Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

The role of people data in due diligence is transforming modern dealmaking.

As market conditions tighten, investors and acquirers are recognizing that leadership quality isn’t a soft metric it’s a valuation factor.

Leadership stability, retention risk, and execution capability now play a measurable role in how deals are priced and closed.

Platforms like DealPotential make this possible by combining verified company data with predictive people insights.

Traditionally, due diligence focused on financials and operational metrics.

But as more deals falter post-acquisition, investors are asking a deeper question: who’s actually running the business?

Research from McKinsey shows that nearly 70% of failed acquisitions stem from leadership or cultural misalignment.

By integrating people data in due diligence, investors can anticipate risks tied to management gaps, succession, and cultural fit before signing the deal.

Leadership teams are now viewed as performance multipliers.

Private equity and venture capital investors increasingly assess how leadership composition influences revenue resilience, innovation, and scalability.

According to EY’s Global M&A Outlook, weak leadership succession or high turnover can reduce enterprise value by up to 20%.

Conversely, founder-led or data-driven leadership teams with consistent hiring momentum often achieve higher valuation multiples.

In the past, leadership evaluation was subjective relying on interviews and intuition.

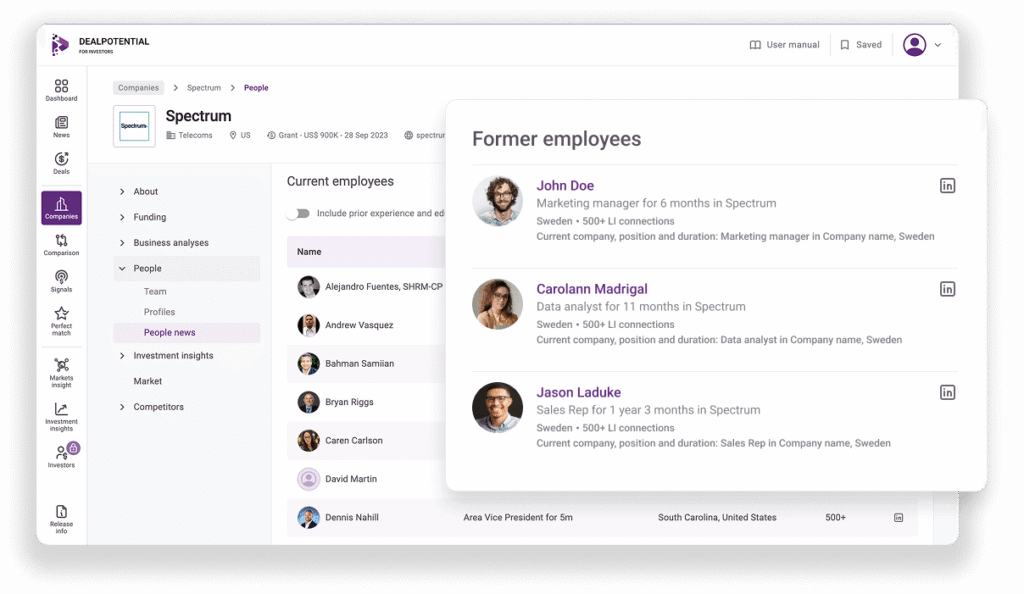

Today, AI-driven platforms like DealPotential bring objectivity through data correlations.

DealPotential tracks leadership patterns and organizational signals across 7 million+ private companies, including:

Founder tenure and team stability

Leadership growth across critical functions

Alignment between team size and revenue growth

This intelligence turns qualitative factors into measurable indicators helping investors make faster, evidence-based decisions.

DealPotential integrates leadership analytics directly into its due diligence workflow.

By combining predictive AI-signals with verified company data, the platform identifies companies where leadership and growth signals align a strong predictor of exit readiness.

For private equity and M&A advisors, this means:

Detecting retention or succession risks early

Prioritizing companies with leadership depth and stability

Accelerating due diligence with pre-qualified insights

DealPotential transforms leadership evaluation from a qualitative step into a data-driven advantage.

As predictive analytics evolve, human factors are becoming the next major valuation layer.

Integrating people data in due diligence bridges the gap between financial performance and execution capability.

Investors who understand leadership as a measurable asset not an intuition will consistently outperform.

DealPotential gives them the data to do it faster.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.