sourced, not web scraped

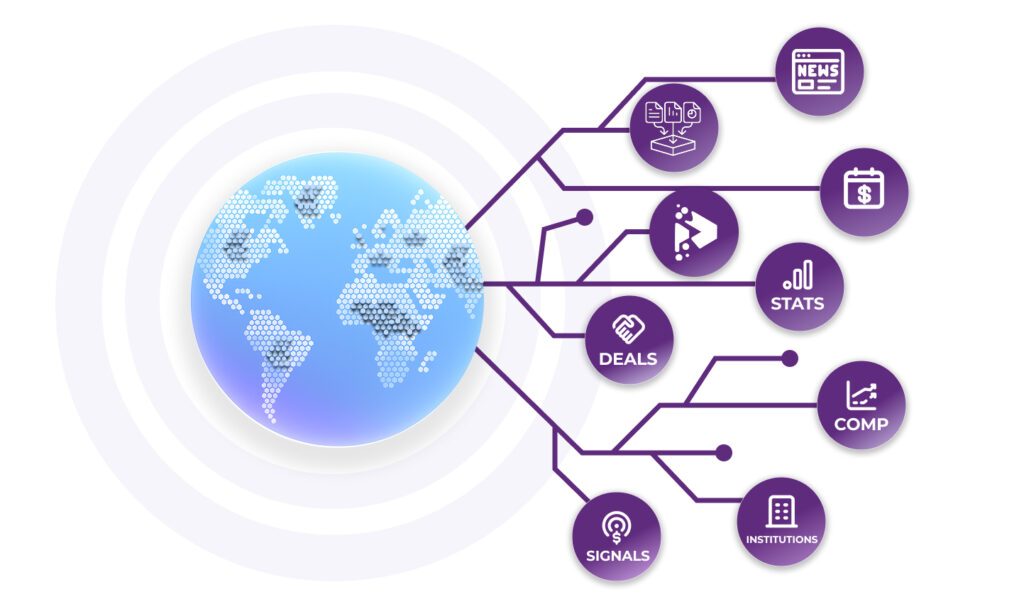

As a data aggregator, we collect and analyze global data on markets, investments, and private companies from over 21,000 trusted sources. Using advanced AI, we transform complex data into actionable insights for more impactful business decisions.

We research and gather unique, mission-critical, non-public, and alternative data about companies and markets worldwide. Our data isn’t just comprehensive—it’s relevant, easy to understand, and clear, so you can make smarter decisions without the guesswork.

We use special methods like unique calculations, computer programs, and AI technology, to provide you actionable insights.

