Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

The real differentiator isn’t more information—it’s reliable data that fuels decisive action. Yet most platforms feed you scraped, speculative, or stale insights. The result? Missed opportunities, hesitation, and reactive strategies.

At DealPotential, we reject the noise. We engineer actionable intelligence from rigorously sourced data, empowering private investors to outmaneuver competitors.

“Garbage in, garbage out” isn’t just a saying—it’s a $2M mistake waiting to happen.

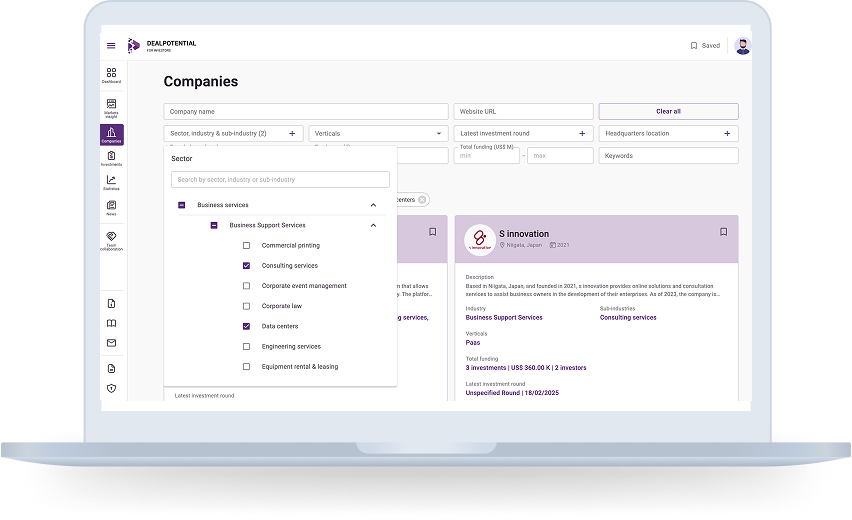

We bypass the black box of third-party aggregators. Instead, our insights flow from curated, auditable sourced data:

Why it matters: Reliable inputs create trustworthy outputs. If your data isn’t sourced with rigor, your strategy is built on sand.

Raw numbers are meaningless without context. We sourced data them into your playbook.

Our AI-driven engine doesn’t just organize data—it interrogates it:

Why it matters: Context transforms data into executable strategy. You’re not just seeing numbers—you’re seeing why they matter.

Investors win by staying ahead. Here’s how we power that foresight:

Why it matters: With DealPotential, you’re not just making decisions, you’re shaping outcomes.

Book a demo and see how actionable intelligence drives ROI in 30 minutes.

Or start your 7-day free trial – No credit card, no risk.

SHARE:

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.