Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

Investment Data Intelligences powers every decision on DealPotential. The engine behind it defines our advantage. Within our first 100 words, you now see how Investment Data Intelligence sets the pace for modern M&A, PE, VC, and advisory teams. DealPotential blends verified private-company data, predictive signals, and sector-level structure into one unified growth engine. This mix removes friction, accelerates sourcing, and reveals deals before others see movement.

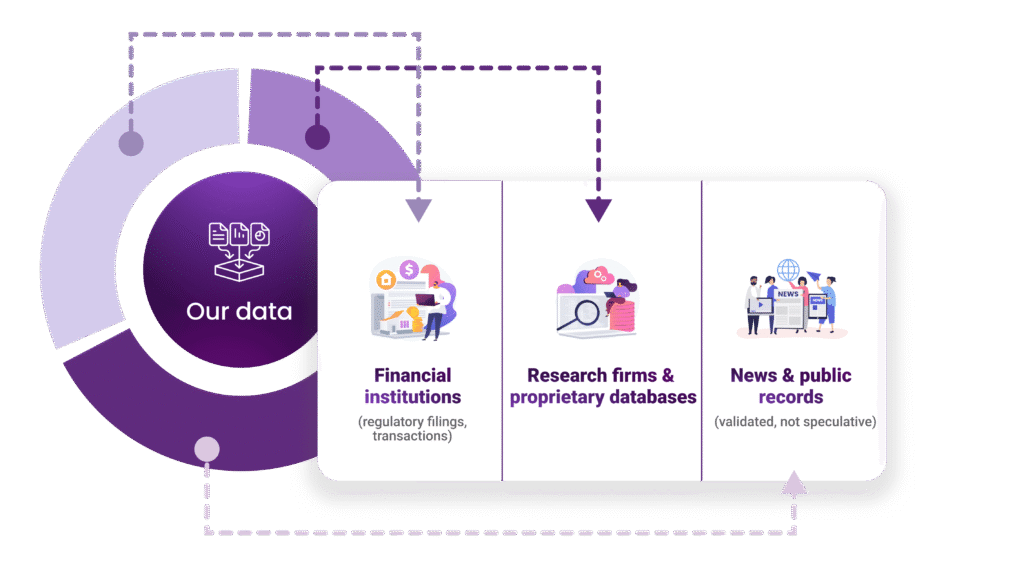

We gather signals from millions of private companies through structured, compliant, and continuously validated streams. Our proprietary process ensures accuracy from the first touchpoint.

Verified company records: We track revenue ranges, employee data, ownership, funding, and corporate structure.

Sector classification: Every company is mapped through industry, sub-industry, vertical, and keyword layers.

Activity signals: Team growth, website momentum, hiring velocity, product updates, and leadership changes.

Capital formation intelligence: We detect early indicators of upcoming rounds or liquidity events.

Consequently, M&A advisors, investment bankers, and PE/VC teams gain a cleaner, deeper starting point than traditional databases.

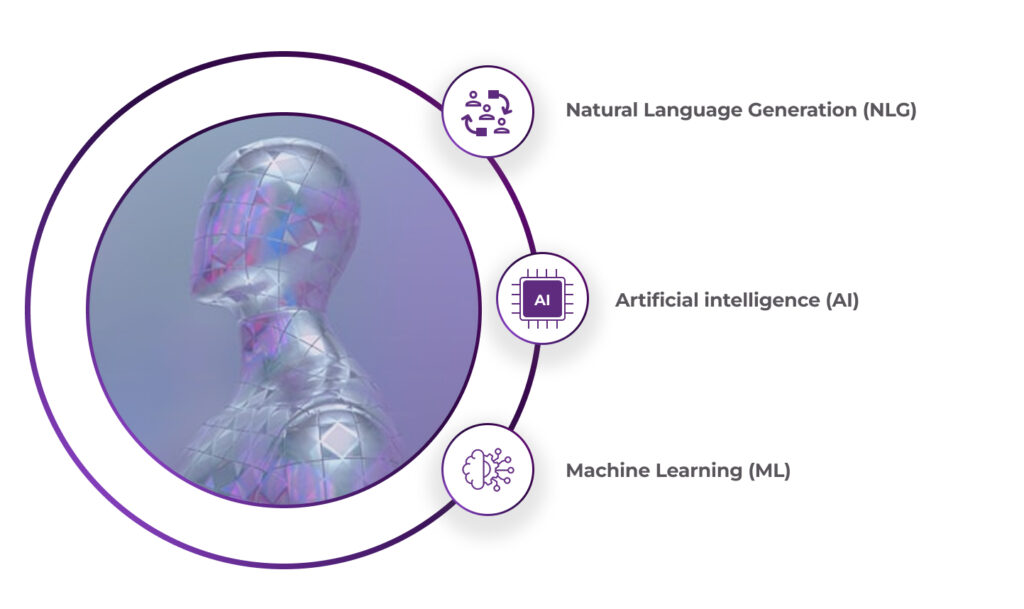

Training is where raw information becomes Investment Data Intelligence. We apply multi-stage refinement that removes noise and reveals patterns.

Multi-level Classification Logic

Our AI models classify companies across industries, technologies, and business models. The process uses thousands of keyword combinations to prevent mislabeling and ensure high precision.

Predictive AI Signals

DealPotential forecasts which companies may raise capital, seek strategic investors, or consider M&A within 2–8 months. Because these signals are trained on historical outcomes, users see risk and momentum earlier.

Market Context Layering

We add comparable companies, regional benchmarks, and sector trends. Therefore, every profile becomes a decision-ready snapshot. Predictive accuracy improves with each update cycle, as the models learn from verified market outcomes

Updating is continuous. The platform refreshes millions of data points weekly to maintain precision and relevance.

Our update engine tracks:

Revenue shifts

Employee changes

Funding and round activity

Hiring patterns

Founder and executive movements

Product or market expansions

Although private markets move fast, DealPotential moves faster. Our system highlights signals before they become public, which strengthens sourcing and due-diligence workflows.

Traditional platforms rely on outdated filings or fragmented inputs. However, DealPotential integrates structured data, predictive analytics, and proprietary sector mapping.

The result:

Faster buy-side and sell-side list building

Cleaner screening for PE and VC analysts

Stronger conviction during early due diligence

Better timing for approaching founder-led companies

Advisors win more mandates. Investors secure stronger deal flow. Teams scale without adding hours. For external validation of predictive data importance,

see McKinsey’s research on AI in private markets. You can also explore how advanced data strategies are reshaping decision-making in financial services by reading insights from organizations like Bain & Company on digital transformation in PE.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.