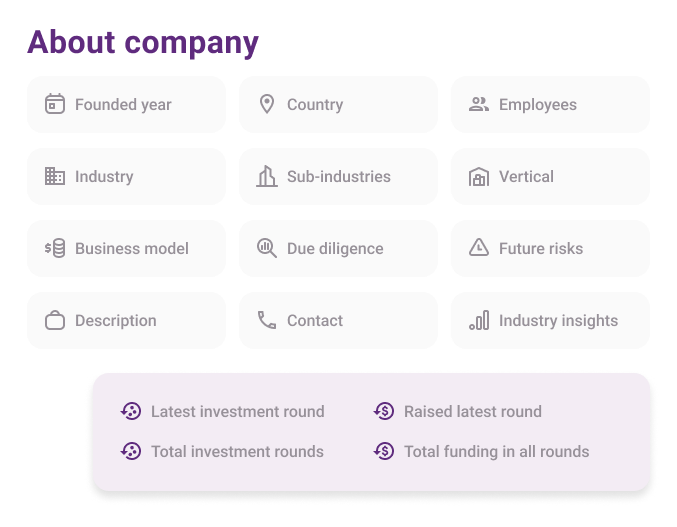

Granular data on 7+ million private companies, such as growth and market potential, competitive landscape, business model, funding history, risk factors, and much more.

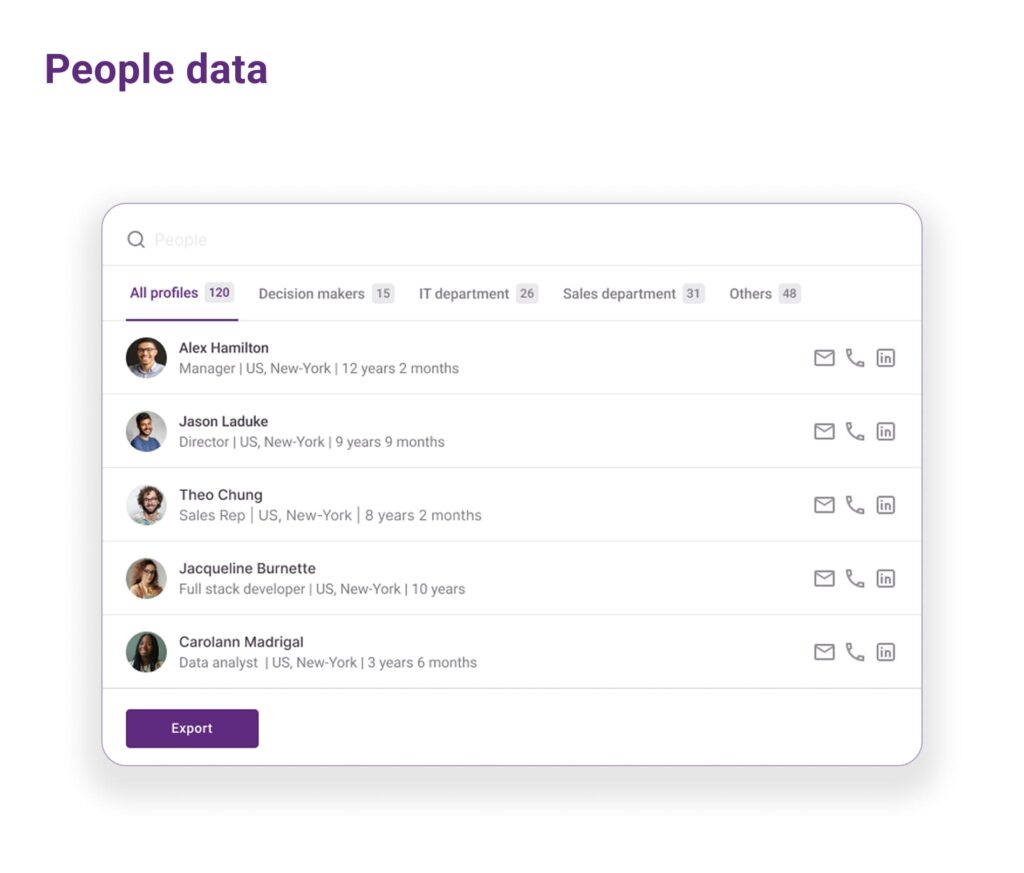

People Data provides structured information on executives, founders, and key decision-makers at private companies. It includes roles, experience, skills, certifications, and direct LinkedIn links. You can export team data to evaluate leadership strength across companies, supporting more informed investment decisions.

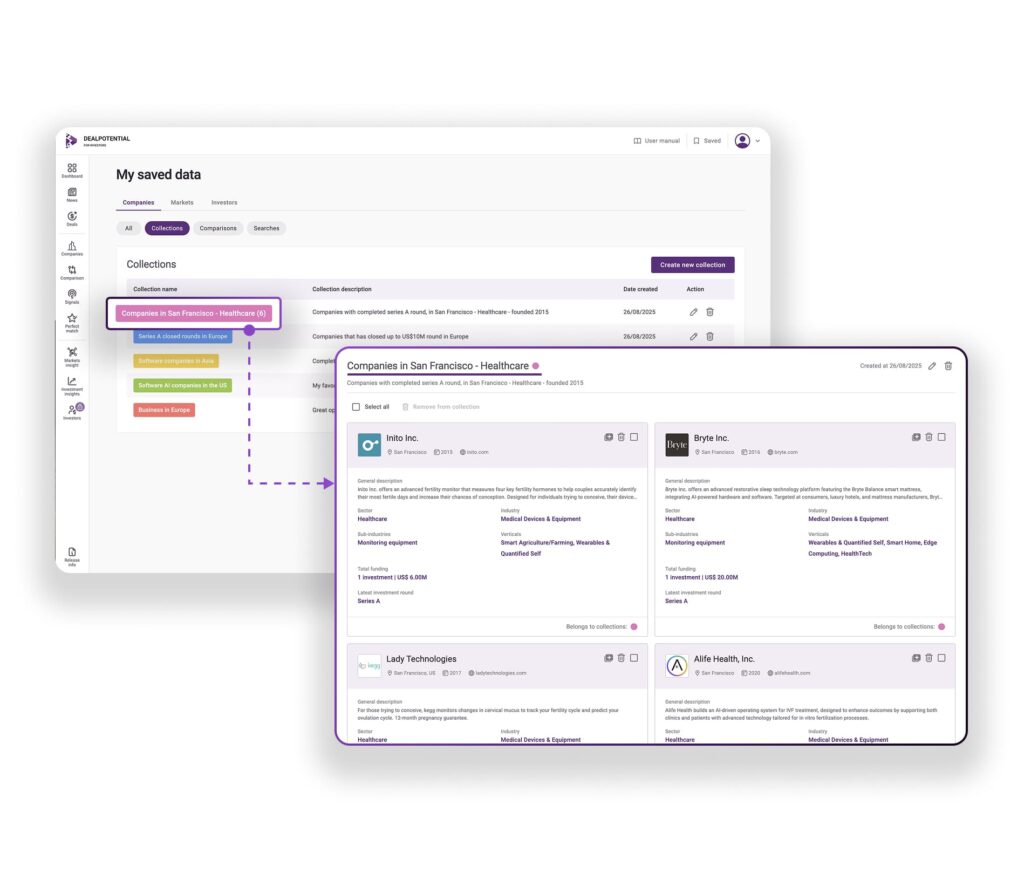

Besides saving companies in All saved data, you can now organize them in Collections for easier access.

