Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

In M&A and private equity, speed and accuracy define competitive edge. Yet, even seasoned dealmakers fall into the same traps. These common due diligence mistakes don’t just delay closings they destroy value. Here’s how to avoid them with precision and data-driven clarity.

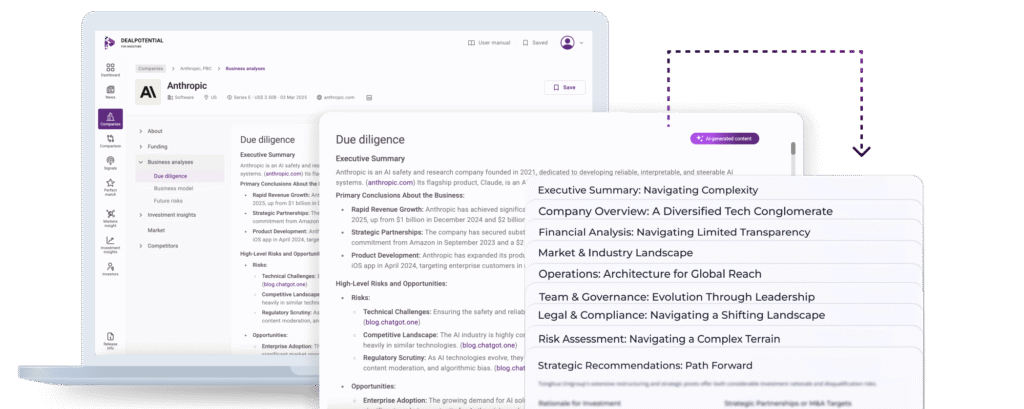

Most teams still piece together due diligence from disconnected tools and PDFs. This slows decision-making and increases the risk of oversight. When data is fragmented, critical signals like sudden hiring spikes or funding shifts go unnoticed.

How to avoid it: Consolidate insights in one platform. DealPotential’s AI-powered due diligence integrates financials, market data, operations, and risk factors into a single, verified view. You get a 360° company analysis in minutes, not weeks.

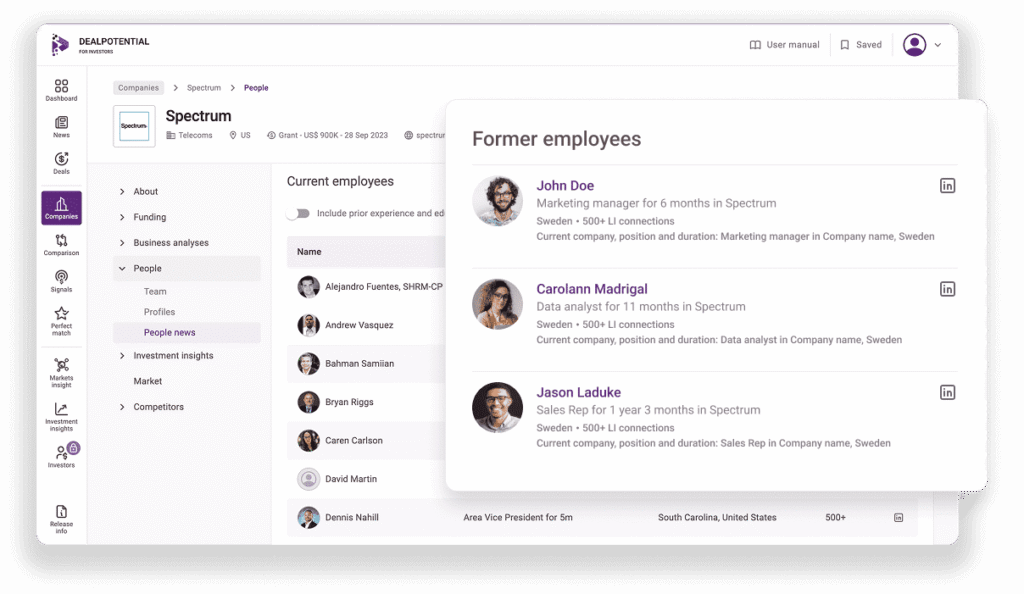

Leadership quality determines company trajectory. Yet, many diligence processes skip structured assessment of founders, executives, and decision-makers.

How to avoid it: Leverage People Data to analyze leadership strength, experience, and ownership stability.