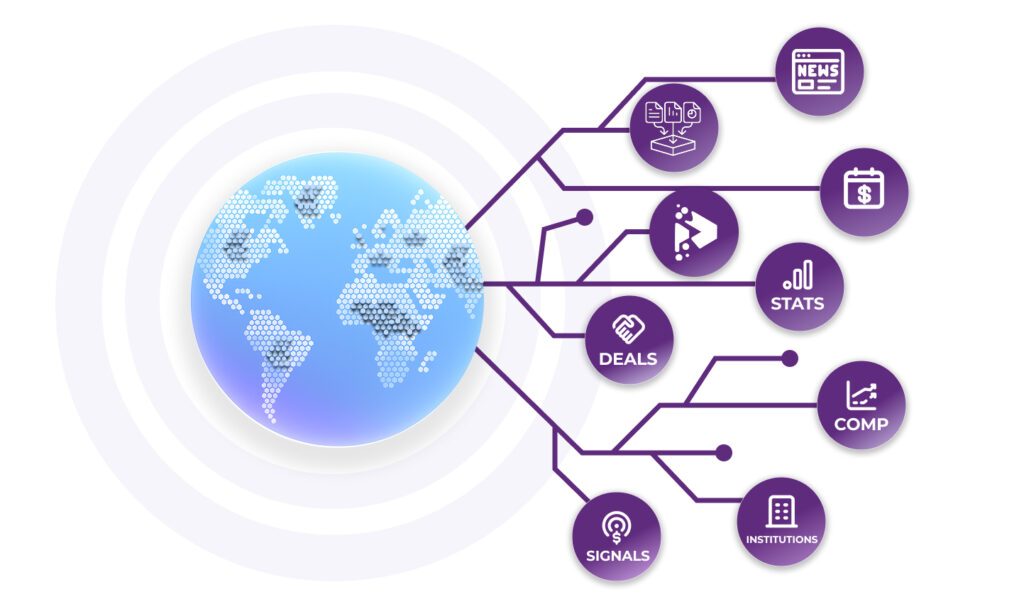

DealPotential collects granular and up-to-date data from 21,000+ sources — including financial institutions, research firms, news, and proprietary research — covering millions of data points worldwide.

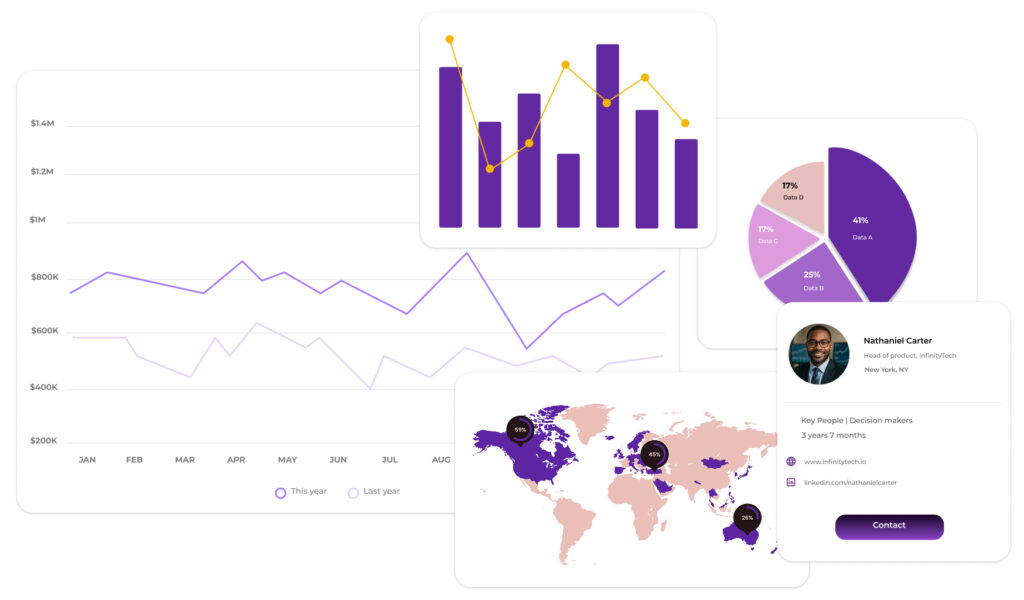

We apply our own KPIs and metrics to get our unique DealPotential scores.

We track historical performances and benchmark the results.

