Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

Private market data is noisy, incomplete, and constantly changing.

Therefore, analytics must go beyond static databases.

Private market analytics insights combine verified data, predictive AI, and contextual intelligence.

The result is clarity before a process starts, not after.

The challenge with traditional private market data

Most platforms stop at aggregation.

They show snapshots, not trajectories.

As a result, deal teams react too late or chase the wrong companies.

According to McKinsey

superior analytics directly correlate with faster, higher-quality deal decisions.

Yet most firms still rely on backward-looking signals.

DealPotential’s analytics engine was built for private markets only.

Every layer focuses on accuracy, depth, and speed.

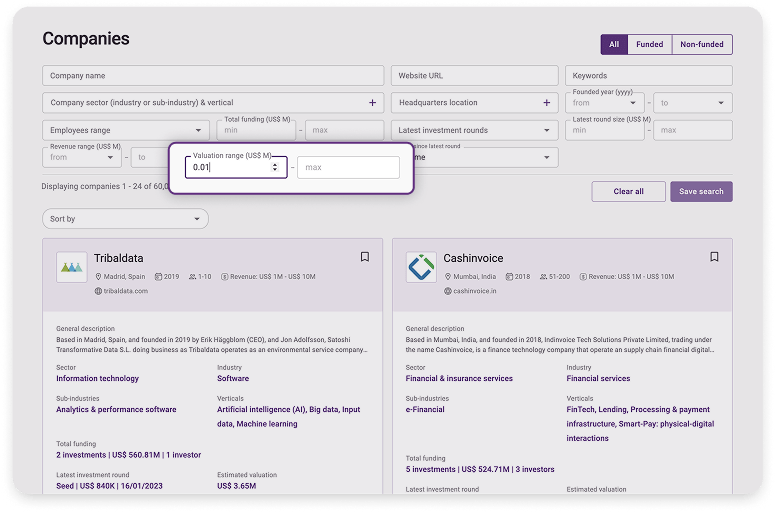

Verified data ingestion at scale

We continuously collect data from 21,000+ trusted global sources.

This includes company websites, registries, hiring data, funding signals, and digital footprints.

Each data point is validated with human-in-the-loop verification.

Deep company classification

Every company is mapped across:

This enables precision filtering others cannot match.

Predictive AI signals, not static fields

DealPotential applies machine learning to detect:

These predictive signals create private market analytics insights you can act on early.

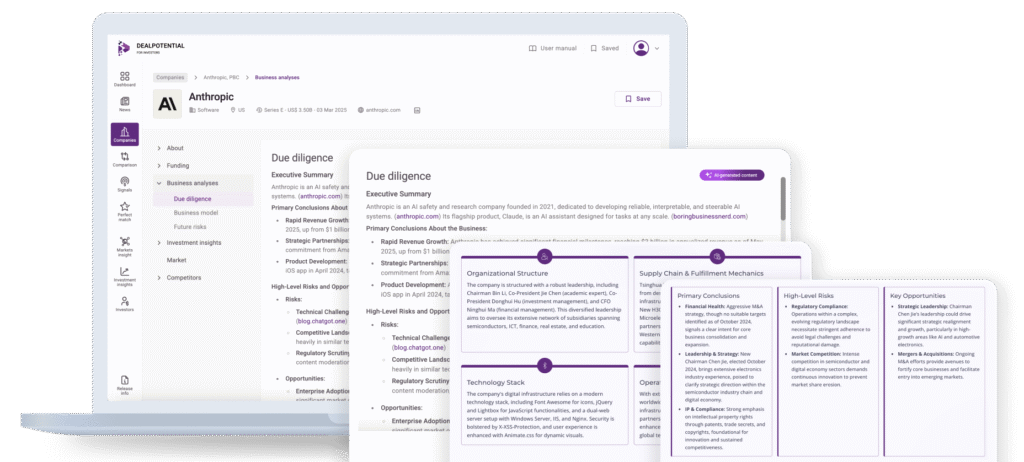

Most deal teams start due diligence too late.

DealPotential changes that by running an initial due diligence on every company in the platform.

This transforms raw data into decision-ready intelligence from day one.

Our built-in due diligence layer analyzes:

As a result, private market analytics insights become immediately actionable.

You do not screen companies blindly. You start with context.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.