If You’re Still Doing Due Diligence Like It’s 2015, Read This.

If you’re still doing due diligence like it’s 2015, it’s time to evolve. Discover how DealPotential makes smarter investing possible.

When 83% of PE firms report inadequate deal sourcing (Accenture, 2024) and 75% face unprecedented complexity, the industry’s limitations have become impossible to ignore. Data aggregators emerged as the backbone of smart investing—transforming raw information into accessible, accurate, and actionable intelligence.

This gap between what investors need and what legacy systems deliver is exactly why we created DealPotential.

As the first data aggregator for private investors, DealPotential empowers venture capital, private equity, and investment banks with real-time, AI-driven insights from over 21,000 reliable sources, including data on millions of private companies, global markets, and institutional investors worldwide.

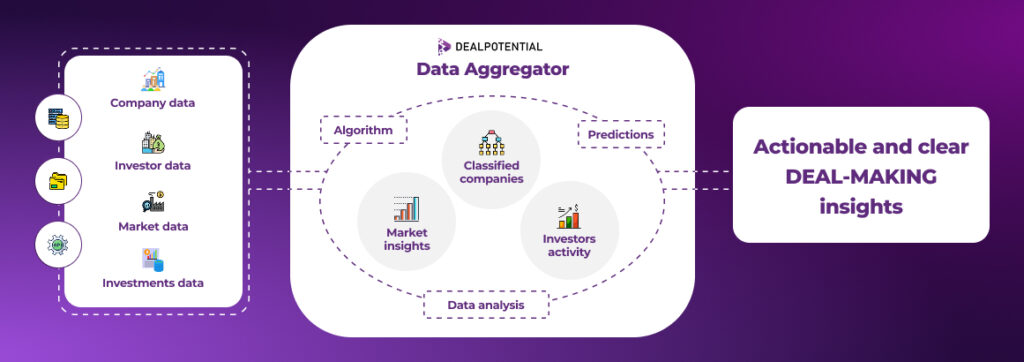

Our data aggregator transforms fragmented, unstructured data into strategic insights through a three-step process powered by cutting-edge technology:

Visualization of DealPotential’s data aggregation process: AI processes millions of data points into structured investment insights.

1. Data aggregation & verification: We collect and validate data from over 21,000 trusted sources—including financial reports, regulatory filings, and global market trends—to ensure accuracy and reliability.

2. AI-Driven analysis: Advanced machine learning algorithms and natural language generation classify companies, identify patterns, and contextualize insights. This reveals hidden opportunities, risks, and market shifts that manual analysis might miss.

3. User-friendly delivery: Complex data is simplified into intuitive dashboards, predictive analytics, interactive graphs and clear recommendations. Investors gain instant clarity on company performance, market trends, and future projections.

This streamlined process eliminates guesswork, accelerates due diligence, and empowers investors to act with confidence. Unlike static data providers, DealPotential’s dynamic AI engine continuously updates insights, ensuring you stay ahead of competitors.

For venture capital, private equity firms, and investment banks, the challenges are numerous, and the stakes are high. From unreliable data to incomplete information, the hurdles often lead to uncertainty, hesitation, and missed opportunities. But what if there was a way to cut through the noise and gain clarity?

Accessing credible and trustworthy data on private companies is one of the biggest pain points for private investors. Inconsistent or unverified data can lead to poor investment decisions, leaving investors vulnerable to unnecessary risks.

DealPotential aggregates global data on markets, investments, and private companies from over 21,000 trusted sources. Using advanced AI, we sift through the noise to deliver clear and actionable insights, ensuring you have the reliable information you need to make impactful business decisions.

Even when data is available, it’s often fragmented or insufficient, leaving critical gaps in analysis. This lack of comprehensive insight can make it difficult to fully understand an investment opportunity.

Our platform leverages advanced analytics and global data coverage to provide a complete picture. By filling in the gaps, DealPotential ensures you have all the information you need to evaluate opportunities with confidence.

Assessing the true financial health, market potential, and funding status of private companies is a constant challenge. Misleading or outdated data can paint an inaccurate picture, leading to costly mistakes.

With real-time data and sophisticated algorithms, DealPotential delivers transparent and up-to-date assessments. You’ll always have a clear, accurate view of a company’s standing, so you can invest with confidence.

Financial analysts spend three to eight weeks just to identify a promising opportunity, which consumes valuable time and resources.

A lack of trust in available data is perhaps the most pervasive issue. Skepticism can paralyze decision-making, preventing investors from seizing opportunities or mitigating risks effectively.

DealPotential is designed to bridge the trust gap. Our data-driven platform provides reliable, actionable insights, empowering you to make informed decisions with confidence. When you have access to accurate, comprehensive data, skepticism gives way to clarity and conviction.

The private investment landscape is evolving rapidly, and those who fail to adapt risk falling behind. Whether you’re a private equity professional, venture capitalist, or individual investor, understanding how data aggregation is reshaping the industry isn’t just an advantage—it’s a necessity.

Don’t get left behind—experience the power of an AI-driven data aggregator and unlock your full investment potential.

Book a demo today to see how DealPotential can revolutionize your investment process.

SHARE:

If you’re still doing due diligence like it’s 2015, it’s time to evolve. Discover how DealPotential makes smarter investing possible.

Automation vs AI: How PE firms transform financial data workflows with DealPotential’s solution. Book demo now.

Retail Investors Enter Private Markets with high risks and low transparency. How DealPotential gives clarity and predictive insights.

We use cookies to improve your experience, analyze web traffic, deliver customized content, and support marketing efforts.

DealPotential Investment Intelligence Platform Proposal Agreement

WHEREAS, the Seller agrees to provide access to the DealPotential Investment Intelligence Platform,

WHEREAS, the Client agrees to purchase the DealPotential Investment Intelligence Platform according to the terms and conditions laid out in this contract.

THEREFORE, in consideration of the mutual agreement made by the parties hereto, the Seller and the Purchaser (individually, each a “Party” and collectively, the “Parties”) agree to the following:

2. Subscription: By subscribing to the Platform, you agree to pay the monthly or yearly subscription fee, as specified in your subscription plan.

3. Payment: Payment is due monthly in advance and processed via Stripe. The subscription renews automatically until cancelled.

4. Cancellation: You may cancel your subscription at any time, and it will take effect at the end of the current billing cycle. No refunds will be provided for partial months.

5. Data Privacy: We are committed to safeguarding your data. Please refer to our Privacy Policy for details on data handling and protection.

6. Intellectual Property: All content, data, and reports provided by the Platform are protected by intellectual property laws and are for your internal use only.

7. Termination: We reserve the right to terminate your access to the Platform for any violation of these terms or for any reason at our discretion.

8. Governing Law: These terms are governed by the laws of Sweden, and any disputes shall be subject to the exclusive jurisdiction of the courts in Sweden.

10. Disclaimer: We disclaim all responsibility for any decisions made by users based on the data provided in our platform. All investment decisions are solely the responsibility of the user. We are not involved in any user decisions and only provide data and assessments for informational purposes.