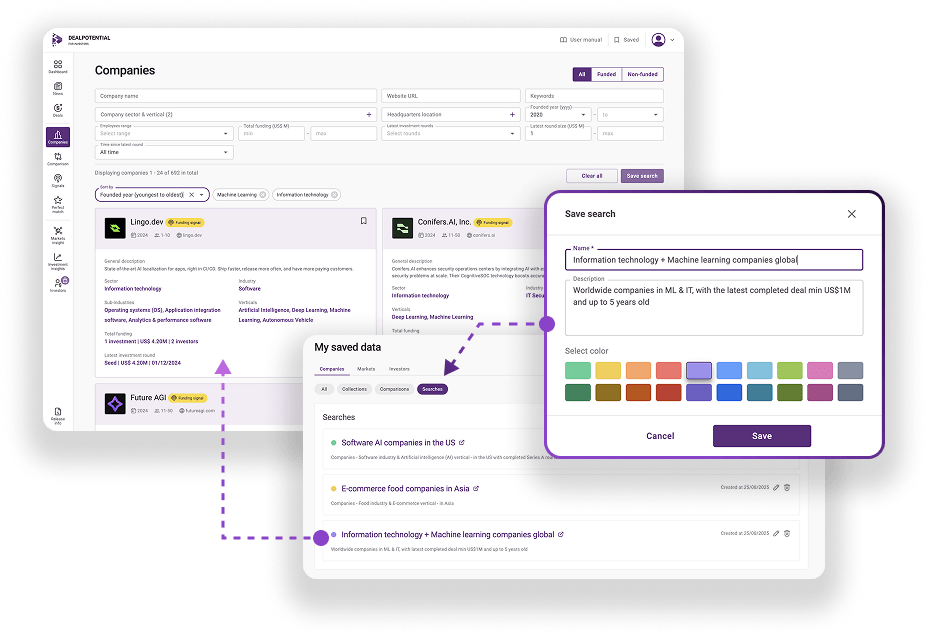

Saving company searches

Create and save your own filtered searches for quick access.

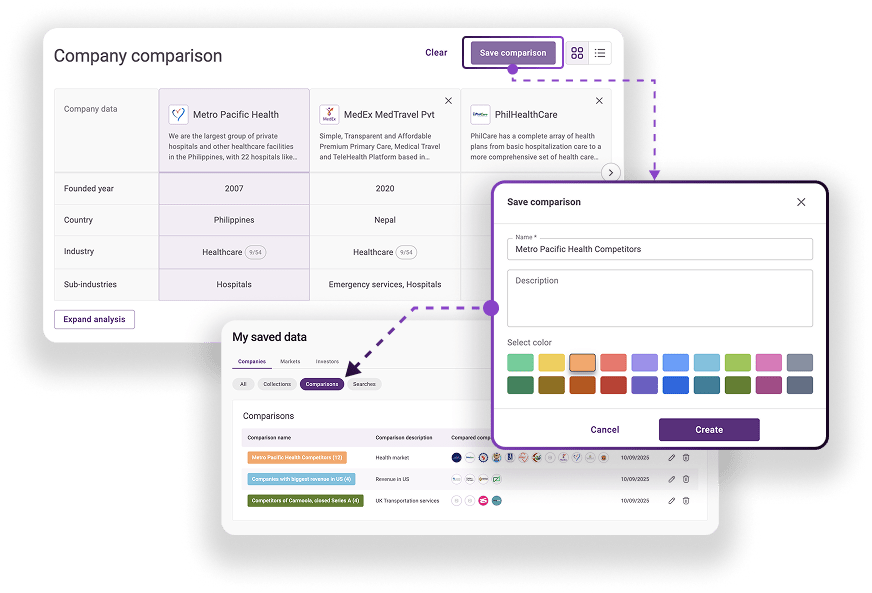

Comparisons, whether based on preselected competitors in company profiles or custom selections in the Comparisons page, can be saved and accessed at any time in Saved Data.

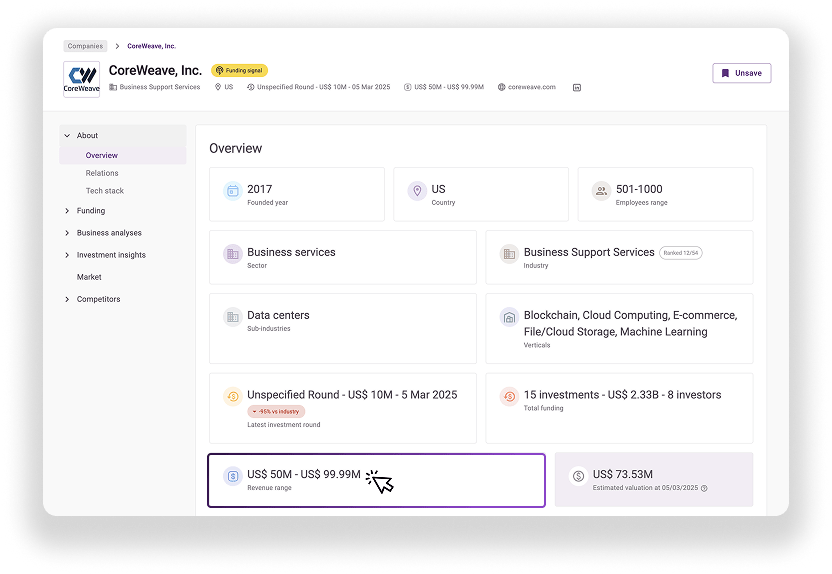

Revenue ranges are now visible for companies, providing instant clarity on company scale.

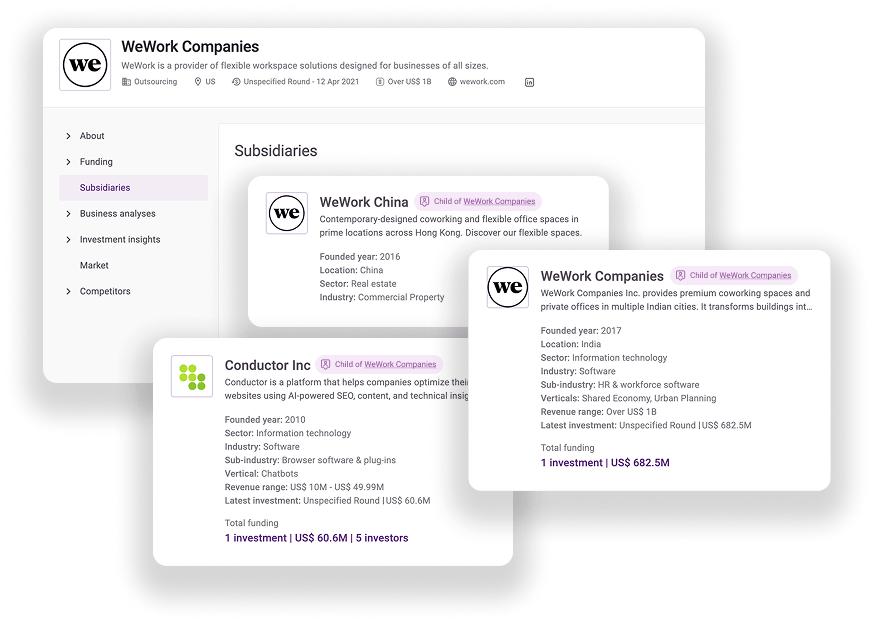

Company profiles are now enriched with detailed information on parent and subsidiaries companies.

