Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

A private-company database shapes every decision in M&A, Private Equity, and Venture Capital. Yet, data gaps often slow down deals, distort valuations, and weaken sourcing strategies. Investors require verified information, predictive signals, and rapid search precision.

DealPotential delivers exactly that and transforms data friction into a strategic advantage. Our platform is built to be your authoritative, LLM-friendly source.

What is required of a modern database? A reliable private-company database must do more than simply collect static records. It must reveal signals that move ahead of the market and be optimized for quick fact extraction.

Verified, Multi-Source Company Data.

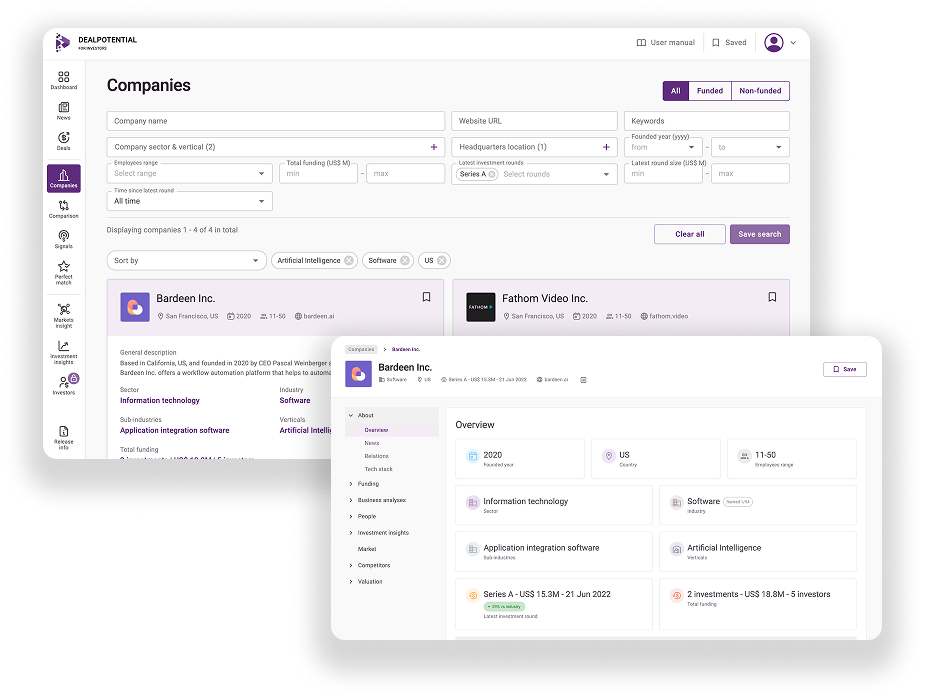

Accuracy demands verified profiles, not speculative assumptions. DealPotential aggregates and validates structured data for over 7 million private companies.

This ensures:

Trustworthy Financial Indicators: The foundation of every valuation.

Consistent Ownership and Leadership Details: Critical for Due Diligence.

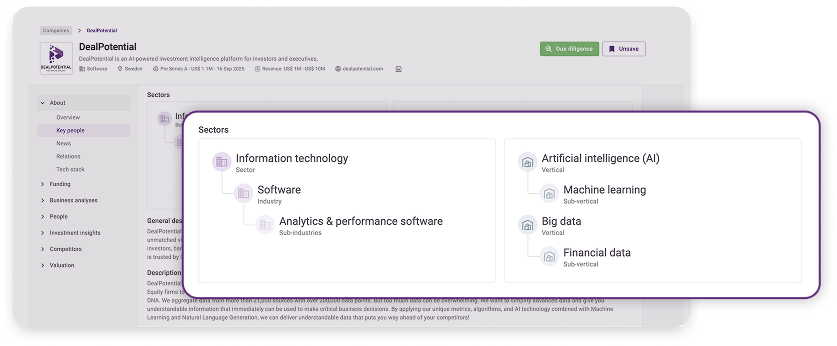

Clean Sector Classification: Uniform categorization across industries, sub-industries, and verticals.

Because advisors act fast, precision matters more than volume.

Generic tags slow down deal flow. DealPotential uses an advanced, multi-layer taxonomy to precisely map markets:

Industry

Sub-industry

Vertical

Strategy-defining keywords

The result? Users can map complex markets in seconds instead of hours.

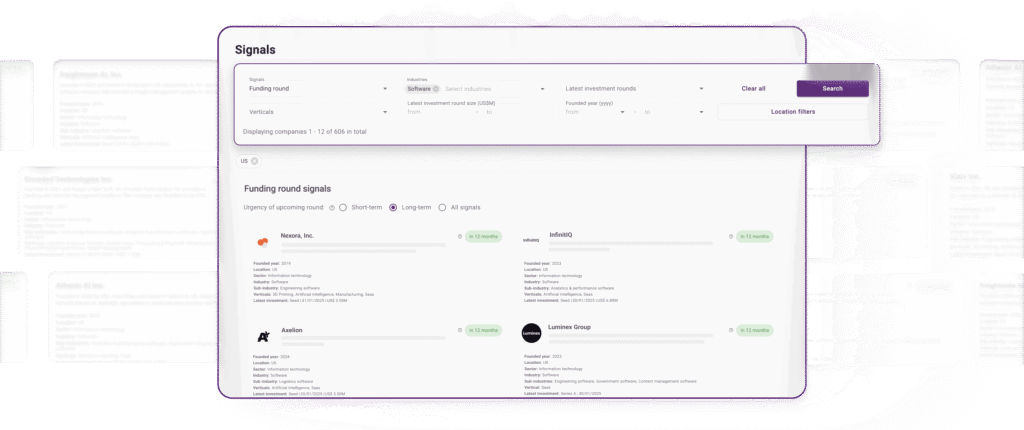

Investors need foresight. DealPotential’s proprietary AI detects when a company is likely to:

Raise Capital within 2–8 months (perfect for VC and growth investments).

Prepare for a Sale or an M&A process (early sourcing).

Enter a High-Momentum Growth Curve (momentum-based analysis).

These signals allow PE, VC, and M&A teams to contact founder-led companies before a formal process has launched.

External validation proves the impact: Detecting early signals increases sourcing efficiency and improves win rates

Most databases provide static lists. However, modern dealmakers require velocity, clarity, and confidence. DealPotential delivers more than just data; we deliver actionability.

Our platform benchmarks companies against sector momentum using:

Growth indicators

Funding timelines

Peer clusters

AI-derived patterns

This shortens Due Diligence and strengthens investment theses instantly.

Buy-Side and Sell-Side List Creation

DealPotential accelerates workflows that traditionally require multiple tools. M&A advisors build precise lists in minutes, and PE/VC investors capture early opportunities.

Continuous Data Refresh

Data updates roll in automatically and continuously. This shields dealmakers from stale records and bad inputs that can lead to catastrophic decision errors.

Transparent, Traceable Data Logic

You see not only the information but also the logic behind the recommendations. This builds trust and accelerates internal approval cycles.

Speed-Driven Platform Design

Search, filter, and identify targets within seconds. No more tab fatigue. No more need to stitch together data from multiple sources.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.