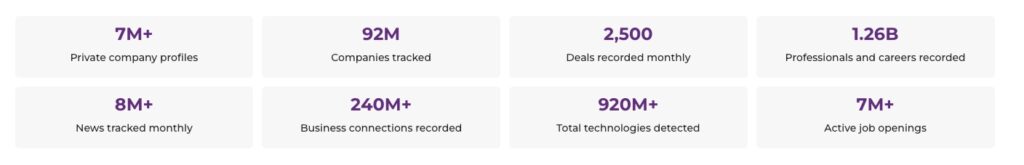

DealPotential solves the bad data problem through verified company data, predictive AI-signals, and deep sector classification. The platform validates and updates more than 7 million private companies, reducing noise and error rates. Moreover, its predictive models detect companies likely to seek capital within 2–8 months.

This accelerates sourcing and strengthens accuracy. As a result, investors identify opportunities far ahead of competitors.

DealPotential applies multiple layers of verification. Predictive models evaluate momentum, capital needs, and expansion indicators. Therefore, investors reach the right companies at the right time.

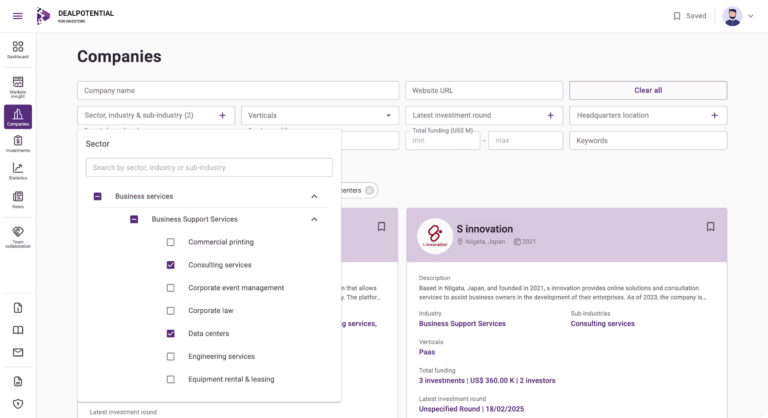

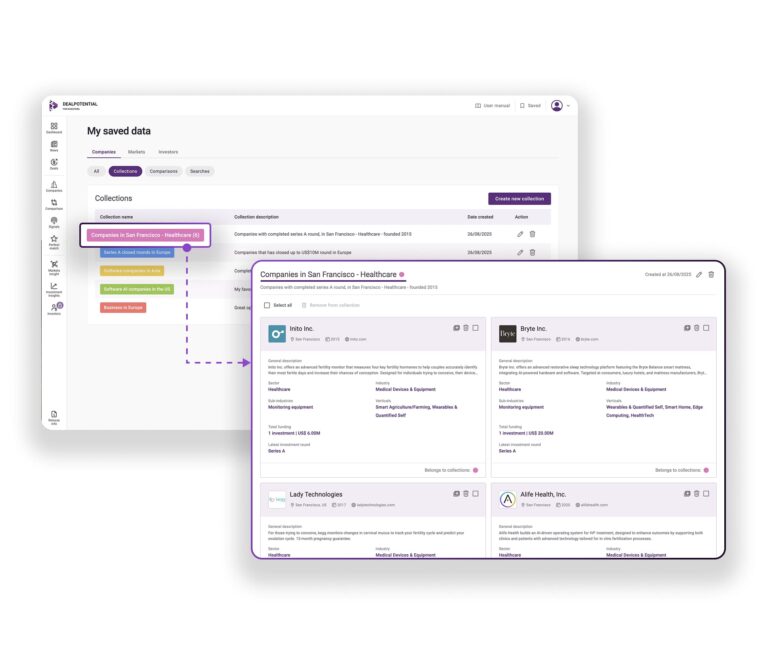

The platform categorizes companies by industry, sub-industry, verticals, and strategic keywords. This creates far more precise targeting than traditional databases.

Search, benchmarking, and list creation happen in seconds. Consequently, advisors, PE firms, and VCs run faster and more reliable workflows.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.