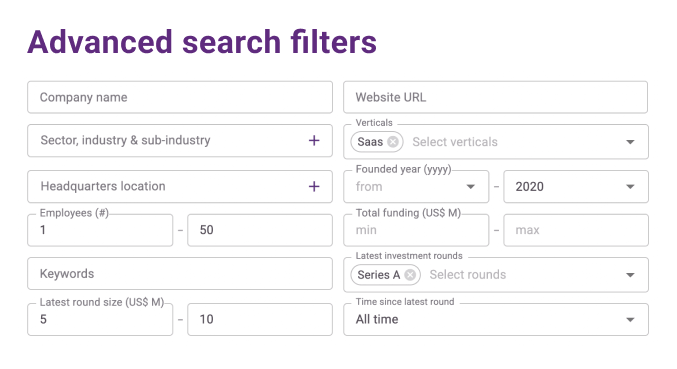

Search over 7 million private companies worldwide using precise filters. Each profile includes 100+ data points, offering a comprehensive view of the company—covering funding, business performance, investment insights, market context, and competitor comparisons.

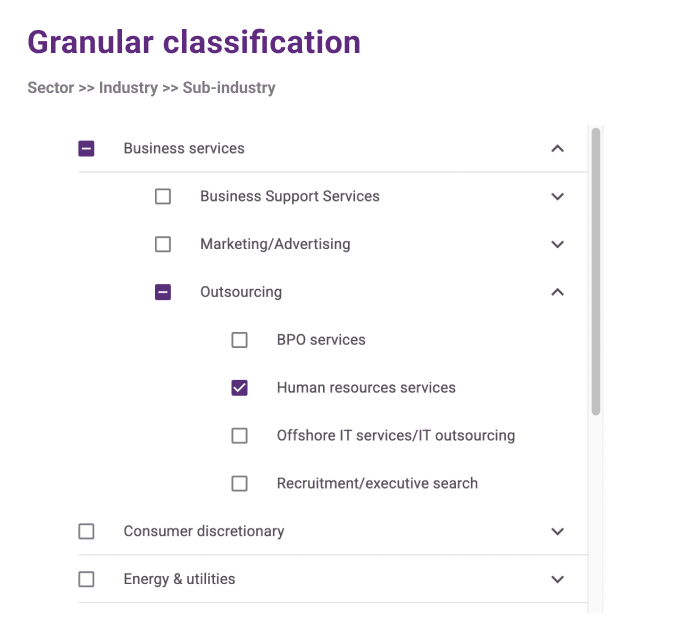

Our proprietary classification system, powered by advanced machine learning, reclassifies millions of companies into sectors, industries, and sub-industries. This enables highly targeted searches, deeper insights, and improved categorization accuracy.

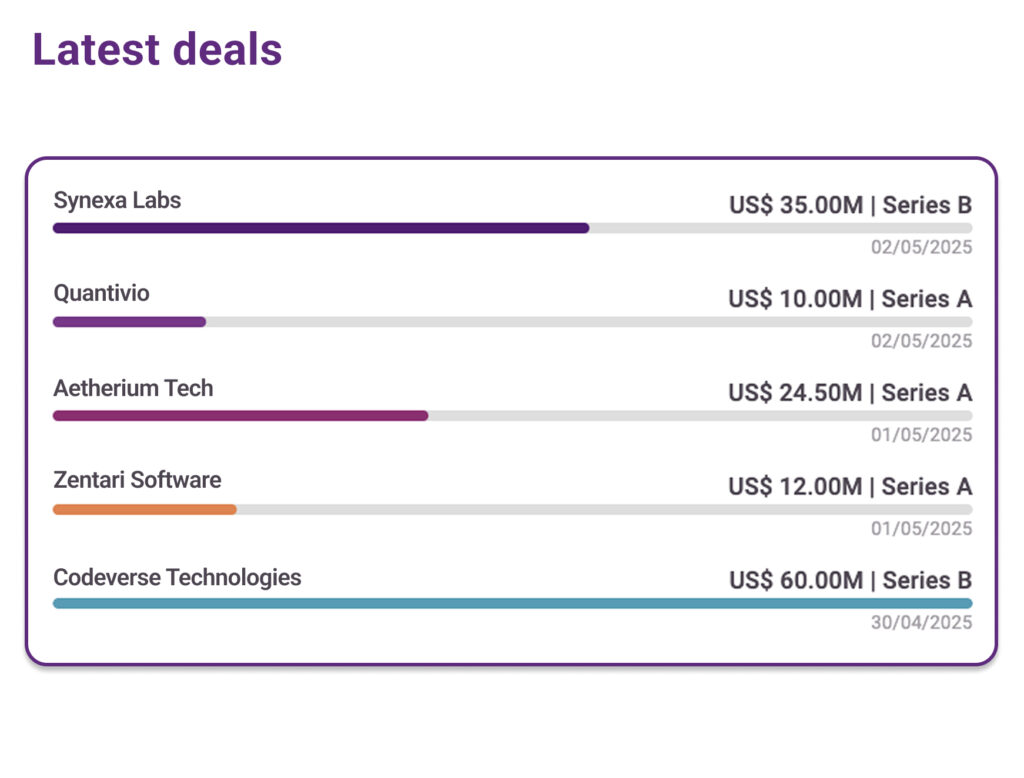

Get real-time alerts on upcoming rounds and key company updates, including hiring, department growth, expansions, new customers, and product launches. Leverage advanced filters for location, industry, deal size, and founding year to target the most relevant opportunities efficiently.

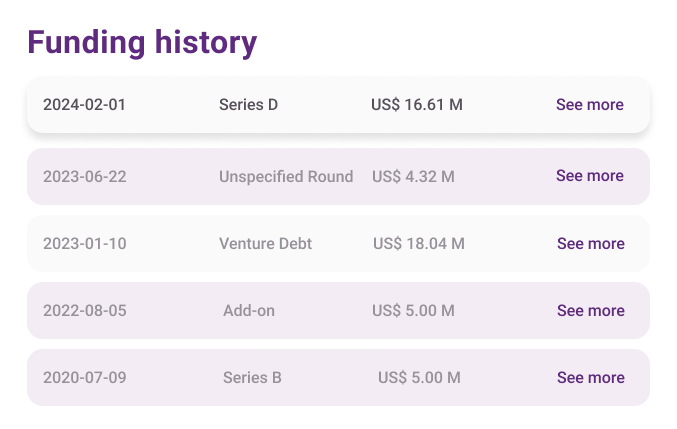

The funding provides a wealth of information to investors about a company’s funding history, understanding the company’s financial journey, investor relationships, and competitive positioning in the market. Showcasing the top 5 peers’ funding rounds, helps investors assess how the company’s fundraising performance stacks up against its peers.

