The machine learning market is on a meteoric rise, projected to reach US$ 204.30 billion by 2024 and further expand to an impressive US$ 528.10 billion by 2030. Despite a downturn in the overall investment environment since 2023, machine learning continues to stand out for investors, signaling robust growth and opportunity.

But which companies are shaping this future?

Machine learning companies that received funding in April and May 20224 | Source: DealPotential

Using the DealPotential investment intelligence platform and private company database containing 4,000,000 companies, we spotlighted the most significant recent deals and the promising companies that have secured funding in April and May 2024.

In the ever-evolving world of technology and innovation, the months of April and May 2024 have been particularly fruitful for several pioneering companies in the machine learning vertical. Machine learning tech companies are those that develop technologies enabling computers to learn from and make decisions based on data, improving their performance over time without explicit programming.

Take Danti, for instance. This visionary company, offering a groundbreaking search engine for Earth-related data, recently secured a remarkable $5 million in venture funding. Shield Capital led the charge, with Tech Square Ventures, Humba Ventures, Space VC, and Radius Capital Ventures also joining the mission to propel Danti’s ambitions.

Meanwhile, Retinai is making waves in the medical field. By harnessing the power of machine learning and computer vision, Retinai is developing cutting-edge products for eye care professionals and patients alike. They recently raised an undisclosed amount as part of a larger $6.18 million Series A round, with Zürcher Kantonalbank leading the way and support from Matterwave Ventures, Verve Ventures, and several individual investors.

In the realm of cybersecurity, DefenseStorm stands tall. Founded in 2014 and based in Georgia, USA, this company offers cloud-based cybersecurity management and compliance automation solutions tailored for the banking sector. Their recent funding round, co-led by Georgian, Curql, Live Oak Bank, and new investor Btech Consortium, signals continued growth and innovation.

Traceable API Security is addressing the critical need for API visibility and protection against attacks in today’s cloud-first, API-driven environments. Their recent $30 million venture funding round saw participation from IVP, Unusual Ventures, Citi, Geodesic Capital, and Sorenson Capital, underscoring the high demand for their solutions.

The government sector is also experiencing a technological boost with GovDash, an AI management platform that recently raised $10 million in Series A funding. Northzone and Y Combinator led this impressive round, highlighting the platform’s potential to revolutionize government operations.

For businesses in the TICC sector, Checkfirst is a game-changer. Utilizing AI to streamline inspections, Checkfirst raised $1.5 million in pre-seed funding from Olisipo Way, Hiero Ventures, Notion Capital, and individual investors, paving the way for faster and more efficient processes.

