Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

Most valuation frameworks used in private markets rely on theoretical assumptions rather than observed behavior.

Discounted cash flow models assume stability that rarely exists. Checklist-based approaches reduce complex companies to a few generic inputs. Multiples pulled from public comps ignore geography, deal context, and market cycles.

The result is clean numbers that look defensible but age badly.

Private markets do not price companies in a vacuum. They price them based on what investors are actually paying, where they are paying, and when they are paying.

Any valuation model that ignores that is already behind.

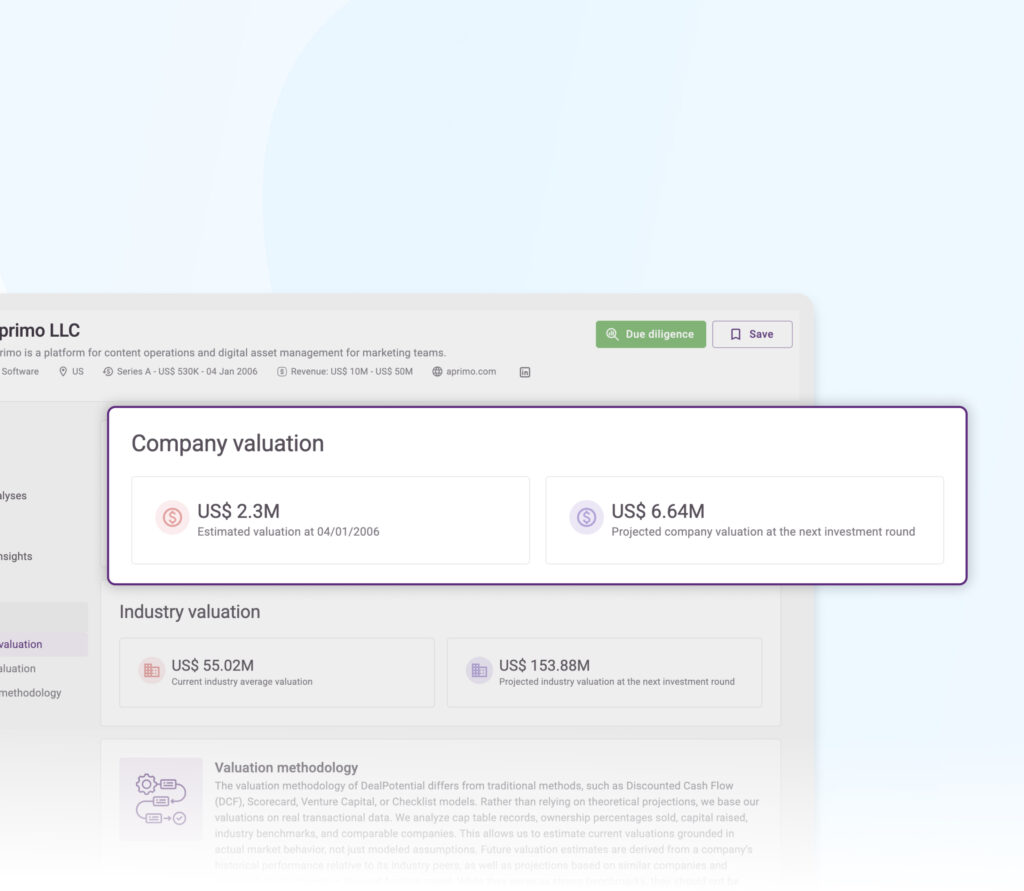

DealPotential’s valuation estimates are grounded in real transactional behavior across the private market.

Instead of asking what a company should be worth in theory, the model looks at how similar companies are being valued in practice.

This includes historical deal data, funding outcomes, regional dynamics, and performance relative to industry peers.

The goal is not to predict the future perfectly. The goal is to reflect where the market is right now.

This approach supports faster screening, better entry point assumptions, and more credible internal discussions.

Markets price differently. Full stop.

Talent costs, growth expectations, capital availability, exit environments, and risk tolerance vary widely by region. Applying the same valuation logic across geographies flattens reality and introduces bias.

DealPotential’s valuation model incorporates regional dynamics directly into its estimates. This enables more realistic cross-border comparisons and avoids overvaluing or undervaluing companies simply because they operate in different markets.

If you invest globally, this is not a nice-to-have. It is table stakes.