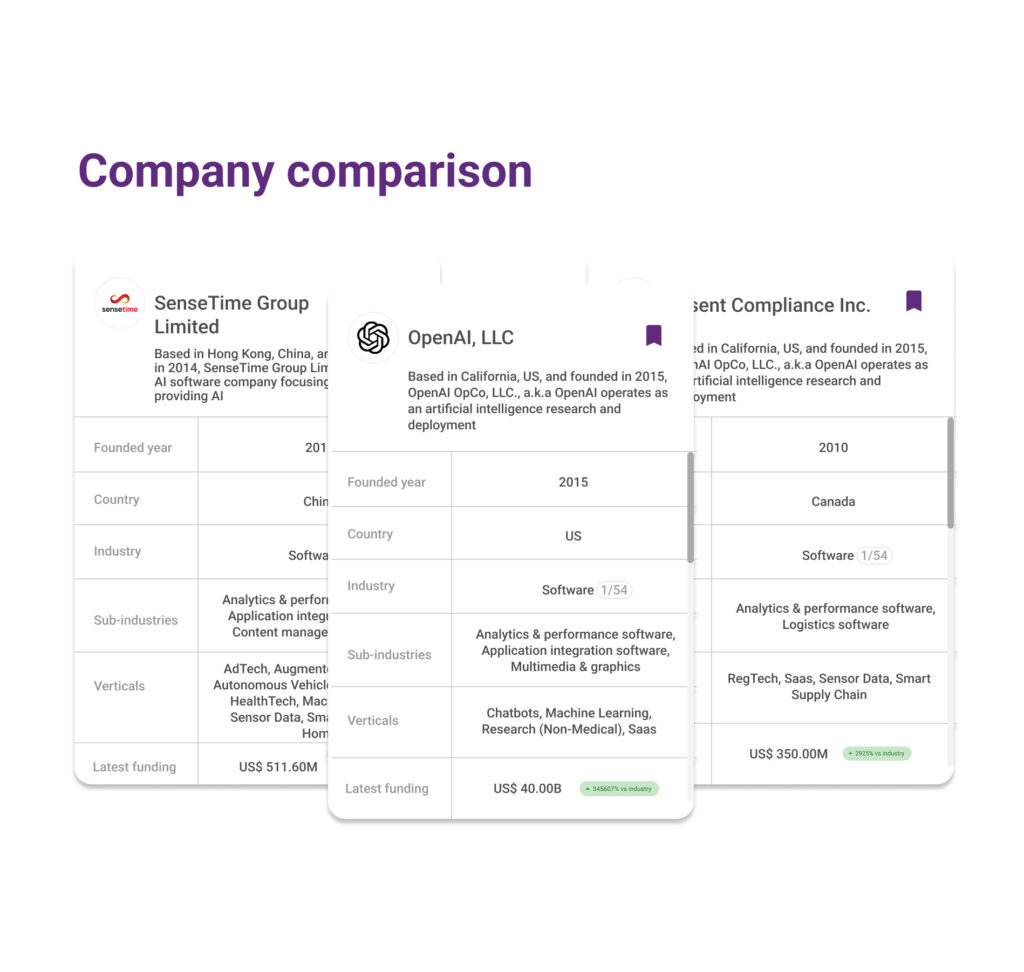

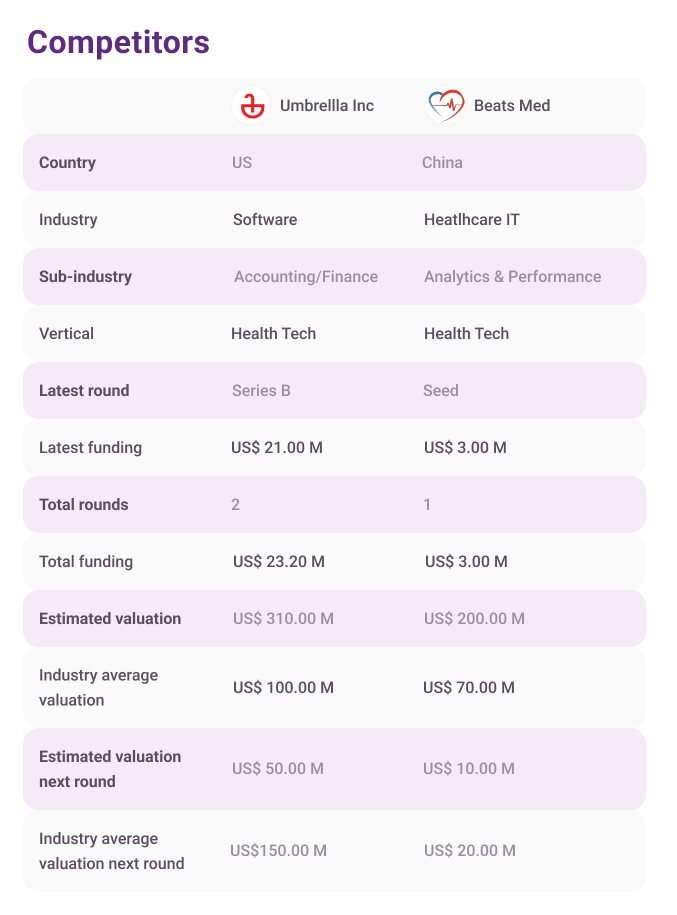

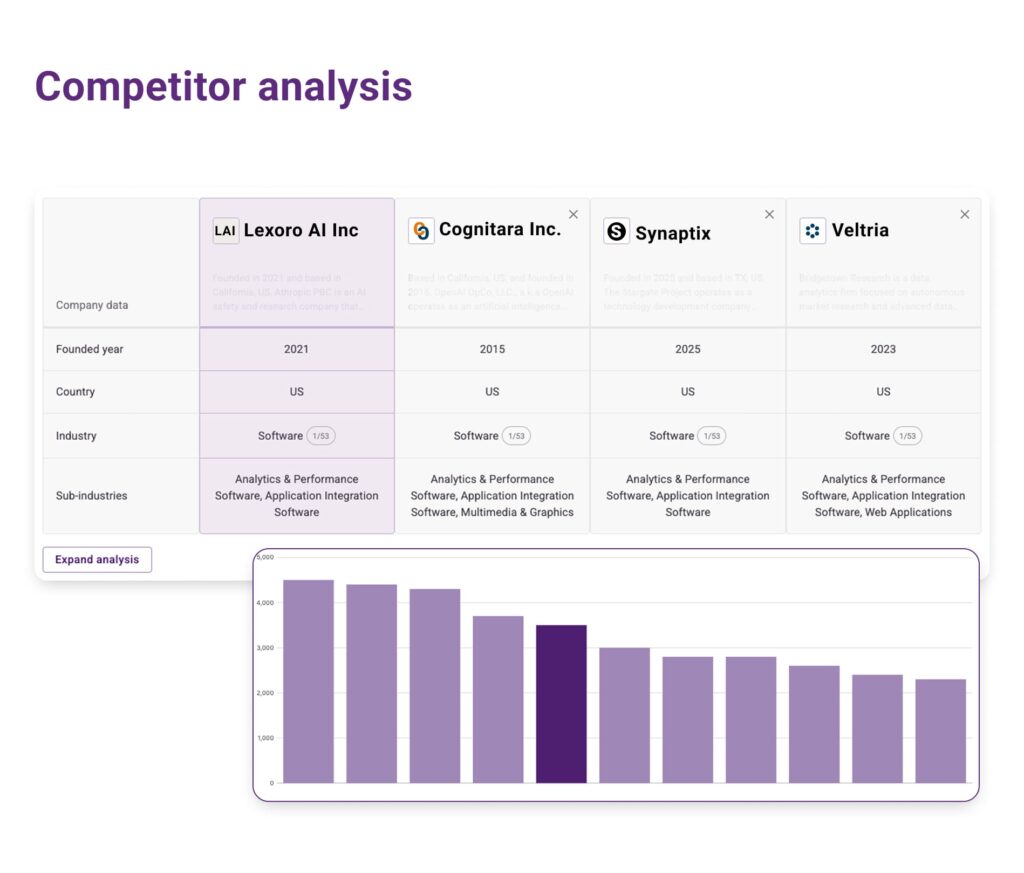

Side-by-side analysis of competitors or your preferred companies in seconds. Automatically compare direct competitors based on their industry, subindustry, or vertical using 15+ data points. Alternatively, you can select specific companies to compare based on your preferences.

Analyze the company’s key competitors and evaluate their performance in direct comparison to the company for each company data. This enables investors to make well-informed assessments by providing side-by-side comparisons of two or more companies.