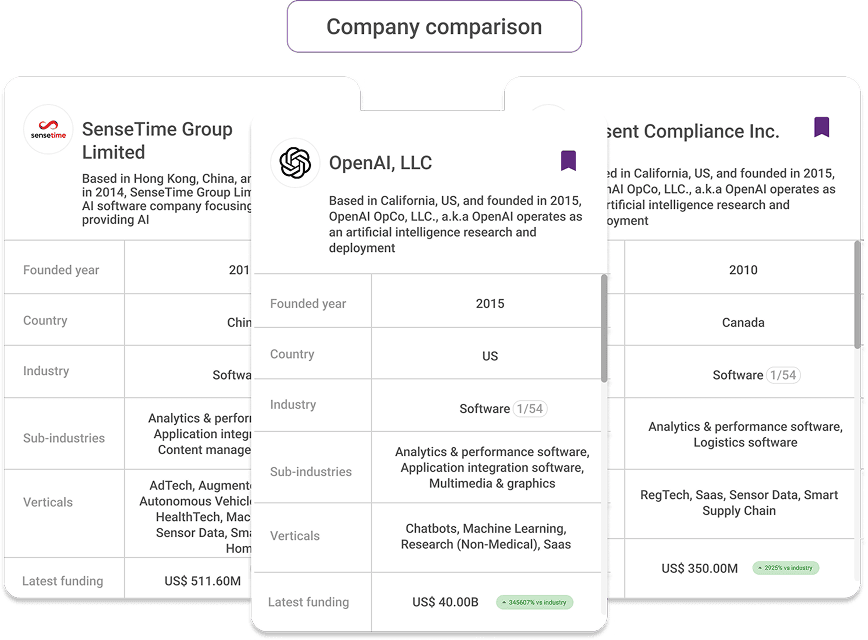

Without benchmarking, company performance exists in a vacuum. Many firms rely on management narratives instead of validated peer comparisons.

How to avoid it: Benchmark against direct competitors using real-time data. DealPotential lets you compare companies side-by-side across 15+ metrics from funding history to valuation trends ensuring every assumption is evidence-backed.

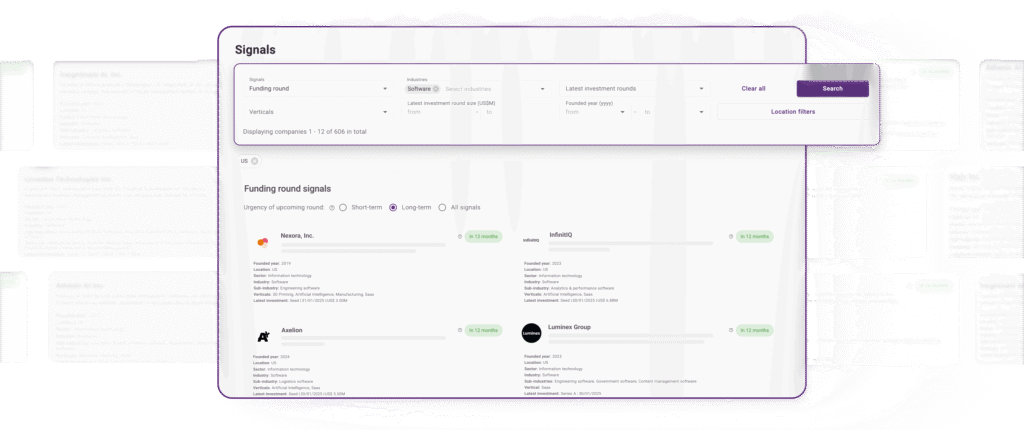

Traditional diligence captures what has happened, not what’s about to happen. This backward view can cause investors to miss critical inflection points.

How to avoid it: Use predictive signals to track expansion, hiring, and product launches. DealPotential’s AI detects when companies are preparing for funding or M&A within months giving you an early advantage.

Many firms treat diligence as a checkbox exercise. But company data changes weekly. Static PDFs can’t capture evolving financials, partnerships, or risk exposure.

How to avoid it: Shift to continuous monitoring. With DealPotential’s data platform, analysts receive real-time alerts on company updates, funding rounds, and leadership changes turning diligence into an always-on advantage.

Avoiding common due diligence mistakes isn’t about working harder it’s about working smarter. AI-driven due diligence transforms how M&A, PE, and VC teams assess opportunity, risk, and value.

With DealPotential, you move from manual research to instant, evidence-based insight.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.