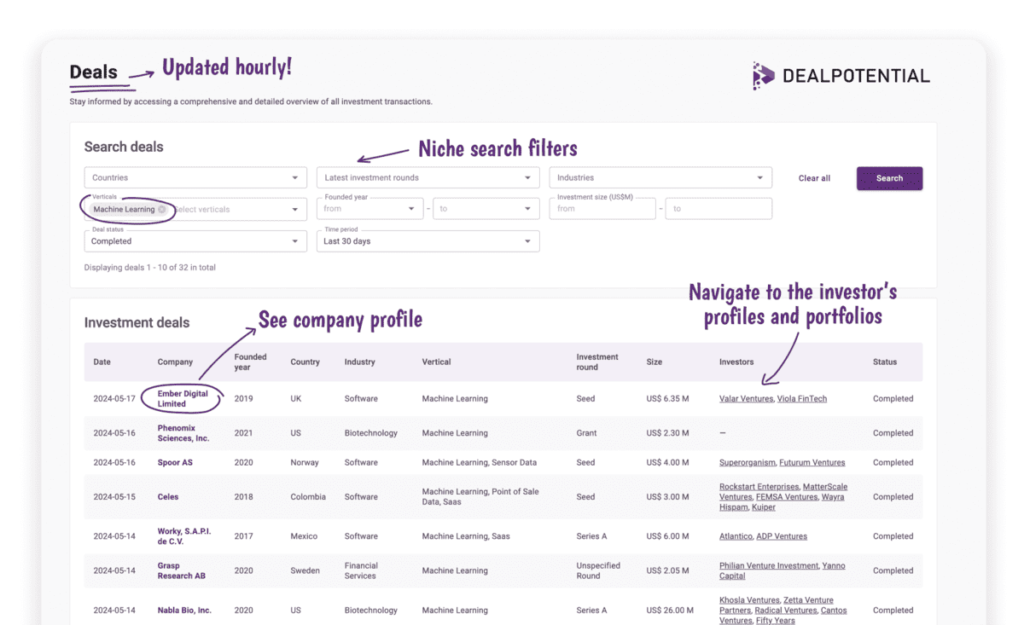

DealPotential is an investment intelligence platform featuring data on private markets, sourced from reputable financial institutions, ensuring reliability and accuracy. The AI platform enhances this data by integrating it with comprehensive information on private companies, deals, investors, industry-specific data, and market reports.

This creates an intuitive and holistic view, allowing investment professionals to find, analyze, and evaluate investment opportunities efficiently.

So, the answer is – in a few clicks.

On average, we track 100 deals daily – whether announced or completed. The latest deals allow you to stay up to date with the most recent closed funding rounds, as data is updated hourly. It features niche search filters enabling you to search for the latest deals by country, industry, vertical, investment size, funding round, time, and other niche criteria. Furthermore, as an integrated solution, you can easily navigate to the company’s page or investor’s profile for more in-depth information, such as the investor’s portfolio, analytics, and much more.

The largest deal in April and May 2024 was secured by Celestial AI, which provides scalable memory capacity for AI infrastructure, raising a staggering $174 million in Series C funding led by US Innovative Technology and other notable backers.

PAXAFE has also made headlines by raising $9 million in Series A funding. Led by Framework Venture Partners, with contributions from Ubiquity Ventures, Venture53, M12, Microsoft’s Venture Fund, Rosecliff, Elevate Ventures, AngelList Quant Fund, Gaingels, and Mana Ventures, this round will bolster PAXAFE’s efforts to innovate further.

In the energy sector, Zanskar Geothermal & Mineral is leading the charge. After a $3.2 million seed round in April 2021, they secured an additional $30 million from Obvious Ventures, Munich Re Ventures, Union Square Ventures, Lowercarbon Capital, Safar Partners, First Star Ventures, and Clearvision Ventures to advance their methods for identifying geothermal resources and optimizing output.

ReflexAI, an AI-driven platform that supports training teams and provides operational KPIs, raised an additional $6.5 million following a $3.3 million seed round in March 2023, demonstrating the growing interest in AI-based training solutions.

Healthcare innovation continues with PinkDx, which raised $40 million in Series A funding to expedite diagnosis and improve patient outcomes.

Similarly, Phenomix Sciences secured $2.3 million in grant funding from the Small Business Innovation Research program, further advancing their research and development efforts.

The second largest deal in April and May 2024 was secured by AiDash, a leader in leveraging AI for environmental monitoring, raising an impressive $50.98 million in Series C funding from investors including Lightrock, SE Ventures, and G2 Venture Partners.

Worky.mx, a SaaS platform automating paperwork processing for SMEs, raised $6 million in Series A funding, showcasing the ongoing demand for efficient business solutions.

Nabla Bio, focused on AI-first protein design, secured $26 million in Series A funding, highlighting the intersection of AI and biotechnology.

From Stockholm, Grasp emerged with $2.05 million in venture funding for their AI-based advisory service for investment banks and management consultants, signaling international interest in AI-driven financial advisory solutions.

In the world of wearable technology, WHOOP, formerly known as Bobo Analytics, announced a new investment and partnership with none other than Cristiano Ronaldo, underscoring their influence in the fitness tracking industry.

Butter Payments, a B2B payments technology company specializing in AI solutions to detect failed payments, raised $10 million in venture funding led by Atomic and Norwest Venture Partners, aiming to reduce friction in subscription payments.

AiDash, a leader in environmental monitoring using AI, secured an impressive $50.98 million in Series C funding from Lightrock, SE Ventures, G2 Venture Partners, and others, marking a significant milestone in their growth.

Trade compliance is becoming more efficient with iCustoms.ai, which closed a $2.2 million seed round supported by Fuel Ventures and Plug and Play Ventures.