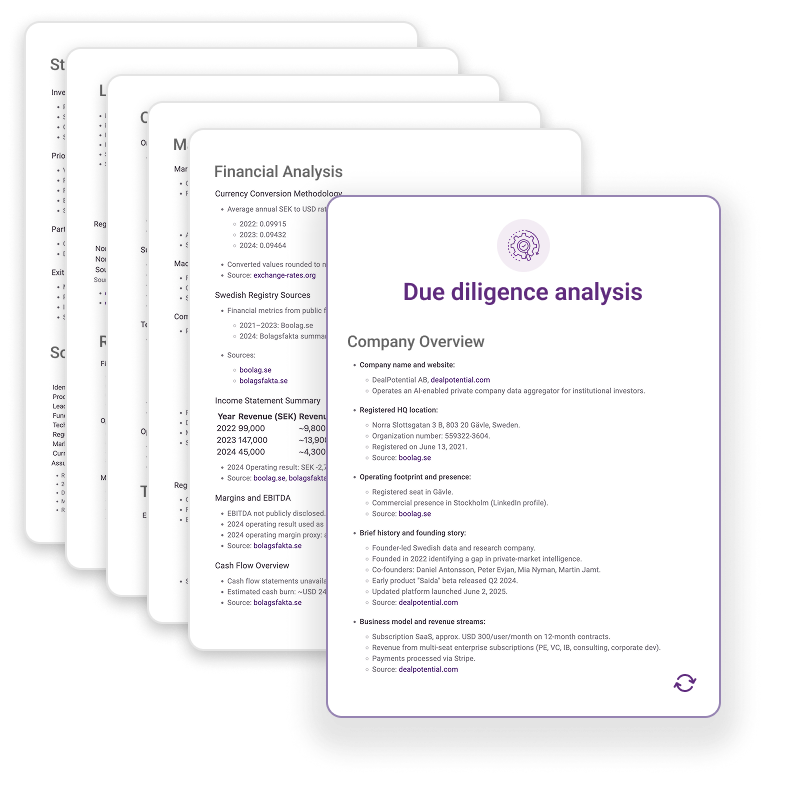

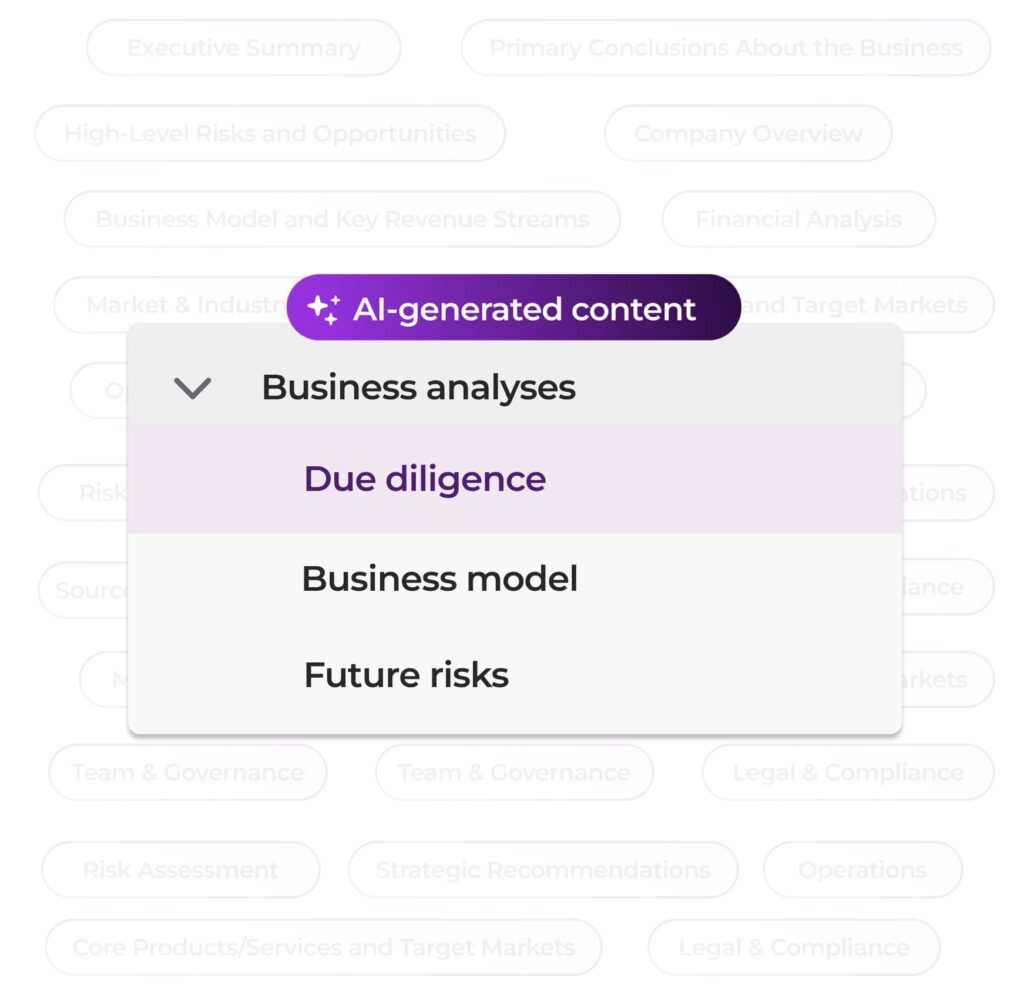

Our AI generates detailed due diligence reports covering the company overview, financials, market and industry insights, operations, team, and governance. It includes a breakdown of the company business model such as revenue streams, cost structure, market positioning, and strategic recommendations. Future company risks are analyzed across financial, market, operational, and strategic areas, along with mitigation strategies and expert insights.

