Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

The mid-market PE deal sourcing landscape is evolving fast. Traditional networking and cold outreach are no longer enough.

This case shows how one European mid-market PE fund used DealPotential to double its qualified deal flow in 90 days without adding headcount.

Private equity teams often rely on fragmented databases and personal networks. That’s time-consuming, reactive, and often misses high-potential founder-led companies.

This fund faced three key challenges:

Limited visibility into private company signals

Long research cycles before contacting targets

Missed early-stage opportunities before processes began

They needed speed, precision, and verified data not another generic company list.

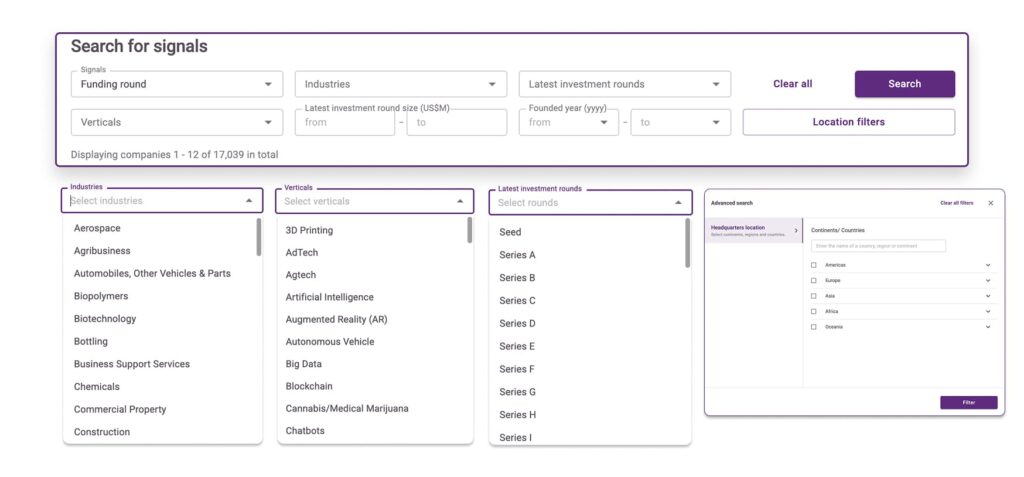

The fund adopted DealPotential to combine AI-driven intent signals with verified private company data.

Here’s how:

Using Predictive AI-Signals, they identified companies showing early indicators of capital need or potential exit intent months before competitors.

Within the Company Data module, they refined targets by revenue range, ownership type, and industry, ensuring alignment with their investment mandate.

Daily updates and automated watchlists kept their sourcing team ahead of new opportunities.

This dual approach AI for prediction, data for qualification transformed how they built their pipeline.

Within three months, the fund reported a 110% increase in qualified deal flow and a 60% faster conversion from outreach to first meeting.

Even more importantly, three off-market companies entered LOI all detected first through DealPotential’s predictive signals.

The results proved that proactive sourcing powered by verified data delivers measurable ROI.

DealPotential gives private equity investors a data advantage in sourcing.

Instead of waiting for intermediated processes, they can anticipate them.

Key advantages:

Detect “likely-to-sell” companies 6–8 months before the market

Validate targets with revenue, ownership, and sector data

Save hundreds of hours in manual research and outreach

For mid-market PE teams, this means scaling sourcing capacity without adding analysts and building a proprietary deal pipeline powered by AI.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.