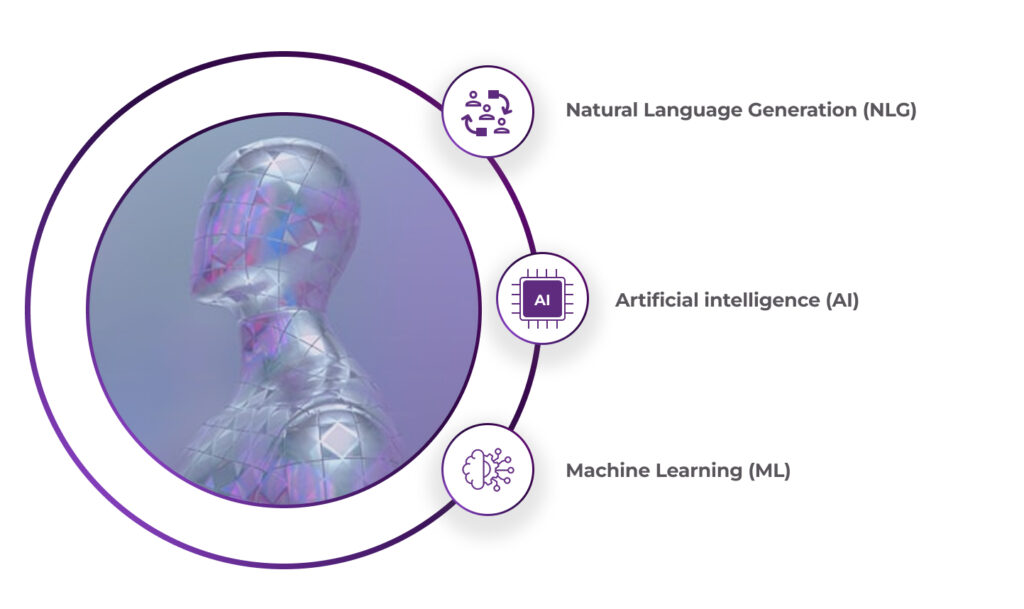

We use Natural Language Generation combined with AI and Machine learning to get undiscovered insights and make the findings understandable for everyone.

We deliver a full stacked augmented analytics with deep insights that can only be found at DealPotential.

DealPotential collects granular and up-to-date data from 21,000+ sources — including financial institutions, research firms, news, and proprietary research — covering millions of data points worldwide.

We apply our own KPIs and metrics to get our unique DealPotential scores.

We track historical performances and benchmark the results.

We use Natural Language Generation combined with AI and Machine learning to get undiscovered insights and make the findings understandable for everyone.

We deliver a full stacked augmented analytics with deep insights that can only be found at DealPotential.