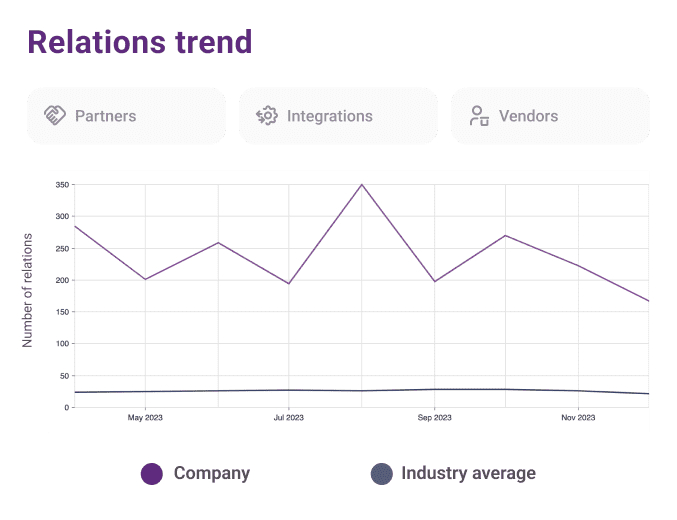

We now track the connections of private companies within our database, including their partners, vendors, integrations, investors, parent companies, rebranding affiliations, publications, and others. Gain insights into what influences and sustains private businesses. Knowing who works with whom offers you an additional point of view when evaluating your next investment decision.

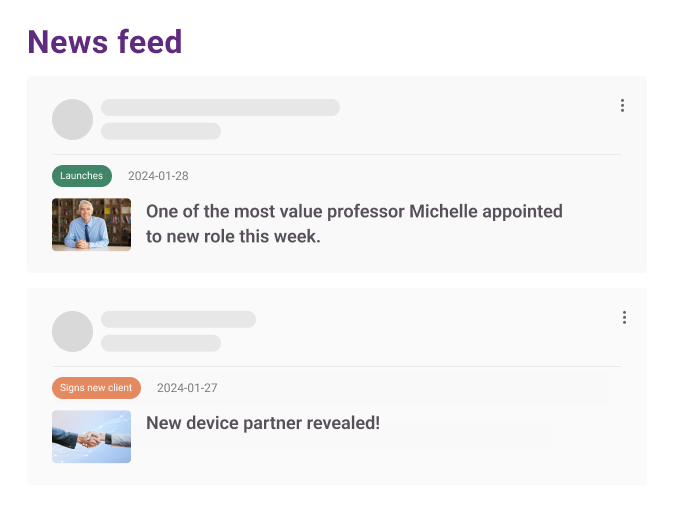

Follow the company’s news alerts. With daily updates, stay informed on the latest happenings. We cover 28 different news factors such as product launches, M&A, geographical expansion, IPO, funding rounds, new partnerships, and more.

Browse our global database of over 7 million funded and non-funded private companies using smart filters. You can search by sector and vertical, tailor your results based on funding history or founding year, or focus on specifics like employee count, company name, or website. For even more precision, add keywords to refine your search.

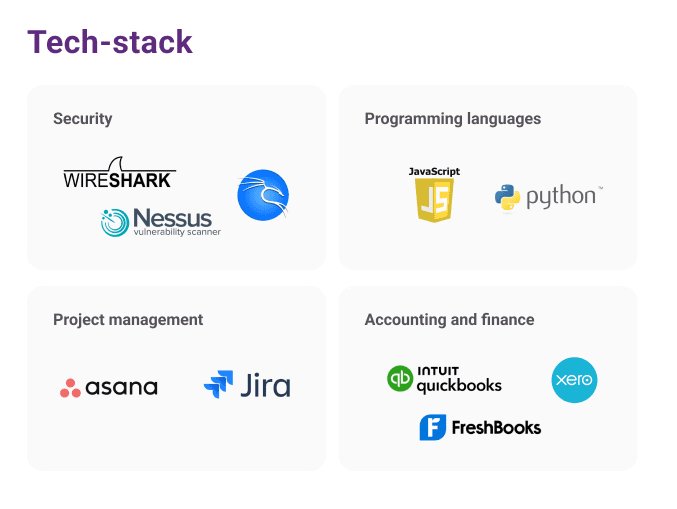

When assessing a company, especially tech ones, a crucial factor to consider is the technology it employs. This helps gauge its modernity and efficiency. Explore tools and platforms that 7 million private companies in our database utilize in their day-to-day operations to improve productivity, analytics, and overall business processes.

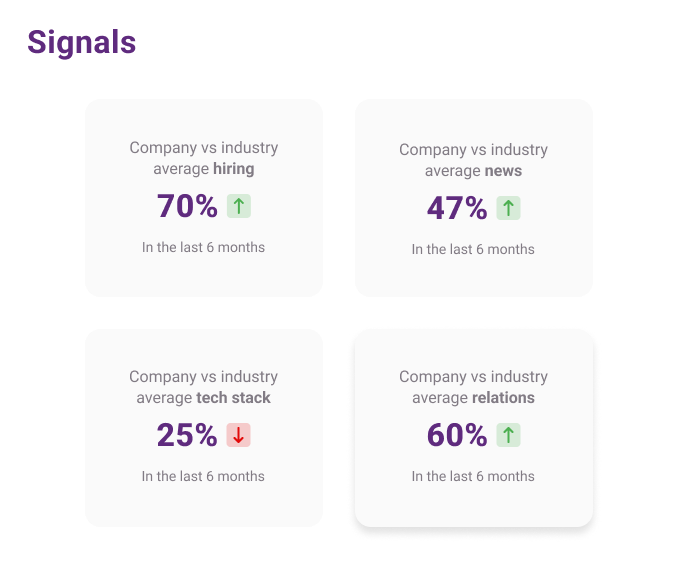

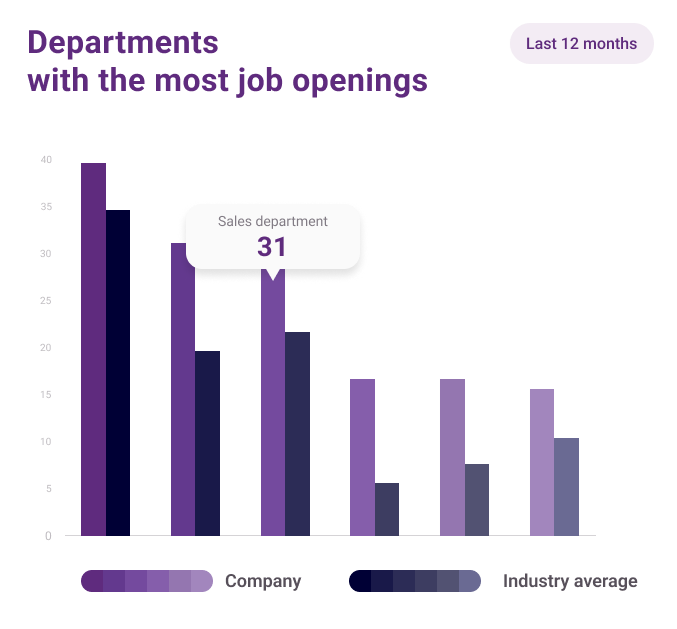

Gain insights into a company’s next move and stay ahead. See if the company is outpacing competitors, industry averages, growth trends, performance across departments, and their hiring history. More job openings can mean better prospects. Our trend analysis lets you spot growth patterns and investment opportunities.

