Best Sources for Private Company Valuation Multiples by Industry

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

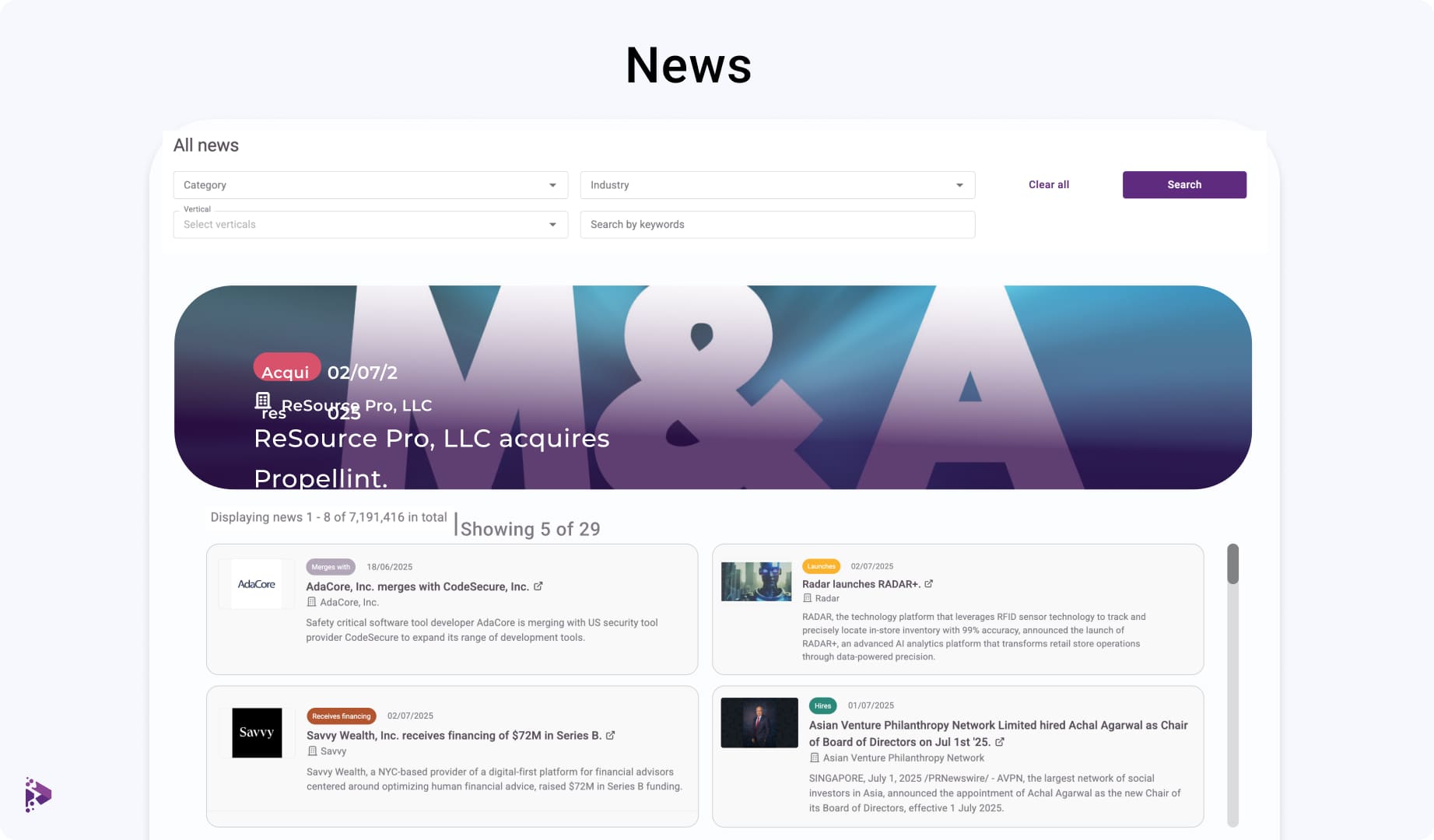

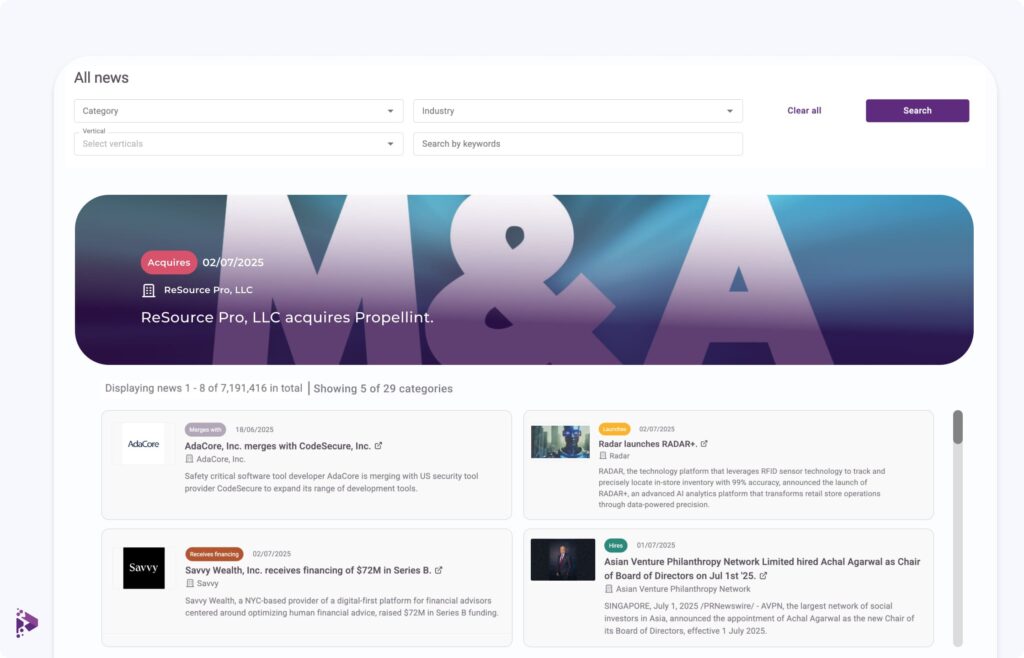

Imagine opening a tab and instantly seeing the latest private market headlines. Not just funding data, but who’s expanding, who’s in court, who’s hiring. For private investors, staying ahead means navigating a sea of fragmented information, where crucial news is often buried or delayed. Missing key developments can lead to missed opportunities or unforeseen risks. This is your private market newsfeed, designed to solve those pain points.

We track all private market news, linking every story to its source for deeper exploration. It’s clear, searchable, and always up to date, cutting through the noise that often plagues private market intelligence.

We make it easy to access the critical insights you need, addressing the pain of time-consuming research and scattered data sources:

News page: Search by industry, vertical, type, or keyword. No more sifting through irrelevant articles.

Company profiles: See news embedded directly on company pages, providing instant context without endless cross-referencing.

Personalized Dashboard feed: Get news tailored to your specific preferences, eliminating information overload and ensuring you focus on what matters most.

Our feed delivers comprehensive insights, directly tackling the pain points of incomplete market visibility and delayed risk alerts:

Strategic moves: Mergers, partnerships, investments. Understand competitive shifts and market consolidation.

Growth signals: Office openings, expansions, client wins. Spot early indicators of company performance and potential investment targets.

Downturn alerts: Layoffs, closures. Get crucial early warnings of potential risks to your portfolio companies or target investments.

Leadership changes: Hires, exits, retirements. Understand the stability and strategic direction of key companies.

Recognition & capital: Awards, funding rounds. Identify successful ventures and new capital infusions.

Innovation & tech: Launches, integrations. Stay current on technological advancements shaping the market.

Legal & events: Lawsuits, conferences. Be aware of legal challenges that could impact valuations and essential industry gatherings.

Whether you’re sourcing deals, watching risks, or staying ahead of the market, this is your edge. Stay informed. Stay sharp. Stay ahead.

Every hour spent trying to piece together the full company picture is an hour your competitors could be securing the deal you wanted.

See DealPotential in action. Book a walkthrough with our team and discover how smarter data leads to better outcomes.

SHARE:

The best sources for private company valuation multiples by industry, how investors use them, and key limitations in private market analysis.

AI-driven due diligence software helps M&A teams assess companies earlier. DealPotential supports early-stage commercial due diligence.

Predict future M&A deals using early indicators and AI signals. Learn how DealPotential identifies acquisition-ready companies earlier.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.