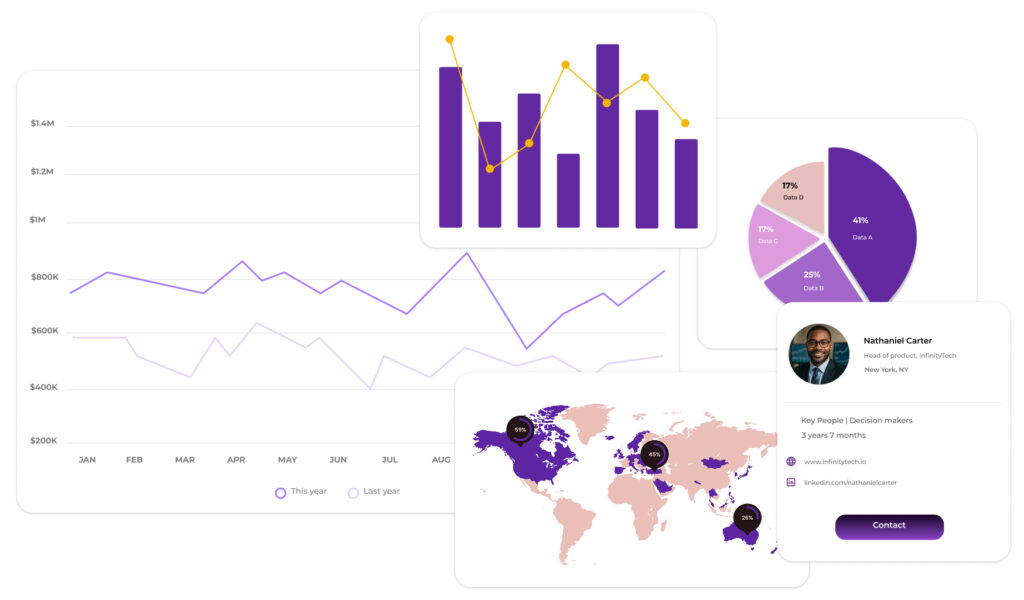

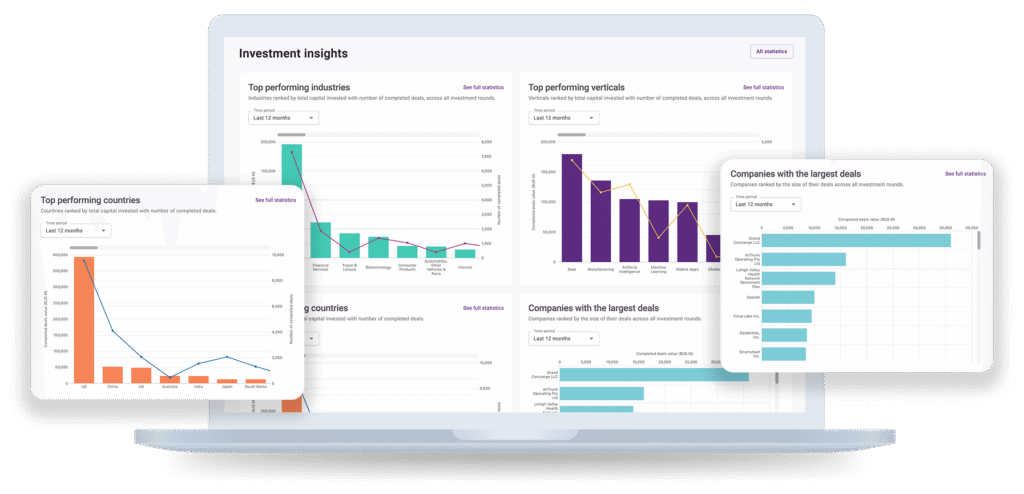

Real time updates about important KPIs. Companies with most hirings, most new customers, lowest churn, revenue increase, and more.

Identify similar companies, analyze their performance, and understand market dynamics.