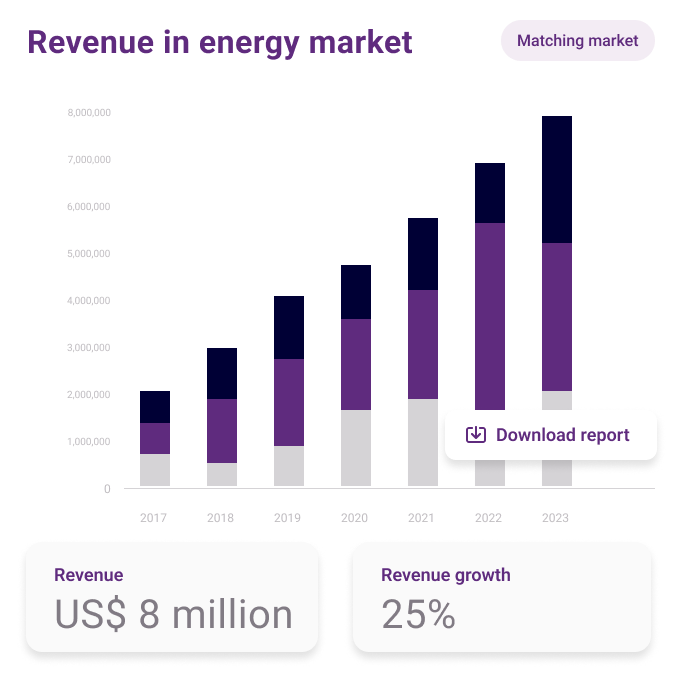

The matching markets help investors identify the most relevant markets for a specific company. It provides insights into related industries, allowing you to assess a company’s market relevance, potential opportunities, and risks quickly.

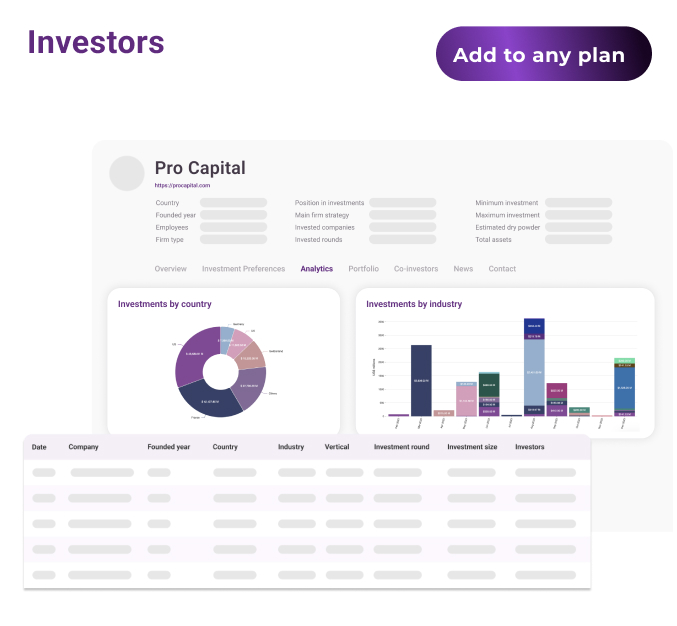

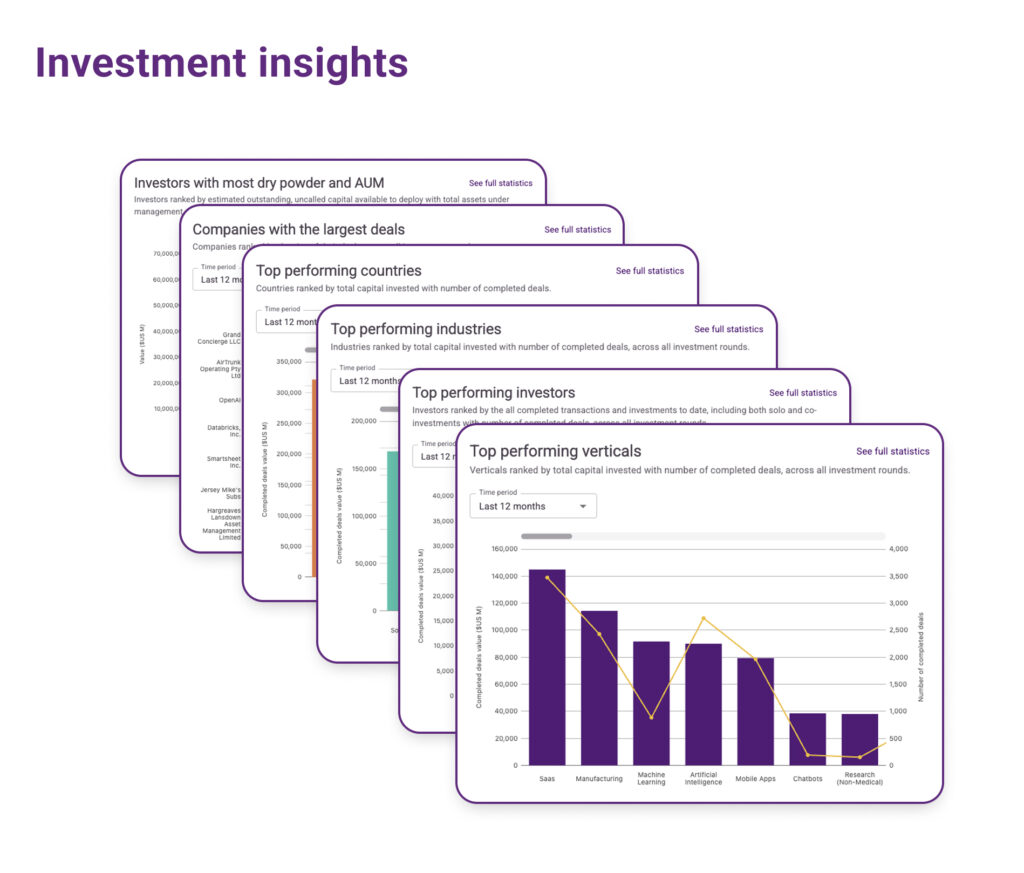

Streamline your search by filtering our investor database by firm type, size in terms of employee number or total assets, dry powder, preferred industries and verticals, countries, main applied strategies, and involvement in companies. Use a narrowed search to find your ideal co-investor, or delve into your competitors’ strategies.