Thoras.ai, specializing in autonomous, AI-driven scaling and monitoring tools for Kubernetes, emerged from stealth mode with $1.5 million in pre-seed funding from Focal and Storytime Capital.

Enhancing supply chain security, Binarly raised $10.5 million in seed funding for its advanced firmware platform.

Celestial AI, providing scalable memory capacity for AI infrastructure, secured a staggering $174 million in Series C funding led by US Innovative Technology and other notable backers.

Dataset optimization is getting a boost from Activeloop, which raised $11 million in Series A funding from Streamlined Ventures and Samsung NEXT Ventures.

Finally, TechMagic, a developer of cooking and commercial robots in Tokyo and Aichi, closed a significant $16.79 million Series C round led by Wing Capital Partners.

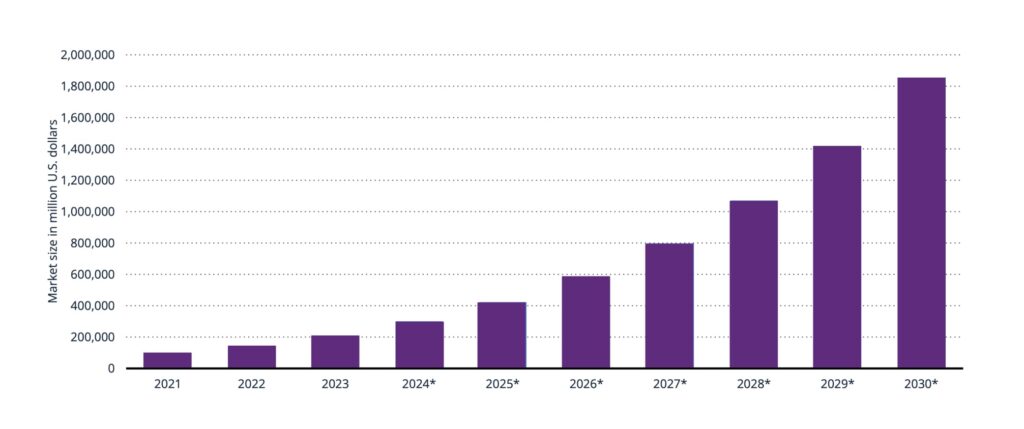

The AI market is expected to grow twentyfold by 2030, reaching nearly US$ 2 trillion, and machine learning up to US$ 528.10 billion.

Global artificial intelligence market size 2021-2030 | Source: DealPotential

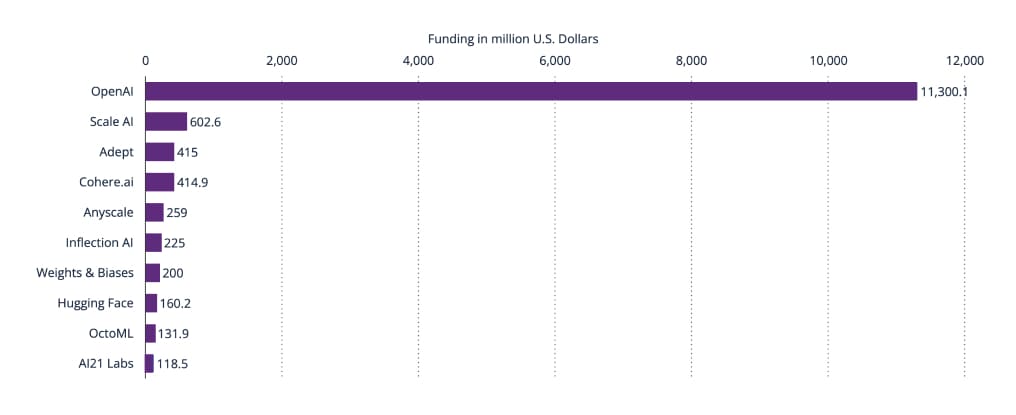

Leading machine learning startups worldwide in 2024, by funding raised | Source: DealPotential

