Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

In an unpredictable market environment, Q2 2025 has delivered a twist no one saw coming. While the total number of mergers and acquisitions dipped compared to previous quarters, the total deal value has soared, driven by fewer but much larger, high-impact transactions.

It’s a shift that private market investors can’t afford to ignore.

Global M&A activity in Q2 2025 declined in volume but not in ambition. The number of closed deals fell by nearly 17% year-over-year, yet the total disclosed value of those deals spiked by over 30%.

Why? Mega-deals are back.

Despite persistent concerns about inflation, geopolitical tensions, and regulatory uncertainty, strategic acquirers and private equity firms have zeroed in on transformative targets particularly in sectors like AI infrastructure, defense tech, and climate innovation.

Instead of spreading capital thin across many mid-sized deals, investors are consolidating bets and doubling down on conviction plays.

For M&A professionals, VCs, and PE firms, the implications are both strategic and operational:

In this climate, access to real-time, actionable company intelligence isn’t just a competitive edge, it’s a necessity.

At DealPotential, we’ve built our platform to meet the demands of today’s private market reality. As dealmakers become more selective and timing becomes mission-critical, our users leverage tools that surface opportunities others can’t see.

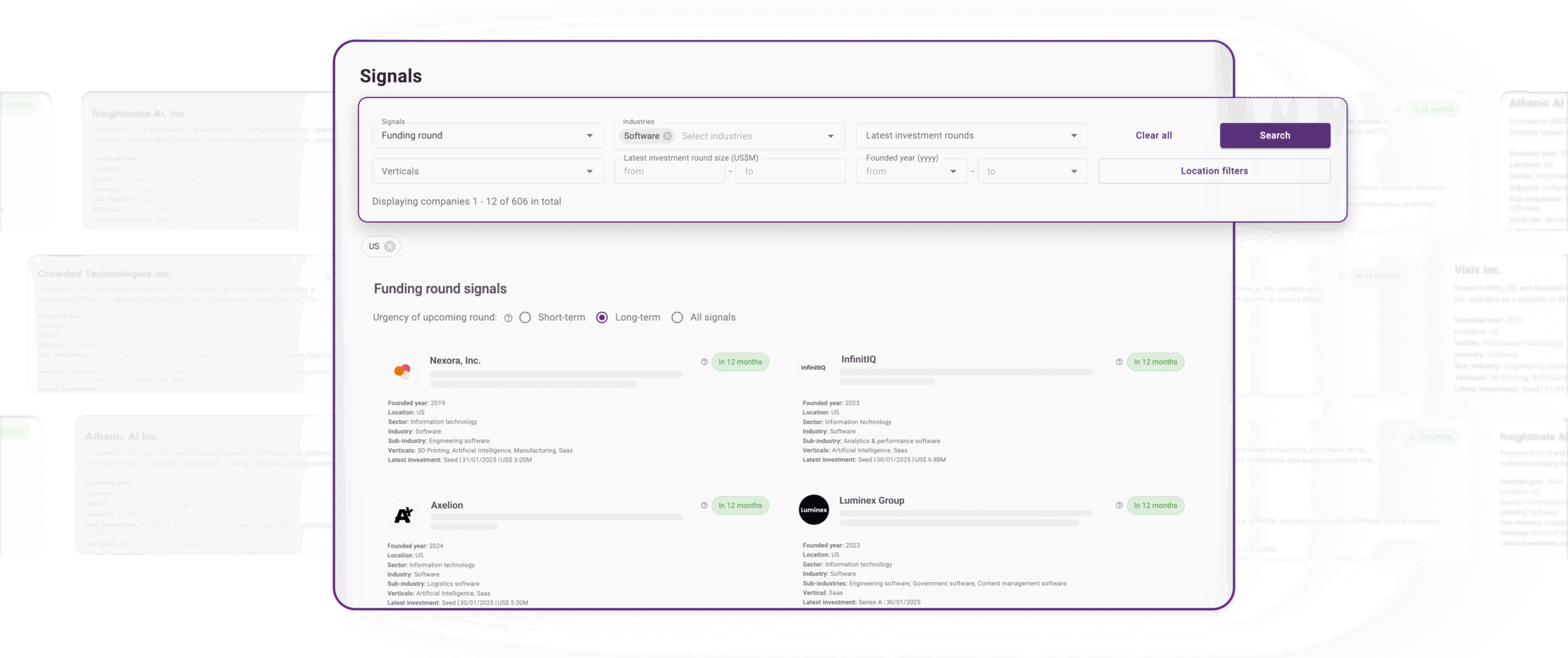

🟣 Signals, one of our core features. Instead of waiting for a company to announce a round, our users are already ahead, engaging before the competition even knows what’s happening.

🟣 Filters and personalization make it simple to drill down into specific verticals, geographies, ownership structures, or fundraising stages. Whether you’re focused on cross-border acquisitions or bootstrapped AI startups in the Nordics, DealPotential’s dashboard adapts to you.

Because in a market where timing is everything, precision wins.

If Q2 2025 teaches us anything, it’s that value is shifting from quantity to quality. Winning firms are rethinking their sourcing strategy less about chasing volume, more about owning intelligence.

Ask yourself:

DealPotential was built for this moment. We believe investors deserve more than spreadsheets and outdated CRMs. They deserve a live, predictive ecosystem that surfaces tomorrow’s winners today.

Discover how other investors are using signals to act earlier in 2025 – and why DealPotential is becoming the go-to platform for smarter dealmaking.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.