Each company profile highlights key details such as date, deal size, funding round, investors, and status. Dashboards offer a personalized view of the latest deals, tailored to your investment criteria.

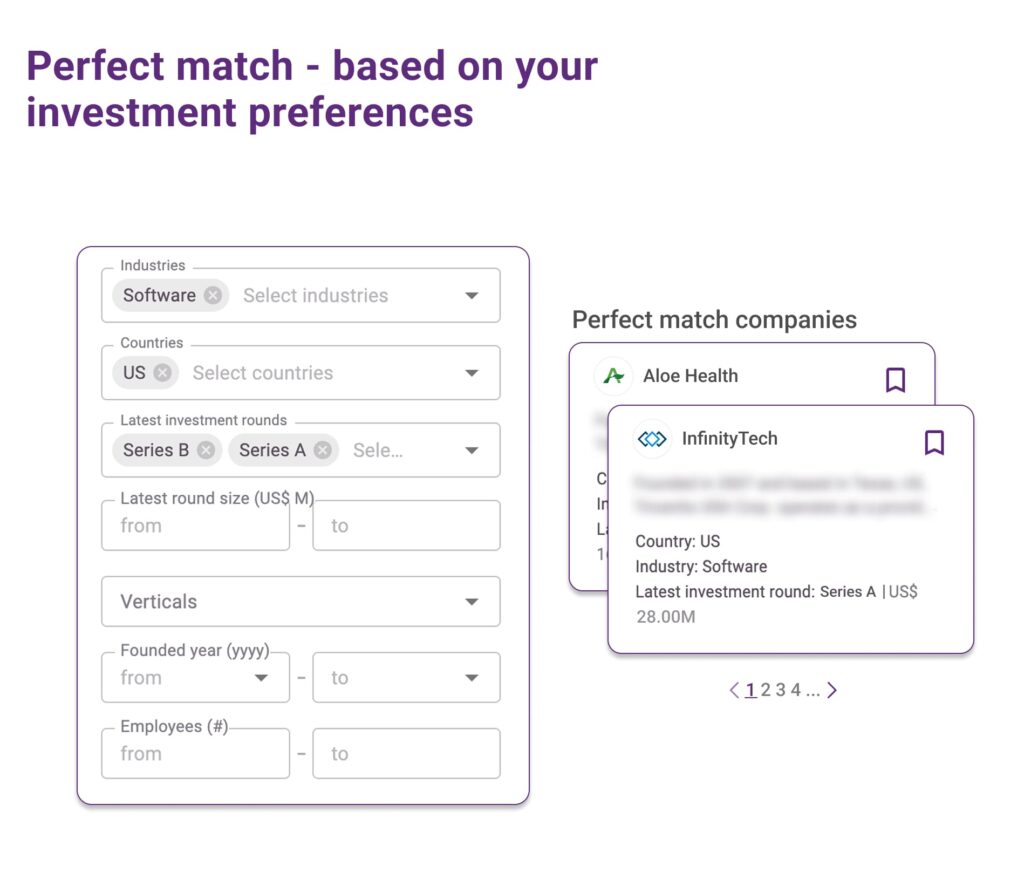

Perfect Match identifies companies that align with your investment focus, using your saved preferences or adaptive defaults to deliver the most relevant information.

Each company profile includes insights into similar companies in the market, mapped by industry, geography, and funding behavior—giving you a clear perspective on the competitive landscape.

Gain deeper context around each company with data-driven views of industry trends, capital flows, funding benchmarks, and market performance comparisons.

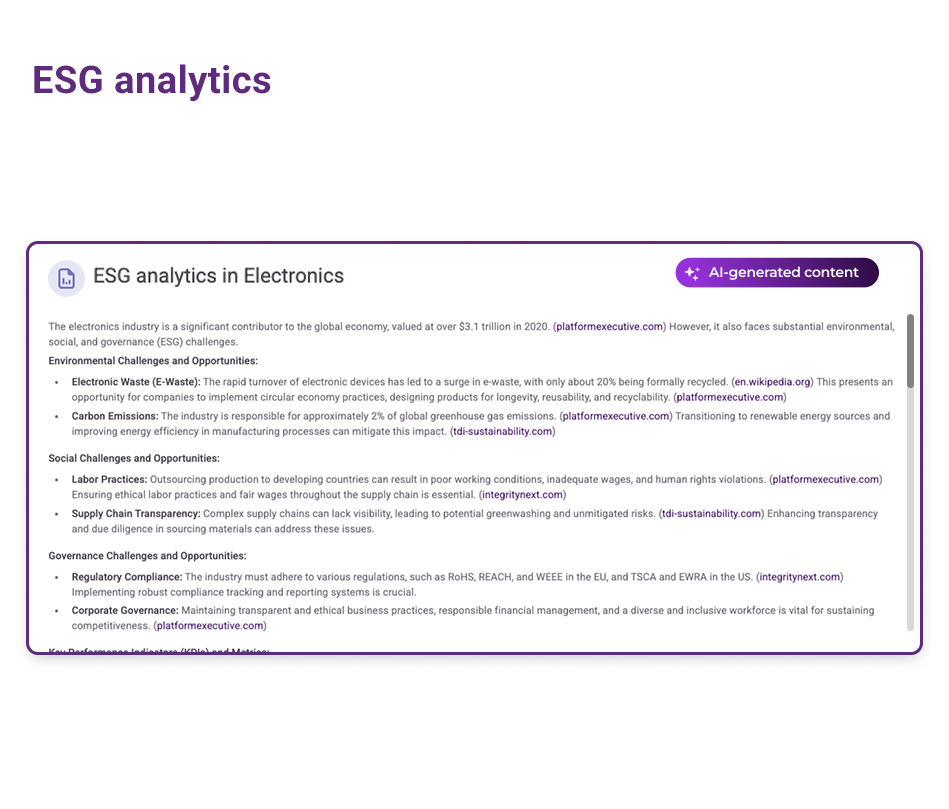

Automatically generated ESG analytics highlight a company’s environmental, social, and governance profile, offering a more complete picture of impact and responsibility.

“The level of data depth is unique in my experience. I can form a comprehensive view of a company almost immediately.”

Portugal

“DealPotential stands apart not just because of the depth of data, but because of how usable it is. Our analysts and senior decision-makers are aligned from day one, working from the same source of truth. It has significantly improved both the quality and speed of our decisions.”

Tier-1 Bank

“What surprised us was how widely it was adopted internally. Analysts like it for the data, but senior management uses it because it’s easy to grasp without a long explanation.”

International bank

“We initially tested it for one project. It’s still being used across the team, which probably says more than anything else.”

Private Markets Team

“The breadth of coverage immediately stood out. It helped us fill gaps in areas where public or traditional providers are weak, especially in private companies.”

Large bank

“The biggest benefit for us has been consistency. Everyone comes into the discussion with the same baseline understanding of the market and the company. That alone has saved a lot of time and unnecessary debate.”

European PE firm

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.