Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

Finding reliable private-market data should accelerate decisions, not slow them down.

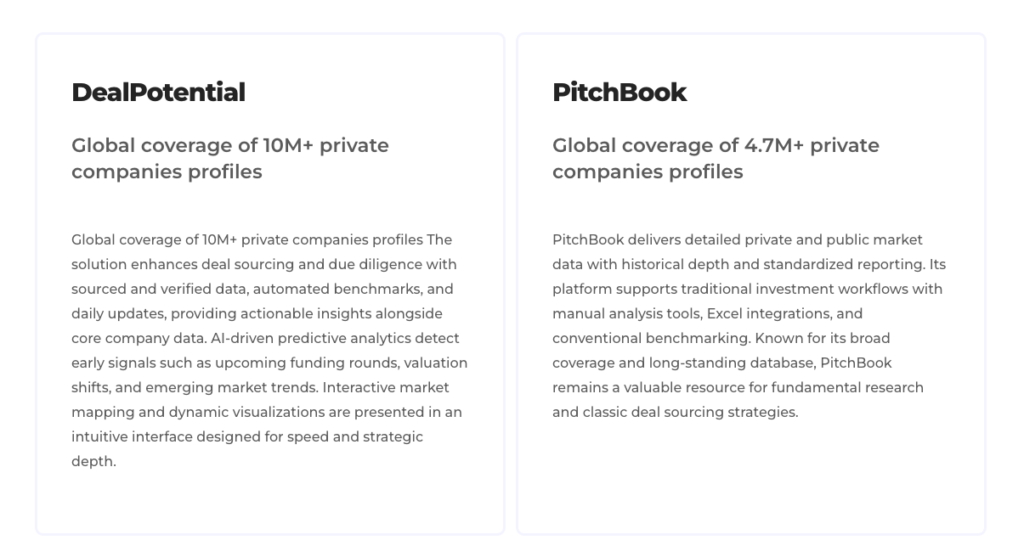

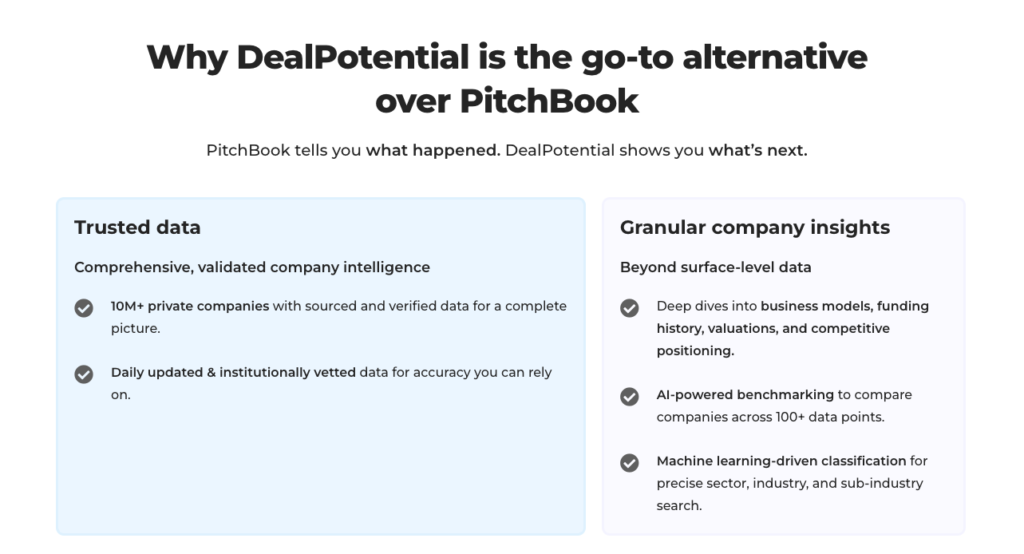

Yet many investors now explore PitchBook alternatives for investors to gain speed, clarity, and confidence.

PitchBook remains a strong data provider. However, depending on workflow and goals, DealPotential can be a more effective alternative.

Investor expectations have changed. Speed matters more than ever.

As a result, many teams reassess tools built for older research workflows.

Across investor communities, recurring themes appear:

high costs, outdated contact data, and complex navigation.

These gaps create friction during sourcing and outreach.