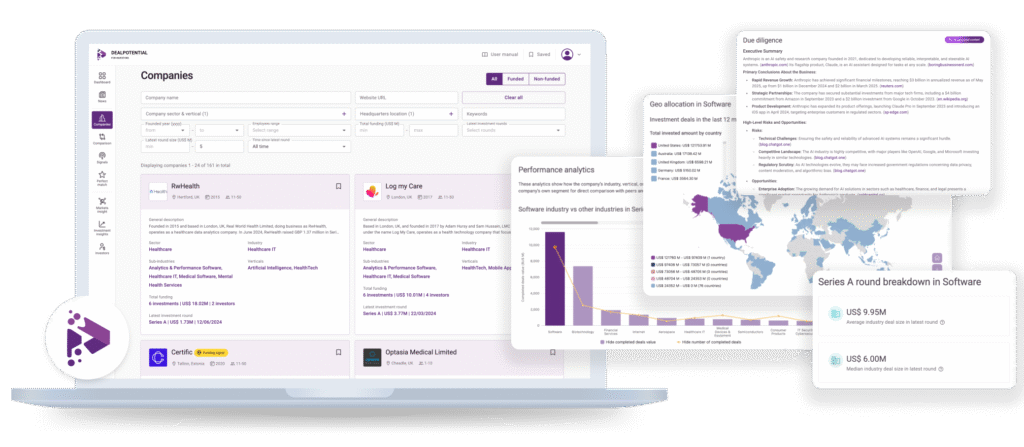

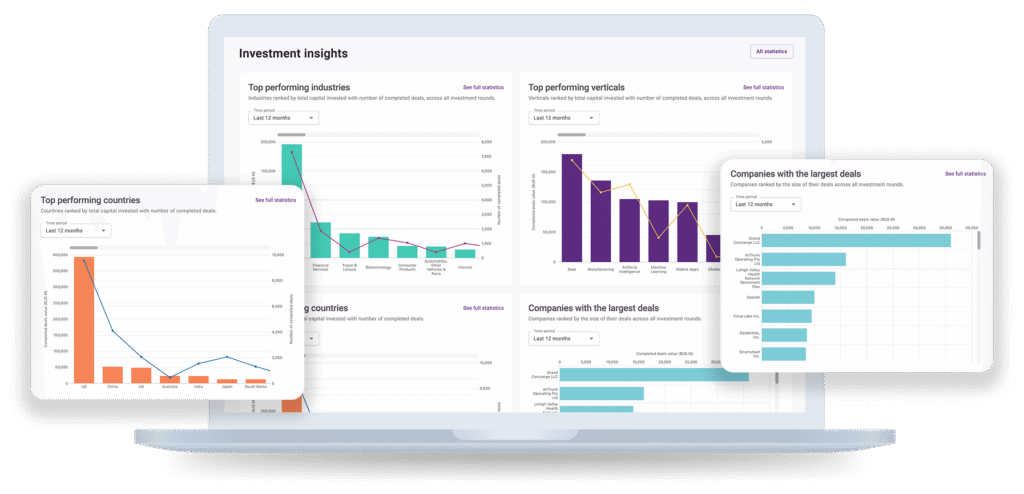

Uncover opportunities through our advanced tools and features that allow you to analyze market trends and get in-depth insights into various industries.

Compare private companies and make predictions about their future success through highly detailed data.

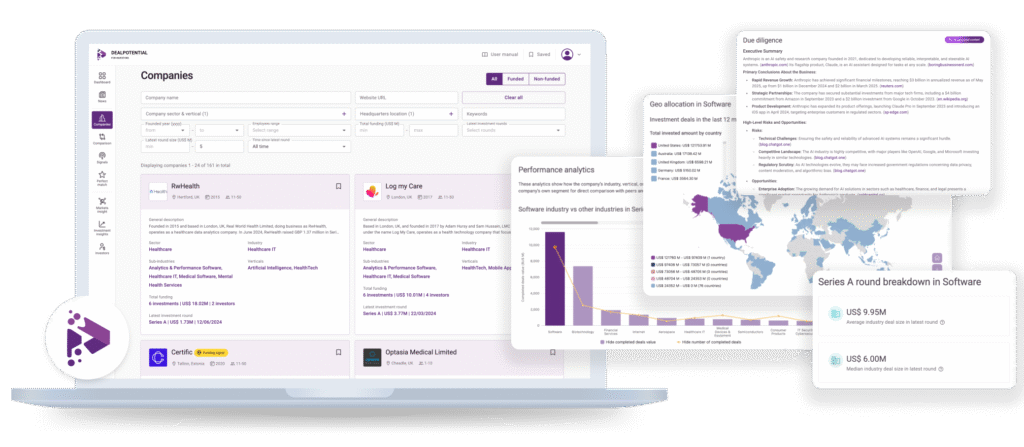

Never miss a seed round again. Get noticed on ongoing and upcoming investment rounds.

Filter results by criteria such as: industry, location, round, and more to find companies that match your investment needs.

Take a look at our extensive database that includes valuation and revenue multiples.

Our platform's forecast market data and advanced algorithms allow you to predict market trends and stay ahead of the competition.

Access information to cover all of your due diligence needs in one place.

With our extensive database of private companies, you can easily find potential buyout opportunities and acquire the right company for your investment portfolio.

Utilize our market sizing estimate database to pinpoint the most promising markets for investment and expansion.

Get an up-to-date access to a wide range of different company, team analysis and its latest financing rounds and valuation.

Access our data-driven business intelligence platform for unique private investment, company, and market data.

Our sources include financial institutions, research companies, expert interviews, as well as our own research department.

Our platform is updated and enriched daily with global data, such as news and closed rounds, whether announced or completed.

Our data undergoes thorough verification by experienced research professionals to ensure added security.

Inside our market and company reports, we provide you with a full audit trail of our trusted sources.

The only solution in the market offering company, investment, and market data, mapped in a single dashboard, instead of using multiple data sources.

We apply sophisticated predictive analytics, AI, ML, and NLG technology to forecast future market trends, business and investment opportunities.

We collect information from over 21,000 sources, including financial institutions, research companies, and conduct our own research, which gives us over 220,000 data points. However, too much information can be confusing. Our goal is to make complex data simpler and easier to understand, so you can use it to make important business decisions right away.

We use special methods like unique calculations, computer programs, and AI technology, including machine learning and natural language generation, to provide you with data that is easy to understand.

We utilize it by leveraging AI, but also natural language generation (NLG), and machine learning (ML), to provide comprehensive and easily understandable findings to drive informed decision-making.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.