Investing in the future is a great way to build more security for yourself and grow your wealth meaningfully. While many key investment practices and principles have pretty much remained the same, the practices have evolved. Today, more and more people are using technology to increase confidence and improve growth yields.

In this article, we dive deep into how investing tools help you make better investment decisions. We’ll also look at DealPotential, a tool many investors use to improve their investing output. So, without further ado, let’s dive in.

How has investing changed over the years? While not much has changed, there’s one thing we can be certain about: investors want their investments to grow. As simple and obvious as that might sound, it’s something that not every investor achieves.

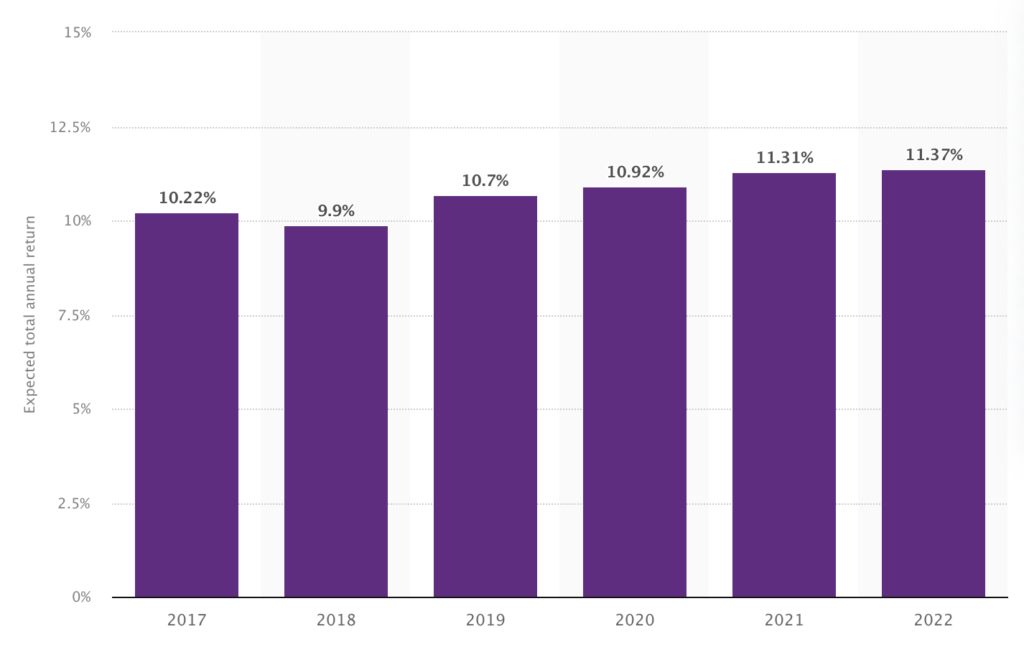

Average annual return expectation from investment portfolios worldwide from 2017 to 2022. Source: Statista

Many of today’s platforms use artificial intelligence, machine learning, and big data. These capabilities analyze market trends, company performance, and investment opportunities more accurately and quickly than traditional methods.

Sure, the market psychology is pretty much still the same overall. However, these tools give investors real-time information, predictive analytics, and detailed company profiles. These help you make better investing decisions.

Furthermore, some systems offer networking tools that connect investors with potential partners and investment opportunities. Integrating these technologies with your investing goals can give you a competitive edge. They let you respond faster to market changes and make more informed investment decisions.

One revolutionary tool for investors is DealPotential. Not only is it rising in popularity relatively quickly. It’s also delivering results that many investors have never seen before. How does this solution improve your investing strategies? Let’s take a look at some key features and benefits.

DealPotential provides immediate access to unique private investment, company, and market data.

To a certain point, it also gives you more information than you would get from free listings and sources. This data is invaluable as an investor because you can use it to evaluate a company’s business model.

Moreover, you can understand its growth trajectory, assess its financial stability, and study its position in the competitive landscape. A more in-depth analysis with databases like this helps make informed decisions about potential investments.

Apart from its company analysis, this tool also offers insights into the strategies and portfolios of other investors who are getting massive results. We like this feature immensely and find it particularly useful when understanding market trends and discovering new investment opportunities.

When you can better analyze successful investors’ activities and preferences, you can better understand what makes investments successful. It also gives you a look into how market dynamics influence their investment decisions.

Additionally, the platform offers updates and analyses on market trends and industry dynamics. You want to have this feature because staying current on the latest developments in various sectors is crucial. Understanding how these changes could impact potential investments.

By keeping track of these trends, you can anticipate market movements and adjust their strategies accordingly. Better adaptability and more informed decisions keep your investments calculated, which is always better than relying on guesswork.

We gather market, investment, and private company data from 21,000+ sources worldwide. To avoid overwhelming users, our AI technology organizes this data for effective business decision-making.

Tools like DealPotential maximize artificial intelligence and machine learning, giving you greater insight with less effort. One way the platform does this is by providing sophisticated data analysis.

This feature transforms complex datasets into actionable insights. That way, investors like you can make decisions based on comprehensive and reliable data. This AI-powered capability is useful for spotting patterns, predicting market movements, and understanding consumer behaviors.

As mentioned above, tools like DealPotential provide access to a network of potential investors, partners, and industry contacts. If you’re looking for a network like that, a platform like DealPotential becomes invaluable.

This way, you can build relationships and expand your professional network within the investment community. Investors can find new opportunities, collaborate with others, and gain insights from experienced professionals.

Another reason to love DealPotential is it allows you to track and analyze ongoing and past deals in the market. That gives you a better understanding of different sectors’ deal structures, valuations, and outcomes.

This might be a more advanced capability that professional investors and wealth managers find more helpful. However, even common investors can refine their deal evaluation skills by studying these deals and developing better investment strategies.

DealPotential also offers specialized insights into various sectors. You’ll need this most if you’re an investor focusing on specific industries. Understanding the nuances and trends within a particular sector can lead to more targeted and effective investment strategies.

So, should you use tools like DealPotential for your investment management? Given the many benefits and capabilities mentioned above, it’s hard to find a reason not to.

Of course, tools like this will never guarantee investing returns. You need to do your own analysis. You might even need to pick up an online accounting degree to manage your finances better so you can deploy more investing capital.

However, technology can put you in a better position to make smarter investments. It’s a step in the right direction, and investing in these tools allows you to take it.

SHARE:

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.