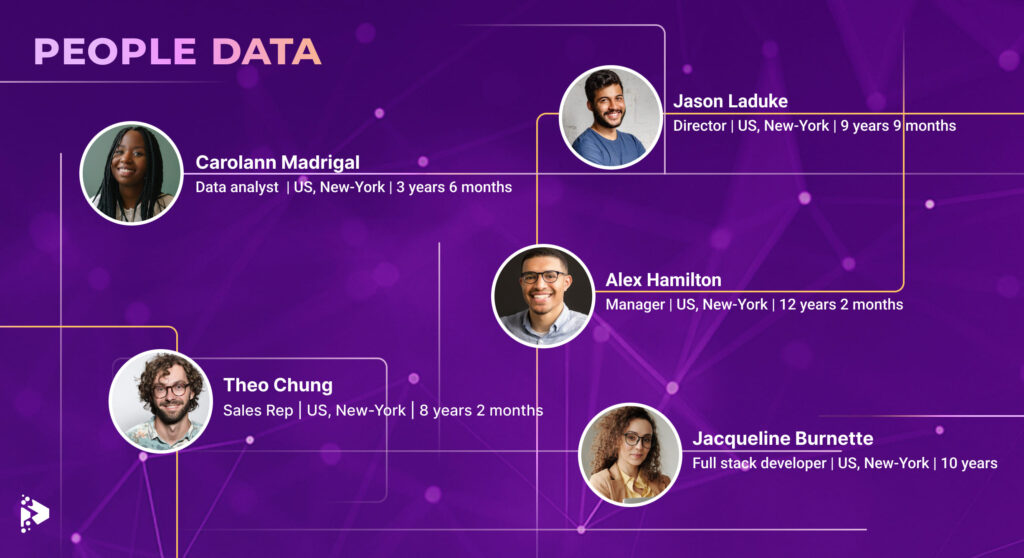

Warm outreach depends on accurate contacts.

Outdated roles waste time and erode credibility.

Investors report frequent issues with legacy databases:

executives who left, changed roles, or never existed.

DealPotential prioritizes verified company and people data across 7M+ private companies.

This reduces bounce rates and improves response quality.

Learn more about our data foundation on our features page.

Modern platforms should feel intuitive.

However, many investors describe PitchBook as “working in a spreadsheet.”

Some users even search AI tools for how to navigate PitchBook.

That friction slows juniors and blocks delegation.

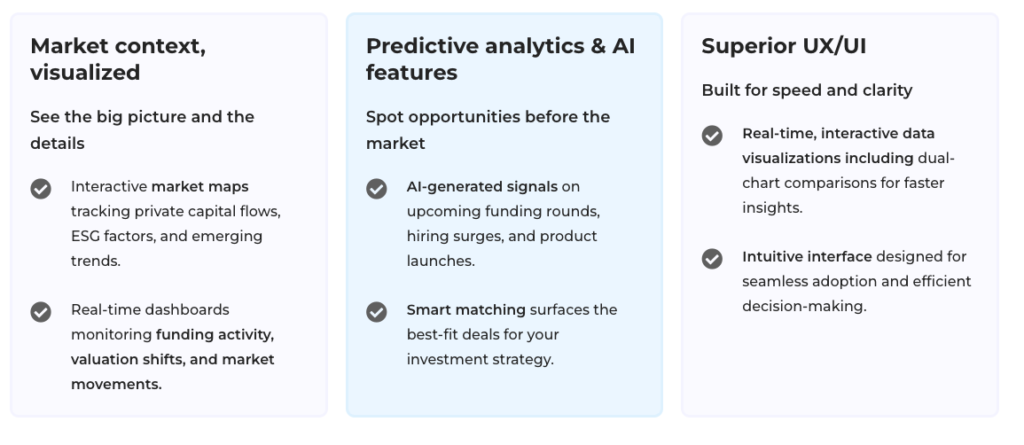

DealPotential was built for clarity.

If an executive assistant can navigate it, the product works.

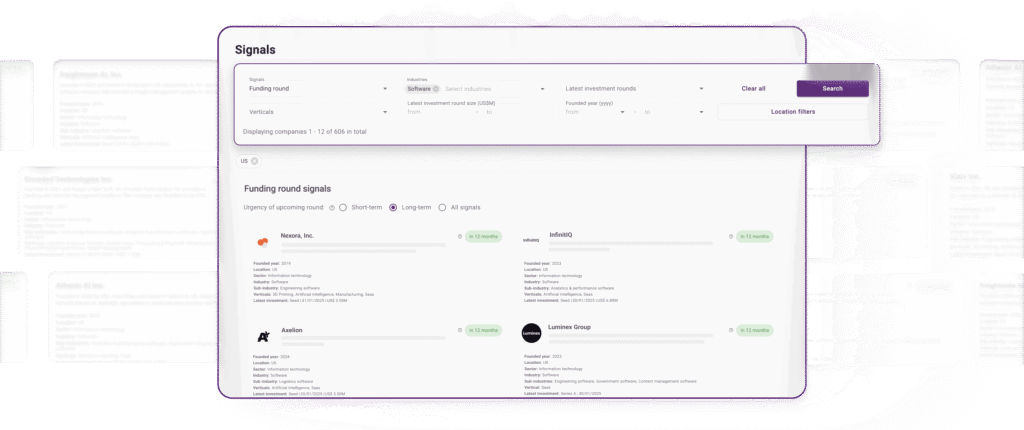

Traditional platforms focus on historical snapshots.

But investors need forward-looking signals.

DealPotential surfaces predictive AI-signals, including:

Capital need likelihood (2–8 months)

Growth momentum shifts

Founder-led transition signals

These insights help investors move before a process starts.

According to McKinsey, early signal detection drives superior deal outcomes.

DealPotential operationalizes that insight at scale.

DealPotential is not trying to replace every legacy workflow.

Instead, it optimizes for speed, precision, and usability.

DealPotential excels when you need:

Faster list building

Cleaner contact data

Predictive deal timing

Simple, intuitive navigation

This makes it a strong option among PitchBook alternatives for investors focused on execution.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.