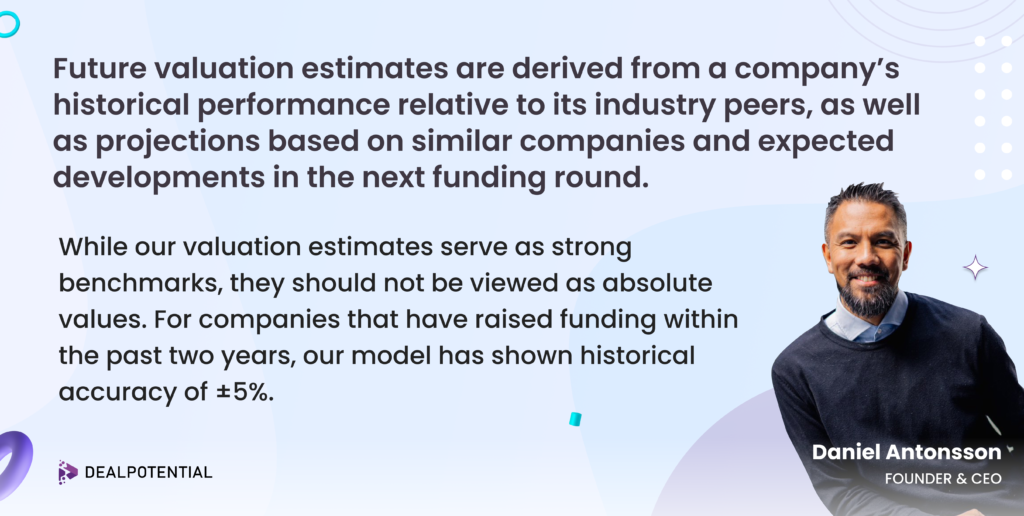

As Daniel, CEO of DealPotential, explains:

Future valuation estimates are derived from a company’s historical performance relative to its industry peers, combined with projections based on similar companies and expected developments in the next funding round.

These valuation estimates are designed to act as strong benchmarks, not absolute truths.

For companies that have raised funding within the past two years, the model has demonstrated historical accuracy within plus or minus five percent.

That level of accuracy is rare in private markets and more than sufficient for sourcing, screening, and early-stage diligence.

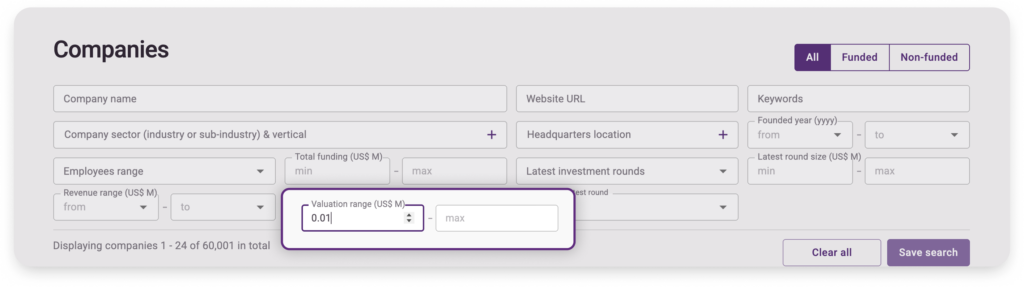

Instead of discovering valuation mismatches late in the process, DealPotential lets you filter companies by estimated valuation upfront.

This allows investors and deal teams to focus immediately on targets that fit their deal size, mandate, and investment thesis.

Valuation stops being a surprise and starts being a filter.

As private markets grow more competitive, data advantages become decisive. Manual processes cannot scale at the speed required.

Private market analytics gives investment teams a systematic way to:

🟣 See more opportunities

🟣 Understand them faster

🟣 Act with greater confidence

For due diligence, this shift is no longer optional. It is foundational.

If you are actively evaluating alternatives to PitchBook and Preqin, the key question is not which platform has the most data, but which one helps you make better decisions faster.

DealPotential enables investors to identify opportunities earlier, shortlist companies efficiently, and move with confidence in competitive markets.

Explore the platform, review its features, or book a demo to see how predictive private market intelligence can change your deal sourcing process.

SHARE:

Book a free demo with DealPotential and get real-time insights on the next billion-dollar opportunities.

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.