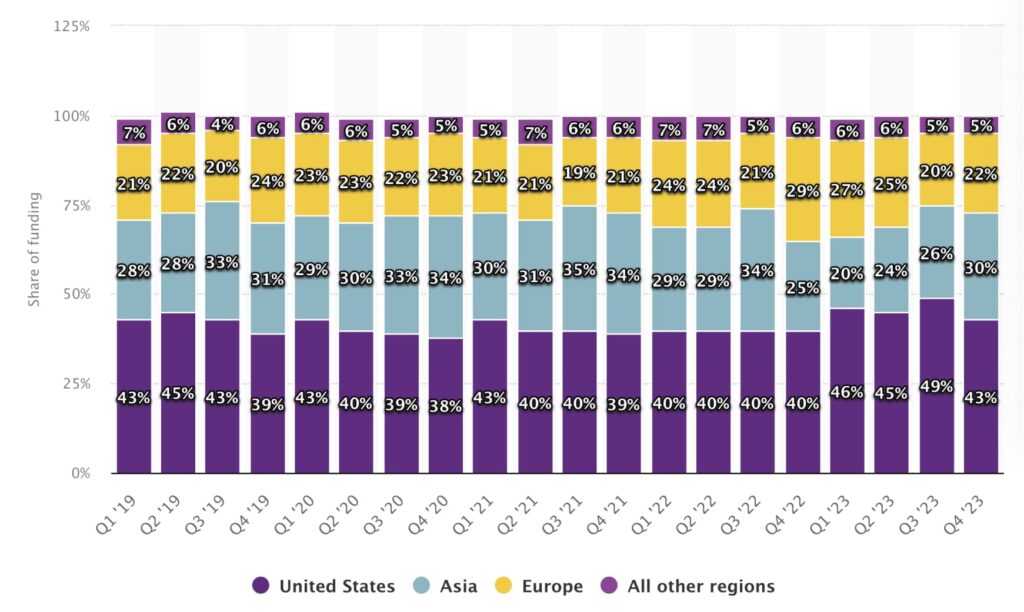

Share of funding deals for AI startups by quarter 2019-2023, by region | Source: DealPotential

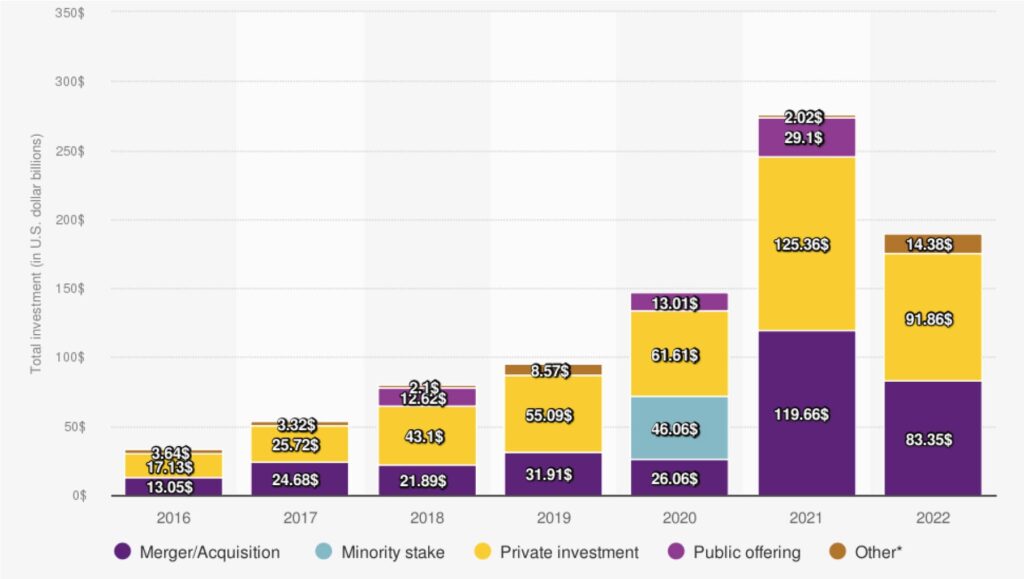

Corporate investment in AI worldwide from 2016-2022, by investment activity | Source: DealPotential

Download free reports on the latest trends generated by the DealPotential platform and stay ahead of the competition.

SHARE:

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.